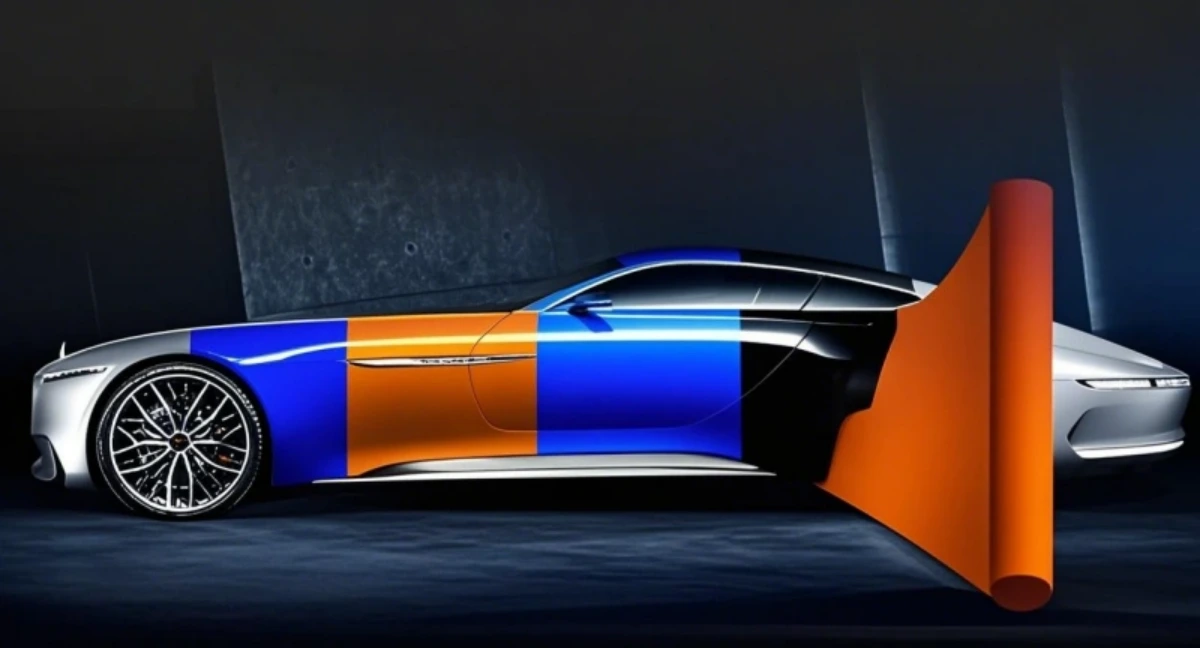

PPF’s protection for matte factory paints prevents shine from polishing, preserving the intended texture.,Covers edges to prevent water ingress.,Enhance Business Performance: Budget – Friendly PPF Wraps, Swift Delivery, Top – Tier Certifications.

The construction and maintenance of PPF:

- PPF-Safe Adhesive Removers – Specialized solvents clean up installation mistakes without damaging the underlying paint.

- Test Applications on Scrap Panels – Practicing on metal scraps refines squeegee pressure before applying PPF to the vehicle.

- Heat Gun Distance Control – Keeping heat guns 15–20cm from edges prevents film shrinkage during edge sealing.

- Edge Trimming – Precision cutting with a blade 1–2mm from panel edges prevents lifting while hiding trim lines.

- Post-Heat Curing – A final pass with a heat gun (80–100°C) on edges accelerates adhesive curing for immediate durability.

- Spring Sealant Application – Applying PPF-specific wax in spring enhances protection against pollen and rain-induced stains.

The horizontal comparison of PPF with other protection methods:

- PPF vs. Anti-Static Sprays – Sprays reduce dust attraction temporarily, while PPF’s anti-static properties last for years, with both aiding cleanliness but PPF offering more durability.

- PPF vs. Vinyl Protectants – Vinyl protectants prevent cracking in vinyl wraps but don’t shield against impacts, unlike PPF which adds scratch resistance to wrapped surfaces.

- PPF vs. Fabric Protectors – Fabric protectors repel stains on interiors, while PPF defends exterior paint, with both using hydrophobic tech but on different materials.

- PPF vs. Polyurethane Sprays – Polyurethane sprays form a hard, brittle layer prone to chipping, while PPF’s flexible TPU base absorbs impacts without cracking.

- PPF vs. Rust Inhibitors – Inhibitors slow metal corrosion but don’t protect paint, whereas PPF acts as a moisture barrier preserving both paint and underlying metal.

- PPF vs. Matte Paint Sealants – PPF preserves matte paint texture while adding scratch resistance, whereas matte sealants focus on maintaining finish but lack impact defense.

