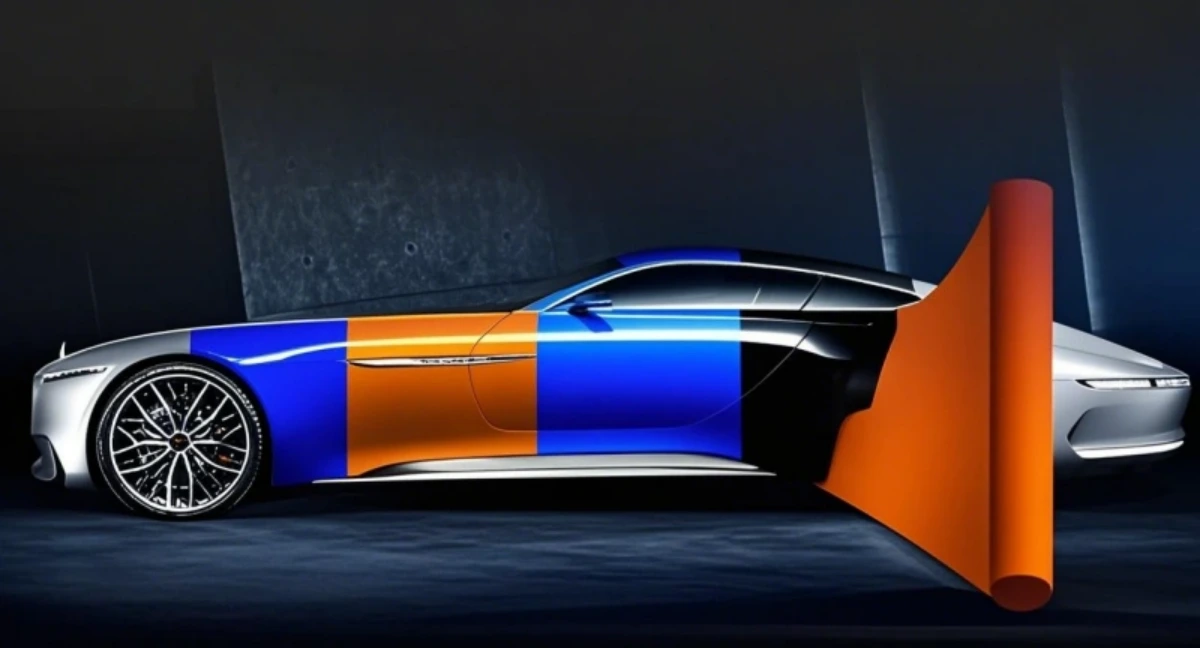

PPF’s protection during transport/ delivery shields new cars from dealer mishaps like accidental scratches or debris.,Thicker options for high-impact areas (bumpers).,Step Ahead of Competitors: Factory – Direct PPF, Swift Delivery, Unbeatable Quality.

TPU PPF VS PET PPF:

- Moisture Barrier – TPU PPF prevents water intrusion for 72 hours, while PET PPF allows moisture penetration after 24 hours at edges.

- Cost Per Square Foot – TPU PPF averages $8–$15/sq ft, compared to PET PPF’s $3–$7/sq ft price point.

- Installation Waste – TPU PPF generates 30% less scrap during installation than PET PPF due to better cutability.

- Cold-Weather Flexibility – TPU PPF remains flexible at -30°C, while PET PPF cracks when bent at -10°C.

- Edge Lifting Resistance – TPU PPF’s heat-sealed edges reduce lifting by 75%, whereas PET PPF edges lift 30% more frequently in car washes.

The construction and maintenance of PPF:

- Avoid Abrasive Cleaners – Steering clear of compounds, polishes with abrasives, or acidic wheel cleaners protects the topcoat.

- Bubble Removal – Puncturing large bubbles with a needle and re-squeegeeing ensures a flawless finish during installation.

- Seasonal Maintenance Adjustment – Increasing cleaning frequency in rainy seasons to prevent mold growth under the film.

