PPF’s anti-static properties repel dust during application, ensuring a cleaner finish in the final product.,Shields rocker panels from tire stone chips.,Maximize Revenue: Low – Cost PPF Wraps, Quick Turnaround, Trusted Certifications.

The market trends and industry changes of PPF:

- Photocatalytic Self-Cleaning PPF – TiO?-infused films decompose 80% of surface dirt under UV light, reducing washing needs by 50% in real-world testing.

- AI Quality Control in Production – Machine vision systems inspect 100% of PPF rolls for defects, reducing post-installation warranty claims by 45%.

- 3D Scanning and Custom Fitment – Laser-precut films using 3D vehicle scanning technology ensure seamless alignment, reducing installation time by 30% compared to traditional hand-cut methods.

- Rapid Growth of High-End PPF Market – The high-end PPF market is projected to reach $4.2 billion by 2033 at an 8% CAGR, driven by luxury vehicle ownership and demand for advanced protection features like self-healing technology.

- ADAS Sensor Compatibility – PPF films with 99.9% LiDAR/radar transparency are becoming standard, ensuring autonomous driving systems function unimpeded post-installation.

- Regional Finish Preferences – Matte PPF dominates Europe (45% of sales) while glossy finishes lead in North America (60%), reflecting aesthetic cultural differences.

- Detailing Chain Partnerships – PPF brands are collaborating with chains like Detail Garage, offering co-branded training and product bundles to expand reach.

The regulations of PPF and after-sales services:

- Class Action Liability – Manufacturers face potential litigation for non-compliant PPFs, as seen in cases involving PFAS contamination or false warranty claims .

- EU PPWR Packaging Mandates – The EU’s Packaging and Packaging Waste Regulation (PPWR) requires PPF packaging to be recyclable by 2030 and prohibits PFAS in food-contact packaging, impacting material choices and disposal practices .

- EU Digital Product Passport – PPF manufacturers must disclose material composition and recycling details via the EU’s Digital Product Passport, enhancing supply chain transparency .

- China’s Consumer Complaint Channels – PPF buyers in China can file quality-related disputes through the national 12315 hotline, facilitating regulatory oversight and resolution .

- Customer Support Hotlines – Brands like NAR PPF provide dedicated hotlines (4008 8181 07) for warranty claims, requiring vehicle details and installation records for processing .

- 3M’s Warranty Exclusions – 3M’s warranty explicitly excludes watermarks, improper maintenance, and non-authorized products, emphasizing the need for professional installation and genuine materials .

- Solvent-Free Adhesive Requirements – EU REACH and California CARB regulations push PPF producers to adopt solvent-free adhesives, reducing carbon footprints by up to 80% .

- Heat-Activated Self-Healing Warranties – Brands guarantee self-healing performance (e.g., 98% micro-scratch repair within 8 minutes at 45°C) under warranty, reflecting confidence in material durability .

- Anti-Yellowing Guarantees – Brands like Aegis Eternal 400 offer 15-year warranties against yellowing, using HALS stabilizers to maintain optical clarity over extended periods .

Why TPU PPF:

- Export-Friendly – Lightweight packaging reduces international shipping damage risks.

- Electric Integration – Pre-wired channels for lighting, speakers, and heating systems.

- Rust-Free Hardware – Stainless steel fasteners prevent corrosion at connection points.

- Design Versatility – Compatible with modern, traditional, and contemporary architectural styles.

- Heritage Site Compatible – Discreet designs suitable for historic districts with preservation guidelines.

- Quick Turnaround – Pre-fabricated kits ship within 2–4 weeks, faster than custom wood builds.

The cutting-edge technology research and development of PPF:

- Dynamic Wettability Coatings – pH-responsive surfaces switch between superhydrophobic and hydrophilic states to adapt to varying environmental conditions.

- Biodegradable Conductive PPF – Carbon nanotube-doped bioplastics enable flexible electronics integration with 2-year composting capability.

- Self-Healing Antimicrobial Coatings – Silver-doped microcapsules in PPF combine scratch repair with long-term bacterial inhibition for medical devices.

- Multifunctional Antimicrobial Films – Nano-silver and copper oxide particles in PPF inhibit 99.9% of MRSA and E. coli while maintaining self-healing properties.

- Graphene-Reinforced Composites – Graphene oxide nanoplatelets (GONPs) and molybdenum disulfide (MoS?) nanoparticles increase PPF tensile strength by 262% and compressive modulus by 108%.

