PPF’s application on side skirts protects against curb rash, a common damage point for low-slung cars.,Matte variant reduces swirl marks (Ra 0.8-1.6μm).,Factory – Driven Collaboration: Quality PPF, Lower Costs.

The product classification and selection logic of PPF:

- Climate Adaptation Logic – Choosing coastal-formulated PPF with anti-corrosion additives for saltwater exposure or cold-flex variants for winter regions.

- Removability Requirement – Choosing residue-free adhesives for lease vehicles to avoid end-of-term penalties.

- Function-Centric Categories – Segmented into self-healing, UV-resistant, anti-yellowing, and hydrophobic variants based on core benefits.

- Anti-Microbial Needs – Choosing silver-ion infused PPF for high-touch interior surfaces in family or commercial vehicles.

- Skill-Level Alignment – Choosing DIY pre-cut kits for experienced users vs. professional installation for complex vehicle contours.

- Warranty Claim Ease – Choosing brands with digital warranty systems for streamlined claims processing.

- Coverage Scope Classes – Divided into partial (hood/fenders), full vehicle, or component-specific (headlights, trim) coverage options.

- Budget-Driven Selection – Prioritizing economy-tier PPF for cost-sensitive buyers, balancing protection with affordability.

- Repair Ease Consideration – Selecting patchable PPF for owners preferring DIY fixes for minor damage.

The market trends and industry changes of PPF:

- Supply Chain Localization – Regional production hubs in Asia-Pacific are emerging to reduce reliance on Western suppliers, with China and India scaling TPU film manufacturing to meet domestic demand.

- Integration of Ceramic Coatings – PPF-safe ceramic coatings applied post-installation (e.g., Onyx PPF Nano Coat) boost scratch resistance by 40%, creating hybrid protection solutions.

- Regulatory Compliance in Manufacturing – Stringent environmental regulations (e.g., EU REACH) are pushing PPF producers to adopt solvent-free adhesives and energy-efficient production processes, reducing carbon footprints by up to 80%.

- Aftermarket Warranty Innovations – Lifetime warranties on select PPF products (e.g., Aegis Eternal 400) are becoming standard, reflecting manufacturer confidence in material durability and performance.

- E-Bike/Scooter PPF Demand – 40% of e-mobility retailers offer PPF for scooter bodies, protecting against urban scratches and extending resale value.

- Local Sourcing Trends – Post-pandemic, 55% of North American PPF brands source TPU locally, reducing supply chain delays by 30%.

The user scenarios and value validation of PPF:

- Food Delivery Bikers – Protects electric bike frames from sauce spills and curb scrapes, extending fleet life by 2 years for platforms like DoorDash.

- Antique Fire Truck Collectors – Preserves vintage 1950s fire engine paint while allowing parade use, with reversible PPF preventing permanent damage.

- Limousine Services – Maintains pristine black paint on Lincoln Town Cars, with PPF reducing swirl marks from frequent client pickups by 80%.

- New Car Buyers – Guards fresh factory paint on brand-new vehicles, with 98% of users avoiding “first scratch” frustration in the first 6 months.

- Luxury Vehicle Owners – Preserves factory paint on high-end cars like Mercedes-Maybach, with 92% of owners reporting retained resale value after 3 years of PPF use.

- Cold-Climate Users – Prevents salt and ice melt damage in Stockholm and Toronto, with PPF-treated bumpers showing 50% less winter-related etching.