- PPF vs. Silicone Coatings – Silicone coatings repel water but degrade quickly (1–2 years) under UV exposure, whereas PPF maintains hydrophobicity for 5 years with UV stabilizers.

- PPF vs. Glass Coatings – Glass coatings excel on windows for clarity but don’t protect paint, whereas PPF is engineered specifically for automotive painted surfaces.

- PPF vs. Ceramic Waxes – Ceramic waxes boost hydrophobicity for 6–12 months but lack impact protection, whereas PPF combines water repellency with scratch resistance.

Why TPU PPF:

- Color Matching – Custom color matching to RAL or Pantone codes for brand consistency.

- Cost-Effective Over Time – Lower lifetime costs despite 30% higher upfront price vs. wood.

- Ergonomic Design – Comfortable headroom (minimum 2.2m) for standing and moving underneath.

- Eco-Friendly Production – Aluminum manufacturing emits 90% less CO? when using recycled materials.

- Cost Predictability – Fixed material costs avoid price fluctuations of lumber markets.

- Sanitary Properties – Smooth surfaces are easy to clean, ideal for food service outdoor areas.

- Global Availability – Manufactured worldwide, ensuring local supply chains and quick delivery.

- Marine-Grade Options – 6061-T6 aluminum alloys resist saltwater corrosion for coastal properties.

- Quick Turnaround – Pre-fabricated kits ship within 2–4 weeks, faster than custom wood builds.

The long-term monitoring and maintenance system after the installation of PPF:

- Quarterly Sealant Boosts – Applying PPF-grade SiO? sealants to restore hydrophobicity and enhance scratch resistance.

- Seasonal Ceramic Coating Boosts – Applying PPF-compatible ceramic sprays (SiO? content ≥30%) to enhance hydrophobicity.

- Winter Snow Removal Guidelines – Using soft-bristle brushes and plastic scrapers with rubber edges to remove snow/ice.

- Microfiber Cloth Protocol – Using lint-free, 300 GSM cloths for drying to avoid micro-scratches from debris in cheaper fabrics.

- Thermal Healing Activation – Parking in sunlight (or using low-heat hair dryers) to accelerate self-healing of minor scratches in cool weather.

- Rainwater Rinse Benefits – Allowing light rain to rinse surfaces, as natural water is softer than tap water in many regions.

The market trends and industry changes of PPF:

- 15-Year Anti-Yellowing Warranties – Premium brands now offer 15-year guarantees against yellowing, using advanced HALS stabilizers to outlast traditional 10-year warranties.

- Anti-Microbial PPF Growth – Post-pandemic, 15% of interior PPF includes silver-ion coatings, inhibiting 99% of bacteria on high-touch surfaces like door handles.

- DIY vs. Pro Installation Split – 30% of entry-level PPF sales are DIY kits, while 90% of luxury films require professional installation for warranty validation.

- Sustainability-Driven Material Shifts – The EU’s Packaging and Packaging Waste Regulation (PPWR) mandates recyclable materials by 2030, prompting PPF manufacturers to adopt bio-based TPU and recycled polypropylene (PP) to reduce environmental impact.

- Regional Market Expansion in Asia-Pacific – The Asia-Pacific PPF market is growing at a 6.6% CAGR, led by China and India, where rising vehicle ownership and premium car sales drive demand for long-lasting protection solutions.

- Regulatory Push for Transparency – The EU’s Digital Product Passport initiative requires PPF manufacturers to disclose material composition and recycling options, driving supply chain accountability.

The materials and technologies of PPF:

- Anti-glare optical optimization: Through coating micro-textures, it reduces mirror reflection glare under direct sunlight, maintaining the visual clarity of the original paint color.

- Hydrographic printing integration: Allows custom patterns (e.g., carbon fiber, brushed metal) to be embedded within the film without compromising clarity.

- Anti-fatigue toughness optimization technology: Through molecular chain elastic modification, the resilience and recovery ability of the membrane material after repeated cold and hot contraction and minor impacts are enhanced, reducing the relaxation deformation over long-term use.

- Salt spray resistance anti-corrosion technology: By adding marine-grade anti-corrosion additives, it undergoes 5,000 hours of salt spray tests without rusting, resisting the erosion of the membrane material by the high-salt environment in coastal areas, and extending the protection lifespan of vehicles near the sea.

- Extreme UV durability enhancement: Uses dual UV absorbers (organic and inorganic) to maintain 90% of original performance after 10,000 hours of accelerated UV testing.

- Closed-loop recycling technology: Using degradable TPU base materials or physical recycling processes, it enables the recycling of discarded film materials, reducing environmental burden.

- UV-stabilized adhesive: Resists yellowing and degradation under prolonged sunlight exposure, backed by 10-year adhesion warranties.

TPU PPF VS PET PPF:

- Recycled Content – TPU PPF incorporates 30% recycled material without performance loss, while PET PPF recycled blends show 20% reduced durability.

