PPF’s database of 10k car models ensures perfect fits, avoiding trimming on sensitive areas like logos or emblems.,Heat-repositionable during installation.,Team Up with Factory: Top – Quality PPF, Color Abundance.

The cost structure and price composition of PPF:

- Regional Labor Rate Differences – Installation labor costs 30–50% more in North America vs. Southeast Asia.

- Raw Material Costs – TPU resin constitutes 35–45% of total production costs, with premium grades (self-healing) costing 2x standard TPU.

- Carbon Offset Surcharges – Optional $5–$10 per vehicle for carbon-neutral shipping, adopted by 15–20% of buyers.

- Cross-Selling Margins – PPF sales boost ceramic coating and detailing revenue by 25–35% at higher margins.

- Partial Coverage Costs – Hood/fender kits at $800–$2,000, with higher per-square-foot pricing than full wraps.

- End-of-Line Discounts – Discontinued models sold at 20–30% off to clear inventory.

- Topcoat Quality Impact – Ceramic-infused topcoats add $0.50–$1.00 per square foot but enable 10–15% price premiums.

- Bio-Based TPU Premium – Plant-derived TPU increases raw material costs by 15–20% but supports premium pricing.

The user scenarios and value validation of PPF:

- Vintage Motorcycle Collectors – Preserves patina on 1950s Triumphs while preventing further wear, with reversible PPF allowing original condition display.

- EV Owners – Protects Tesla and Rivian battery hoods from stone chips, maintaining thermal efficiency and avoiding warranty-related paint damage claims.

- Desert Dwellers – Blocks UV-induced fading in Dubai and Phoenix, keeping paint vibrant 3x longer than unprotected vehicles in 45°C heat.

- Wine Tour Vehicles – Protects luxury SUVs from grape juice spills and gravel roads, ensuring client-facing vehicles stay presentable year-round.

- Cold-Climate Users – Prevents salt and ice melt damage in Stockholm and Toronto, with PPF-treated bumpers showing 50% less winter-related etching.

- Mobile Veterinary Vans – Shields interiors from animal fluids and scratches, with PPF making sanitization 30% more efficient between appointments.

TPU PPF VS PET PPF:

- Anti-Fog Properties – Hydrophilic TPU PPF options prevent headlight fogging, a feature absent in PET PPF.

- Material Flexibility – TPU PPF offers 500% elongation for contour-hugging application, while PET PPF provides <100% elongation, limiting use on curved surfaces.