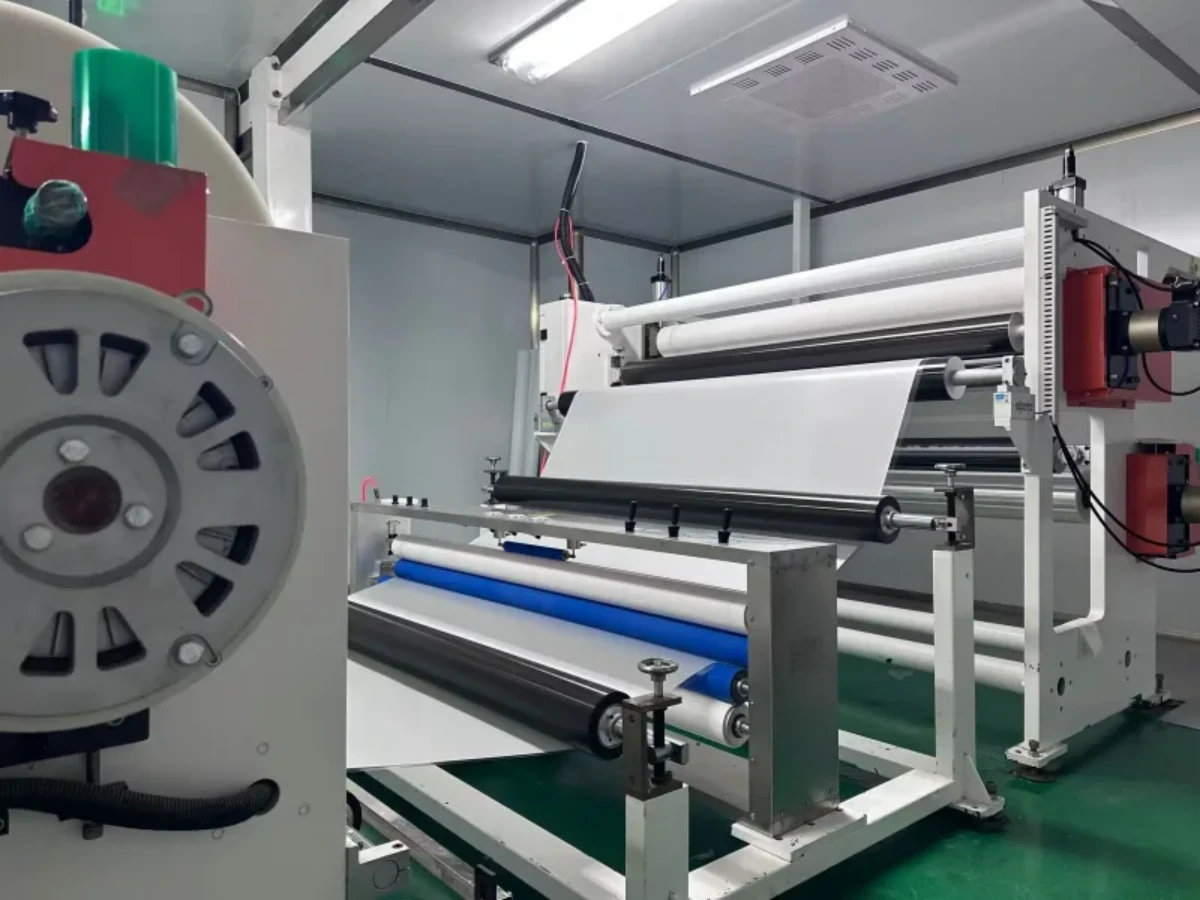

The production supply chain and quality control system of PPF:

- Machine Vision Inspection – High-resolution cameras detecting micro-defects (≥20μm) in TPU films during production.

- Statistical Process Control (SPC) – Real-time monitoring of extrusion parameters with control charts to maintain CpK ≥ 1.33.

- Maintenance Parts Logistics – Localized inventory of extrusion die parts and coating rollers to minimize downtime.

- Technology Partnerships – Collaboration with IoT firms for real-time supply chain visibility tools.

- Dealer Inventory Management – Cloud-based systems tracking installer stock levels to trigger automatic reorders.

- Non-Conforming Material Handling – Quarantine, segregation, and disposition processes for defective materials/finished goods.

- Finished Goods Warehousing – Regional distribution centers with climate control (20–25°C) to preserve adhesive quality.

- Localization Strategies – Regional production for large markets (e.g., China, US) to reduce shipping costs and tariffs.

- Extrusion Process Management – Real-time monitoring of temperature, pressure, and speed to ensure consistent film thickness.

The regulations of PPF and after-sales services:

- EU Digital Product Passport – PPF manufacturers must disclose material composition and recycling details via the EU’s Digital Product Passport, enhancing supply chain transparency .

- Japan’s Window Tinting Restrictions – Japanese regulations ban PPF installation on front driver/passenger windows and mandate partial windshield film transparency to ensure unobstructed visibility .

- India’s BIS Certification for PP Materials – Polypropylene (PP) used in PPF production must meet India’s BIS certification under IS 10951:2020, ensuring quality and safety for domestic and export markets .

- Regulatory Updates for EVs – EV-specific PPFs must comply with OEM heat resistance standards (e.g., 120°C for battery zones) to avoid delamination .