- Bio-Based Antioxidants – Rosemary extract and tocopherol derivatives replace synthetic stabilizers, extending PPF lifespan by 30% in UV exposure.

The cost structure and price composition of PPF:

- Energy-Efficient Production Savings – Solar-powered factories reduce energy costs by 20–30%, lowering unit prices marginally.

- Export Compliance Costs – Documentation and customs clearance add $0.20–$0.50 per square foot for international sales.

- Raw Material Costs – TPU resin constitutes 35–45% of total production costs, with premium grades (self-healing) costing 2x standard TPU.

- Brand Premium – Established brands (3M, XPEL) command 20–30% higher prices than generic alternatives for similar quality.

- Material Thickness Pricing – Each mil increase (6→10mil) adds $1–$2 per square foot due to higher material usage.

- Customer Acquisition Costs – Average $200–$500 per new client, factored into initial service pricing.

- Marketing Surcharges – Limited-edition or co-branded PPF includes 5–8% markup for brand collaborations.

- Installation Training Costs – Certified installer programs add $50–$100 per vehicle to cover technician certification.

- Regulatory Compliance – REACH/EPA certifications add $0.20–$0.40 per square foot for market access in strict regions.

TPU PPF VS PET PPF:

- Custom Thickness Matching – TPU PPF tailors thickness to vehicle zones (e.g., 10mil for hoods), while PET PPF uses uniform thickness due to manufacturing limits.

- Marine Applications – Saltwater-resistant TPU PPF protects boats, while PET PPF degrades 3x faster in saltwater environments.

- Resale Value Impact – TPU PPF-preserved vehicles retain 5–10% more value, while PET PPF’s shorter lifespan offers minimal resale benefit.

- Cold-Weather Flexibility – TPU PPF remains flexible at -30°C, while PET PPF cracks when bent at -10°C.

- Global Compliance – TPU PPF meets REACH, FDA, and CARB standards, while some PET PPF formulations exceed VOC limits in strict regions.

- Lightweight Advantage – TPU PPF’s strength-to-weight ratio is 2x higher than PET PPF, allowing thinner films with equivalent protection.

- Removability – TPU PPF peels cleanly after 5 years, whereas PET PPF often leaves adhesive residue requiring professional removal.

- Dust Repellency – TPU PPF’s nano-textured surfaces reduce dust adhesion by 40%, while PET PPF attracts 25% more surface dust.

- ADAS Compatibility – TPU PPF maintains 99.9% radar transmission, whereas PET PPF can reduce signal strength by 15–20%.

The extension of PPF’s functions:

- Before: Tailgate with faded decals and paint transfer from loading; After: PPF covers decals to preserve them and resists paint transfer, maintaining graphics.

- Before: Door panels (exterior) with handprint stains and smudges; After: PPF’s non-porous surface hides stains and wipes clean easily, resisting new smudges.

- Before: Faded red paint with uneven color from UV exposure; After: UV-blocking PPF revives depth and uniformity, making the color pop like fresh factory paint.

- Before: Hood prop rod mounting point with paint worn from contact; After: PPF covers mounting area, hiding wear and reducing friction damage from prop rod.

- Before: Step bumper with paint worn thin from loading cargo; After: Heavy-duty PPF adds protective layer, hiding wear and withstanding future use.

- Before: Exhaust tip surrounds with heat discoloration; After: High-temperature PPF covers blueing and resists heat damage, maintaining appearance.

The cost structure and price composition of PPF:

- Energy-Efficient Production Savings – Solar-powered factories reduce energy costs by 20–30%, lowering unit prices marginally.

- Export Compliance Costs – Documentation and customs clearance add $0.20–$0.50 per square foot for international sales.

- Raw Material Costs – TPU resin constitutes 35–45% of total production costs, with premium grades (self-healing) costing 2x standard TPU.

- Brand Premium – Established brands (3M, XPEL) command 20–30% higher prices than generic alternatives for similar quality.

- Material Thickness Pricing – Each mil increase (6→10mil) adds $1–$2 per square foot due to higher material usage.

- Customer Acquisition Costs – Average $200–$500 per new client, factored into initial service pricing.

- Marketing Surcharges – Limited-edition or co-branded PPF includes 5–8% markup for brand collaborations.

- Installation Training Costs – Certified installer programs add $50–$100 per vehicle to cover technician certification.