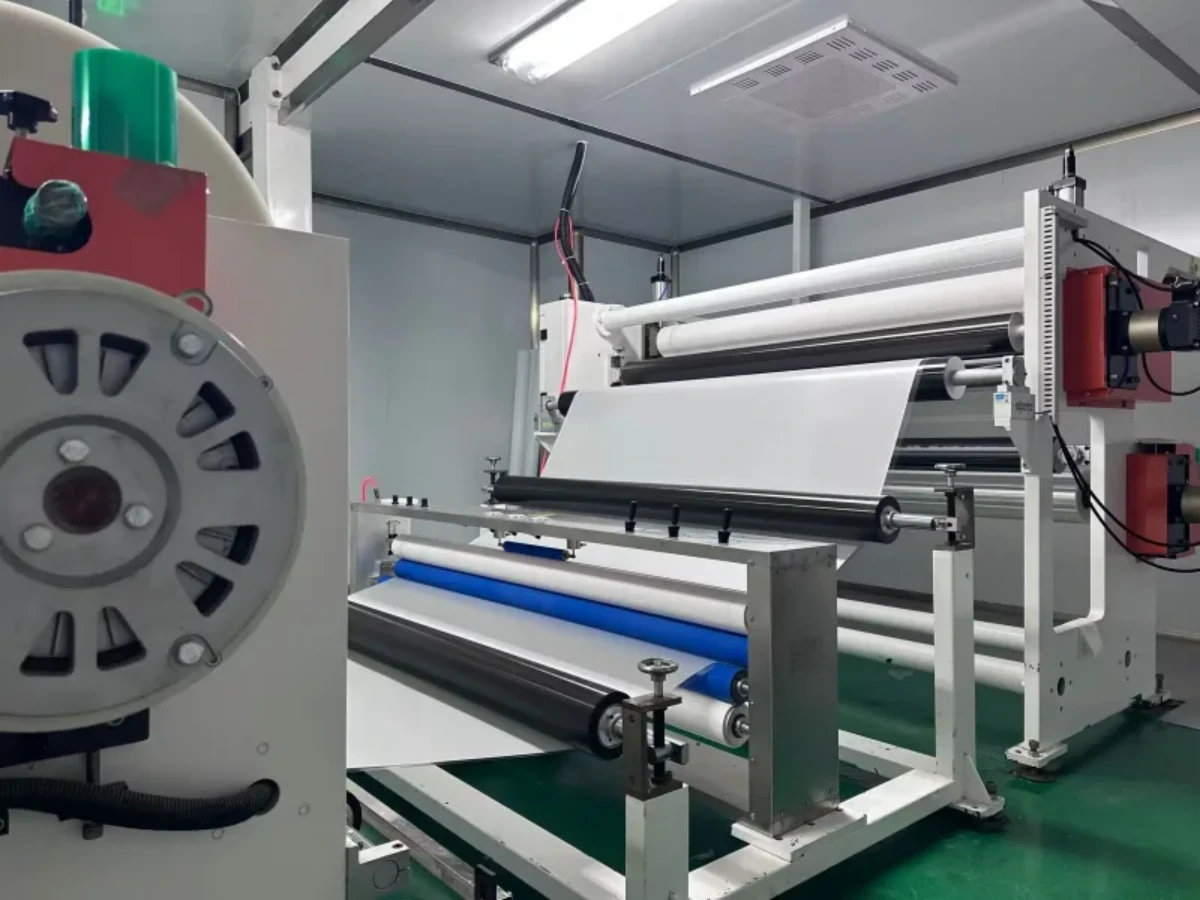

- Production Efficiency – TPU PPF’s continuous extrusion reduces waste by 40%, while PET PPF’s batch production generates 25% more scrap.

- Matte Compatibility – TPU PPF preserves matte paint texture, while PET PPF’s glossy finish distorts matte aesthetics with shine spots.

- Temperature Tolerance – TPU PPF withstands -40°C to 80°C without cracking, unlike PET PPF which becomes brittle below 0°C.

- Repair Potential – TPU PPF allows spot patching of damaged areas, while PET PPF requires full panel replacement for localized damage.

- Weathering Testing – TPU PPF passes 3,000 hours of QUV testing, while PET PPF fails at 1,500 hours with significant cracking.

The protective performance of PPF:

- **Weatherproof Sealant Effect** – It creates a weatherproof sealant – like effect, protecting the paint from the combined effects of rain, wind, and sunlight.

- **Moisture Barrier** – PPF acts as a moisture barrier, preventing water from seeping into the paint and potentially causing rust or corrosion, especially in areas with high humidity or salty road conditions.

- **Resistance to Abrasion from Roadside Vegetation** – When driving on narrow roads with overhanging vegetation, PPF protects the vehicle’s paint from scratches caused by the plants.

- Digital Warranty Claims – Streamlines service requests with online submissions and proof of purchase.

- Yellowing Resistance – Prevents discoloration caused by UV exposure, environmental pollutants, and natural aging processes.

The horizontal comparison of PPF with other protection methods:

- PPF vs. Anti-Scratch Sprays – Sprays offer mild scratch resistance for 1–3 months, while PPF provides robust defense against deep scratches for 5 years.

- PPF vs. Paint Sealants – Sealants provide 6–12 months of chemical resistance, while PPF adds physical barrier protection against impacts, with both enhancing gloss but PPF lasting longer.

- PPF vs. Silicone Coatings – Silicone coatings repel water but degrade quickly (1–2 years) under UV exposure, whereas PPF maintains hydrophobicity for 5 years with UV stabilizers.

- PPF vs. Traditional Wax – PPF provides long-term scratch/dent defense (5 years) compared to wax’s 2–3 months of mild UV protection and gloss enhancement.

- PPF vs. Rust Proofing Treatments – PPF shields exterior paint from corrosion triggers (salt/sand), while rust proofing targets metal undercarriages, with complementary roles in full protection.

- PPF vs. Truck Bed Liners – Liners protect cargo areas from heavy impacts, while PPF shields exterior panels from road debris, with distinct application zones and purposes.

- PPF vs. Headlight Restoration Kits – Restoration fixes yellowing, while PPF prevents UV damage and rock chips on headlights, extending clarity 3x longer than restored lenses alone.

- PPF vs. Stone Guard Films (Thin) – Thin stone guards protect against small debris but lack self-healing, while PPF handles larger impacts and repairs minor damage automatically.

- PPF vs. Liquid Glass Coatings – Liquid glass offers 6–12 months of chemical resistance but lacks physical impact protection, while PPF combines 5 years of scratch defense with self-healing capabilities.