- Solvent-Free Adhesive Requirements – EU REACH and California CARB regulations push PPF producers to adopt solvent-free adhesives, reducing carbon footprints by up to 80% .

- Customer Support Hotlines – Brands like NAR PPF provide dedicated hotlines (4008 8181 07) for warranty claims, requiring vehicle details and installation records for processing .

- China’s Consumer Complaint Channels – PPF buyers in China can file quality-related disputes through the national 12315 hotline, facilitating regulatory oversight and resolution .

- Recall Protocols for Defects – In cases of material defects (e.g., delamination), manufacturers like PurePPF coordinate nationwide recalls and replacements via authorized installers .

- NAR Auto Film’s Compensation Policy – NAR PPF provides 1:1 pre-installation and 1:2 post-installation defect compensation, backed by factory insurance covering up to 100% of replacement costs .

The long-term monitoring and maintenance system after the installation of PPF:

- Smart Sensor Data Reviews – Analyzing embedded sensor data on temperature exposure and impact forces to predict maintenance needs.

- Self-Healing Activation in Cold Weather – Parking in sunlight on mild days or using a hair dryer (low heat, 30cm distance) to repair micro-scratches.

- Avoid High-Pressure Direct Sprays – Keeping pressure washers ≥30cm from edges to prevent forcing water under lifted seams.

- Matte Finish Drying Techniques – Air-drying matte PPF partially before gentle patting to preserve texture and avoid streaks.

- Quarterly Tar and Sap Removal – Using citrus-based solvents to dissolve road tar and tree sap without damaging adhesives.

- Interior PPF UV Protection – Using window tints with 99% UV blockage to reduce dashboard film fading in sunny climates.

- 6-Month Bubble Detection – Using polarized light to identify subsurface bubbles invisible to the naked eye, especially post-installation.

- Post-Storm Damage Assessments – Inspecting for debris impacts or chemical residue after hailstorms, sandstorms, or acid rain events.

- Thermal Stress Monitoring – Documenting film performance after extreme heat (>35°C) or cold (<0°C) to identify temperature-related degradation.

- Avoid Circular Wiping Motions – Using straight, back-and-forth strokes to minimize swirl marks during cleaning.

The user perception and consumption misconceptions of PPF:

- Correct Perception: Temperature Tolerance – Cold-climate users seek flexible PPF, avoiding cracking in sub-zero conditions unlike rigid alternatives.

- Consumer Misconception: “PPF Is Only for Luxury Cars” – Overlooking value for mainstream vehicles, where PPF still cuts repair costs by $300–$800 annually.

- Correct Perception: Thickness Depends on Use Case – Off-roaders choose 10mil PPF, while daily drivers opt for 8mil to balance protection and flexibility.

- Consumer Misconception: “All PPF Self-Heals the Same” – Assuming budget films repair as well as premium ones, unaware that microcapsule density varies by price point.

- Correct Perception: Brand Certification Matters – Buyers seek installers certified by brands like XPEL, linking training to better long-term results.

- Correct Perception: Edge Sealing Importance – Savvy users check for heat-sealed edges, knowing proper sealing reduces lifting by 80% in car washes.

- Consumer Misconception: “PPF Yellowing Is Inevitable” – Fearing all PPF yellows, unaware that modern anti-yellowing formulas with HALS stabilizers last 10 years clear.

- Correct Perception: Matte Finish Compatibility – Educated buyers seek matte-specific PPF, avoiding gloss films that ruin specialty paint textures.

- Consumer Misconception: “PPF Needs Waxing Like Paint” – Over-maintaining with wax, unaware that PPF’s topcoat排斥 traditional waxes, requiring specialized sealants.

AUTOLI(CN) PPF(Paint Protection Film) oem factory

autoli TPU PPF Applied to all brand car models as bmw、Honda、Maserati、jeep、Land Rover.Our factory cooperates with PPF brand、PPF wholesaler、PPF agent、PPF brand and all so in many countries and regions around the world,like England,Bulgaria,Thailand,Belgium,Norway,Japan,Warranty: 10 years.Our advantages:SGS, ASTM, REACH, UL and other certifications;SGS, ASTM, REACH, UL and other certifications;High quality raw materials and advanced technology;Your Key to Profitable PPF Ventures;Collaborate for Lucrative Returns: Source factory.Our factory also provides Vinyl Car Wrap、Car Wrap、Car Wrap Vinyl.