- Regulatory Compliance – REACH/EPA certifications add $0.20–$0.40 per square foot for market access in strict regions.

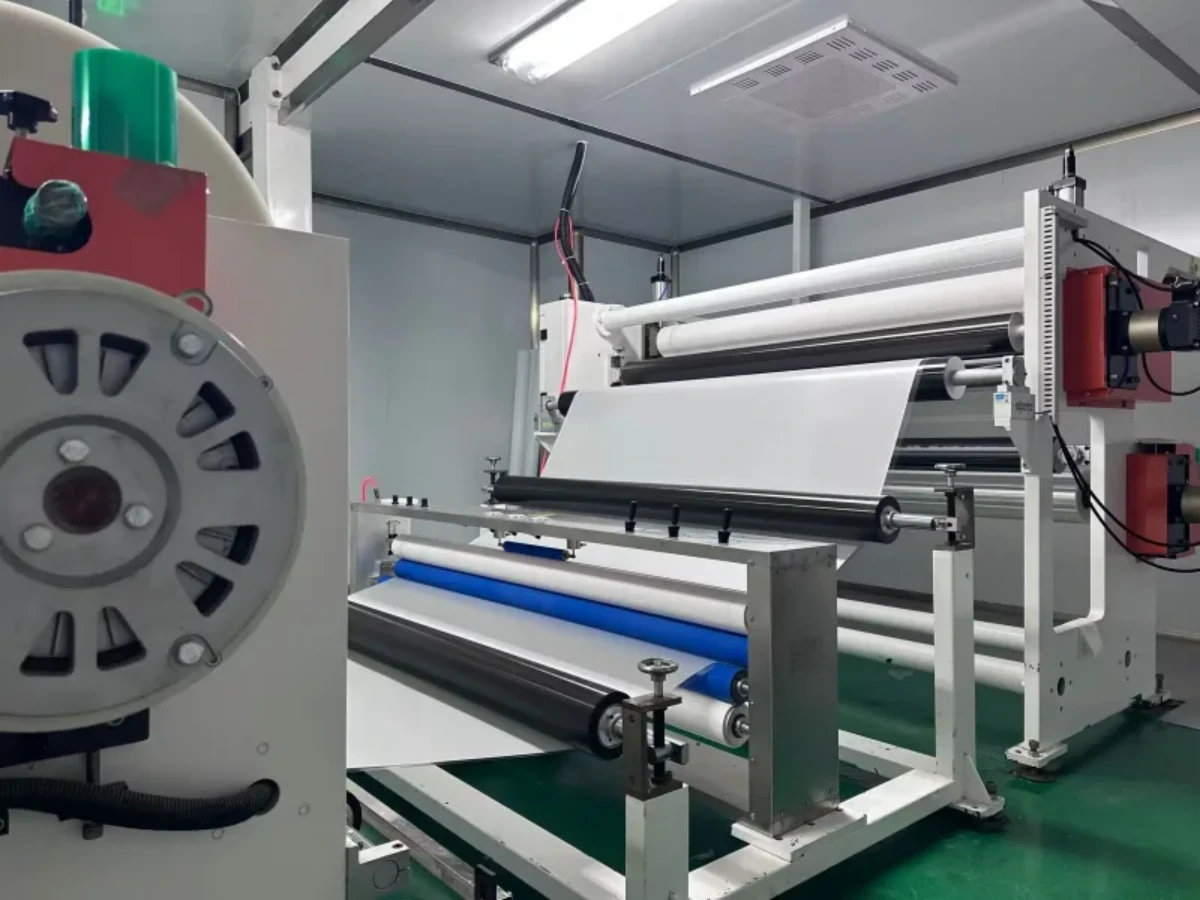

AUTOLI(CN) PPF(Paint Protection Film) factory

autoli TPU PPF Applied to all brand car models as Audi、Chevrolet、Volkswagen、McLaren、jeep、Dodge.Our factory cooperates with Auto Detailing service、PPF installer、Car Customization Shop and all so in many countries and regions around the world,like Luxembourg,Cameroon,Denmark,Turkey,Paraguay,Warranty: 10 years.Our advantages:Raw material purchasing advantage;Raw material purchasing advantage;Unlock Business Growth with Our Factory’s PPF;SGS, ASTM, REACH, UL and other certifications.Our factory also provides Car Paint Protection Film、PPF FILM.