- PPF vs. Powder Coating – Powder coating provides durable metal protection but is rigid and permanent, unlike PPF’s flexible, removable barrier for painted surfaces.

The market trends and industry changes of PPF:

- Aftermarket Warranty Innovations – Lifetime warranties on select PPF products (e.g., Aegis Eternal 400) are becoming standard, reflecting manufacturer confidence in material durability and performance.

- ADAS Sensor Compatibility – PPF films with 99.9% LiDAR/radar transparency are becoming standard, ensuring autonomous driving systems function unimpeded post-installation.

- Regulatory Compliance in Manufacturing – Stringent environmental regulations (e.g., EU REACH) are pushing PPF producers to adopt solvent-free adhesives and energy-efficient production processes, reducing carbon footprints by up to 80%.

- Data-Driven Marketing Strategies – Brands are using AI analytics to identify regional demand patterns, tailoring product launches (e.g., anti-yellowing films for high-sun areas) to specific markets.

- Ceramic-PPF Hybrid Kits – Pre-packaged ceramic coating PPF bundles now account for 25% of aftermarket sales, simplifying multi-layer protection for consumers.

- Subscription-Based PPF Services – Startups offer monthly PPF maintenance subscriptions, including cleaning and inspections, with 20% renewal rates after the first year.

- Thinner Yet Stronger Films – 6-mil PPF films now match the durability of 8-mil predecessors, reducing material use by 25% while maintaining impact resistance.

- Aerospace PPF Expansion – Lightweight PPF is being tested on aircraft exteriors, protecting against bird strikes and UV degradation in high-altitude environments.

The user pain points of PPF and their solutions:

- Edge Lifting – Addressed through heat-sealed edges and nano-adhesive technology, reducing lifting by 75% in car washes.

- Uncertainty About Lifespan – Resolved by clear warranty durations (5–15 years) and real-world durability data from field tests.

- Matte Paint Distortion – Solved by matte-specific PPF (20–30% gloss) designed to preserve texture without shine spots.

- Damage from Road Debris – Mitigated by impact-dispersing multi-layer films, reducing stone chips by 70% at highway speeds.

- High Installation Costs – Mitigated by tiered pricing (DIY kits vs. premium pro installs) and financing options for budget flexibility.

- High Heat Damage (EV Batteries) – Solved by heat-resistant PPF (120°C ) with thermal conductivity for battery zone protection.

- Confusion About Maintenance Products – Solved by brand-specific cleaning kits and “approved products” lists to avoid topcoat damage.

The extension of PPF’s functions:

- Before: Side marker lights with cracked lenses from impacts; After: PPF’s impact absorption covers minor cracks and prevents lens breakage.

- Before: Running boards with worn paint from foot traffic; After: PPF’s durable layer covers wear and resists scuffs from shoes and boots.

- Before: Side mirror adjustment controls (exterior) with paint wear; After: PPF covers controls, hiding wear and reducing friction during adjustments.

- Before: Trunk lid with key scratches and luggage scuffs; After: PPF’s self-healing properties erase fine scratches, creating a flawless surface for loading/unloading.

- Before: Hood prop rod mounting point with paint worn from contact; After: PPF covers mounting area, hiding wear and reducing friction damage from prop rod.

- Before: Front grille with chipped paint on edges; After: PPF’s impact-absorbing layer covers chips and shields vulnerable grille edges from debris.

- Before: Rear window wiper motor cover with faded paint; After: PPF covers cover, restoring color and protecting against weathering damage.

- Before: Side mirrors with spiderweb cracks from stone impacts; After: PPF application conceals minor cracks and absorbs future impacts, extending mirror life.

- Before: Door window weatherstripping with paint worn where it contacts glass; After: PPF lines contact areas, hiding wear and reducing friction damage.

AUTOLI(CN) PPF(Paint Protection Film) oem factory

autoli TPU PPF Applied to all brand car models as Chevrolet、Mazda、binli、Lamborghini、AstonMartin.Our factory cooperates with Auto Detailing、PPF brand、AutoZone and all so in many countries and regions around the world,like Singapore,Slovakia,USA,Ecuador,Korea,Pakistan,Warranty: 10 years.Our advantages:High quality raw materials and advanced technology;Your Key to Profitable PPF Ventures;Raw material purchasing advantage;Collaborate for Lucrative Returns: Source factory;SGS, ASTM, REACH, UL and other certifications.Our factory also provides Window tint、Car Wrap Vinyl、TPU PPF.