- Long-Term Replacement Planning – Scheduling replacement before topcoat failure (typically 5–10 years) avoids adhesive residue buildup.

- Ceramic Coating Compatibility – Applying a PPF-safe ceramic coating after 30 days enhances scratch resistance by 40%.

- pH-Neutral Cleaning – Using pH 6–8 car wash soap avoids damaging the PPF’s protective topcoat or weakening adhesives.

- Squeegee Technique – Using firm, overlapping strokes with a felt-edge squeegee removes water and air bubbles for a tight bond.

- Controlled Environment Setup – Installation in dust-free, temperature-controlled (20–25°C) shops minimizes airborne particle interference.

- Avoid Parking Under Trees – Reducing exposure to sap, berries, and debris minimizes cleaning frequency and potential stains.

The market trends and industry changes of PPF:

- Automation in Production Processes – Laser cutting technologies (e.g., GCC RX II) with 600g cutting force enable precise, waste-reducing PPF customization, improving material utilization efficiency to 94%.

- Competitive Pricing Pressures – Market saturation in North America and Europe is driving price reductions, with entry-level PPF options now 20% cheaper than premium products, appealing to cost-conscious consumers.

- Cross-Industry Collaborations – Material suppliers (e.g., Lubrizol) are partnering with PPF manufacturers to develop specialized films for extreme climates, such as heat-resistant variants for desert regions.

- Automotive Designer Collaborations – PPF brands work with OEM designers to create pre-cut patterns for concept cars, ensuring seamless protection on unique contours.

- Increased Adoption in Non-Automotive Sectors – PPF applications are expanding to electronics (screen protection), aerospace (corrosion resistance), and industrial equipment, diversifying revenue streams for manufacturers.

- Southeast Asia Market Surge**- Indonesia and Vietnam’s PPF markets are growing at 11% CAGR, driven by rising middle-class car ownership and demand for affordable protection packages.

- Sustainability-Driven Material Shifts – The EU’s Packaging and Packaging Waste Regulation (PPWR) mandates recyclable materials by 2030, prompting PPF manufacturers to adopt bio-based TPU and recycled polypropylene (PP) to reduce environmental impact.

- Regional Finish Preferences – Matte PPF dominates Europe (45% of sales) while glossy finishes lead in North America (60%), reflecting aesthetic cultural differences.

- Aerospace PPF Expansion – Lightweight PPF is being tested on aircraft exteriors, protecting against bird strikes and UV degradation in high-altitude environments.

- OEM Integration and EV Demand – Original equipment manufacturers (OEMs) are increasingly factory-installing PPF, particularly for electric vehicles (EVs), which represent 19% of OEM PPF applications due to their premium paint protection needs.

How TPU Redefines PPF:

- Adhesive Innovation – TPU’s low-tack yet strong adhesives redefined PPF from permanent-only films to removable options safe for lease vehicles.

- Installation Ease – TPU’s air-release adhesives and repositionable properties redefined PPF installation from labor-intensive to DIY-friendly with minimal bubbles.

- Chemical Compatibility – TPU’s resistance to cleaning agents redefined PPF from delicate films to easy-maintain solutions compatible with pH-neutral cleaners.

- Chemical Resistance – TPU’s resistance to bird droppings, road salt, and fuels redefined PPF from basic shields to multi-hazard barriers.

- Nano-Reinforcement – Graphene or ceramic-infused TPU redefined PPF from standard films to high-performance barriers with 200% improved tensile strength.

- Low-Cost Repairs – TPU’s patchable design redefined PPF from full-replacement products to affordably repairable systems for minor damage.

- Long-Term Value – TPU’s preservation of resale value redefined PPF from expense to investment, increasing vehicle resale prices by 5–10%.

- Thin Yet Tough – High-strength TPU allowed 6–8mil films to match 10–12mil PVC protection, redefining PPF as lightweight yet durable.