- Long-Term Adhesion – TPU PPF maintains 90% adhesion after 7 years, while PET PPF’s adhesion drops to 50% after 4 years.

- Heat-Activated Bonding – TPU PPF’s adhesive strengthens with heat curing, while PET PPF’s bond weakens under prolonged heat exposure.

- Weight Difference – TPU PPF adds 1.2kg per vehicle (full wrap), while PET PPF adds 0.8kg due to lower density but reduced coverage efficiency.

- Self-Healing Capability – TPU PPF repairs 3μm scratches via heat activation, whereas PET PPF lacks self-healing, requiring replacement for even minor damage.

The user scenarios and value validation of PPF:

- Military Reserve Vehicle Owners – Protects surplus Jeep Wranglers from off-road training damage, maintaining functionality for both duty and leisure use.

- Luxury Vehicle Owners – Preserves factory paint on high-end cars like Mercedes-Maybach, with 92% of owners reporting retained resale value after 3 years of PPF use.

- Electric Scooter Fleets – Shields shared e-scooter bodies from urban abuse, reducing repair frequency by 55% for companies like Bird and Lime.

- Construction Managers’ Trucks – Shields Ford F-150s from concrete splatters and tool drops, extending time between repaints from 12 to 24 months.

- Desert Dwellers – Blocks UV-induced fading in Dubai and Phoenix, keeping paint vibrant 3x longer than unprotected vehicles in 45°C heat.

- Cold-Climate Users – Prevents salt and ice melt damage in Stockholm and Toronto, with PPF-treated bumpers showing 50% less winter-related etching.

- Food Truck Operators – Protects mobile kitchen exteriors from road grime and food splatters, maintaining brand aesthetics for customer appeal.

- Food Delivery Bikers – Protects electric bike frames from sauce spills and curb scrapes, extending fleet life by 2 years for platforms like DoorDash.

- Mountain Road Drivers – Shields Subaru Outbacks and Toyota 4Runners from rock slides, with PPF reducing windshield and fender chip repairs by 65%.

- Luxury Vehicle Owners – Preserves factory paint on high-end cars like Mercedes-Maybach, with 92% of owners reporting retained resale value after 3 years of PPF use.

The production supply chain and quality control system of PPF:

- Dual-Sourcing Strategy – Critical materials (e.g., high-performance TPU) sourced from 2 suppliers to prevent production delays.

- Finished Goods Warehousing – Regional distribution centers with climate control (20–25°C) to preserve adhesive quality.

- Customs Broker Partnerships – Global logistics firms managing import/export documentation to comply with regional regulations.

- Extrusion Process Management – Real-time monitoring of temperature, pressure, and speed to ensure consistent film thickness.

- Global Raw Material Network – Multi-region sourcing of TPU to mitigate supply risks from geopolitical or logistical disruptions.

- Warranty Claim Analysis – Tracking failure patterns to identify systemic issues requiring process adjustments.

The cost structure and price composition of PPF:

- Loyalty Program Discounts – Repeat customers receive 5–15% off, reducing margins but increasing retention.

- Carbon Offset Surcharges – Optional $5–$10 per vehicle for carbon-neutral shipping, adopted by 15–20% of buyers.

- Regional Labor Rate Differences – Installation labor costs 30–50% more in North America vs. Southeast Asia.

- Raw Material Costs – TPU resin constitutes 35–45% of total production costs, with premium grades (self-healing) costing 2x standard TPU.

- Referral Program Incentives – $50–$100 discounts for referrals reduce net prices by 3–5% but lower acquisition costs.

- Sample Costs – Free or low-cost samples (5–10 sq ft) add 1–2% to marketing expenses but drive sales.

- Premium PPF Costs – 10mil multi-layer films with lifetime warranties retail at $12–$20 per square foot, 50–60% margins.

- Topcoat Quality Impact – Ceramic-infused topcoats add $0.50–$1.00 per square foot but enable 10–15% price premiums.

- Warranty Administration Fees – Digital warranty systems add $0.05–$0.10 per square foot but reduce claim processing time.

AUTOLI(CN) PPF(Paint Protection Film) manufacturer

autoli TPU PPF Applied to all brand car models as Mazda、Tesla、byd、AstonMartin、jeep.Our factory cooperates with PPF installer、PPF wholesale、Auto Detailing Shop、PPF wholesaler and all so in many countries and regions around the world,like Turkey,Iceland,Germany,Iraq,Slovenia,Costa Rica,Warranty: 10 years.Our advantages:SGS, ASTM, REACH, UL and other certifications;Large stock of styles for you to choose from;Unlock Business Growth with Our Factory’s PPF.Our factory also provides PPF Vinyl Car Wrap、vinyl car wrapping.