- Low-Maintenance Design – TPU’s self-cleaning properties redefined PPF from high-upkeep products to “set-it-and-forget-it” solutions requiring minimal care.

The user perception and consumption misconceptions of PPF:

- Consumer Misconception: “New Car Paint Is ‘Protected’ from Factory” – Trusting factory clear coats alone, unaware they lack the impact resistance of PPF.

- Correct Perception: Partial Coverage Value – Many opt for high-impact areas (hood, fenders) over full wraps, balancing protection and cost effectively.

- Consumer Misconception: “All PPF Self-Heals the Same” – Assuming budget films repair as well as premium ones, unaware that microcapsule density varies by price point.

- Correct Perception: Brand Certification Matters – Buyers seek installers certified by brands like XPEL, linking training to better long-term results.

- Consumer Misconception: “PPF Traps Moisture Under Paint” – A false fear that PPF causes rust, ignoring that proper installation creates a moisture barrier preventing corrosion.

- Correct Perception: Impact Absorption Benefits – Off-road enthusiasts correctly rely on PPF to disperse rock impacts, reducing paint chipping by 75%.

- Correct Perception: UV Testing Validates Anti-Yellowing Claims – Checking for 1,000 hours of UV testing data, ensuring films resist discoloration in real-world use.

- Consumer Misconception: “PPF Needs Waxing Like Paint” – Over-maintaining with wax, unaware that PPF’s topcoat排斥 traditional waxes, requiring specialized sealants.

- Correct Perception: Brand Reputation Matters – Discerning buyers choose established brands, associating 3M or XPEL with consistent quality over generic alternatives.

The regulations of PPF and after-sales services:

- Lifetime Warranty Programs – Premium PPF brands like 3M offer 7-year warranties on Pro Series films, covering defects like delamination and yellowing, while excluding wear and tear or improper installation .

- Supply Chain Traceability – EU PPWR mandates tracking PPF materials from production to disposal, ensuring compliance with recycled content targets (e.g., 30% by 2030) .

- California CARB VOC Limits – PPF adhesives sold in California must comply with CARB’s strict VOC regulations, reducing harmful emissions during installation to align with regional air quality standards .

- China’s Consumer Complaint Channels – PPF buyers in China can file quality-related disputes through the national 12315 hotline, facilitating regulatory oversight and resolution .

- Australia’s UV Protection Standards – PPFs sold in Australia/NZ must comply with AS/NZS 4399 for UV protection, requiring UPF ratings ≥15 and transparency in labeling .

- Solvent-Free Adhesive Requirements – EU REACH and California CARB regulations push PPF producers to adopt solvent-free adhesives, reducing carbon footprints by up to 80% .

The cost structure and price composition of PPF:

- Online vs. Offline Pricing – E-commerce channels offer 5–10% lower prices due to reduced physical store overhead.

- Seasonal Material Adjustments – Cold-weather formulations cost 5–10% more in winter months due to demand spikes.

- Financing Options – Monthly payment plans include 8–12% interest, increasing total customer cost.

- Military/First Responder Discounts – 10–15% price reductions, offset by tax benefits for businesses.

- Marketing Expenses – Brand advertising and influencer partnerships contribute 5–8% to retail price markup.

- Entry-Level PPF Pricing – 6–7mil single-layer films retail at $5–$8 per square foot, with 30–40% gross margins.

AUTOLI(CN) PPF(Paint Protection Film) oem manufacturer

autoli TPU PPF Applied to all brand car models as Chevrolet、Lexus、Benz、Alfa Romeo、Honda、Ferrari.Our factory cooperates with ppf installation、PPF trading、PPF installer and all so in many countries and regions around the world,like Macedonia,Madagascar,USA,Austria,Brazil,Warranty: 10 years.Our advantages:Collaborate for Lucrative Returns: Source factory;Large stock of styles for you to choose from;High quality raw materials and advanced technology;Perfect after-sales service.Our factory also provides PET FILM、Window Film、Paint Protection Film.