PPF’s application in controlled 23±2℃ environments ensures optimal adhesion and minimizes installation defects.,Enhances car show appearance with gloss.,Bid Farewell to Business Woes: Team with Our Factory’s Versatile PPF.

The construction and maintenance of PPF:

- 48-Hour Road Tar Removal Window – Using专用 solvents to remove tar within 48 hours prevents permanent staining on PPF.

- Air Blower Drying – Low-pressure air dryers reduce towel contact, minimizing micro-scratches on PPF surfaces.

- Bi-Weekly Bird Dropping Inspections – Regular checks allow prompt removal of acidic droppings before they etch the topcoat.

- Emblem Masking with Low-Tack Tape – Removable tape protects badges from accidental cutting or adhesive residue during installation.

- UV-Protection Boosters – Applying UV-resistant sprays in high-sun regions extends anti-yellowing performance.

- Long-Term Replacement Planning – Scheduling replacement before topcoat failure (typically 5–10 years) avoids adhesive residue buildup.

The protective performance of PPF:

- **Anti-Graffiti Resistance** – It makes it difficult for graffiti to stick to the vehicle’s surface, and if any is applied, it can be removed more easily without harming the paint.

- **Anti – Abrasion in Car Washes** – Protects the paint from the abrasion caused by automatic car wash brushes, ensuring that the paint finish remains smooth and unblemished.

- Chemical Resistance – Resists damage from acids, oils, solvents, and corrosive substances like road salt and industrial pollutants.

- Professional Installation Training – Certified installers ensure bubble-free application and optimal edge sealing.

- Impact Energy Dispersion – Multi-layer design spreads collision forces across the film, minimizing stress on paint.

- Salt Spray Resistance – Protects against corrosion caused by road salt used in winter or coastal environments.

- Edge Sealing Technology for Longevity – Prevents edge lifting through precise installation and heat-activated adhesive, ensuring 10 year durability.

- High-Impact Energy Absorption – Multi-layer TPU films disperse collision forces, protecting against deep dents from rocks or debris.

- Advanced Anti-Yellowing Formula – Incorporates UV inhibitors and stabilizers to prevent discoloration over 5 years of exposure.

The cost structure and price composition of PPF:

- Raw Material Costs – TPU resin constitutes 35–45% of total production costs, with premium grades (self-healing) costing 2x standard TPU.

- DIY Kit Pricing – Pre-cut kits retail at $300–$800 per vehicle, with 40–50% margins due to lower labor costs.

- Damage Waiver Fees – Optional $50–$100 waivers cover minor installation errors, adding 2–3% to revenue.

- Bundle Pricing Discounts – PPF ceramic coating bundles reduce total cost by 10–15% vs. separate purchases.

- Military/First Responder Discounts – 10–15% price reductions, offset by tax benefits for businesses.

- Production Labor Costs – Skilled operators for extrusion lines contribute 12–18% of total manufacturing expenses.

- Low-Volume Vehicle Surcharges – Custom cuts for rare models add 20–30% due to template creation costs.

- Volume Discounts – Fleet purchases reduce per-unit prices by 10–15% for orders over 50 vehicles.

- Regulatory Compliance – REACH/EPA certifications add $0.20–$0.40 per square foot for market access in strict regions.

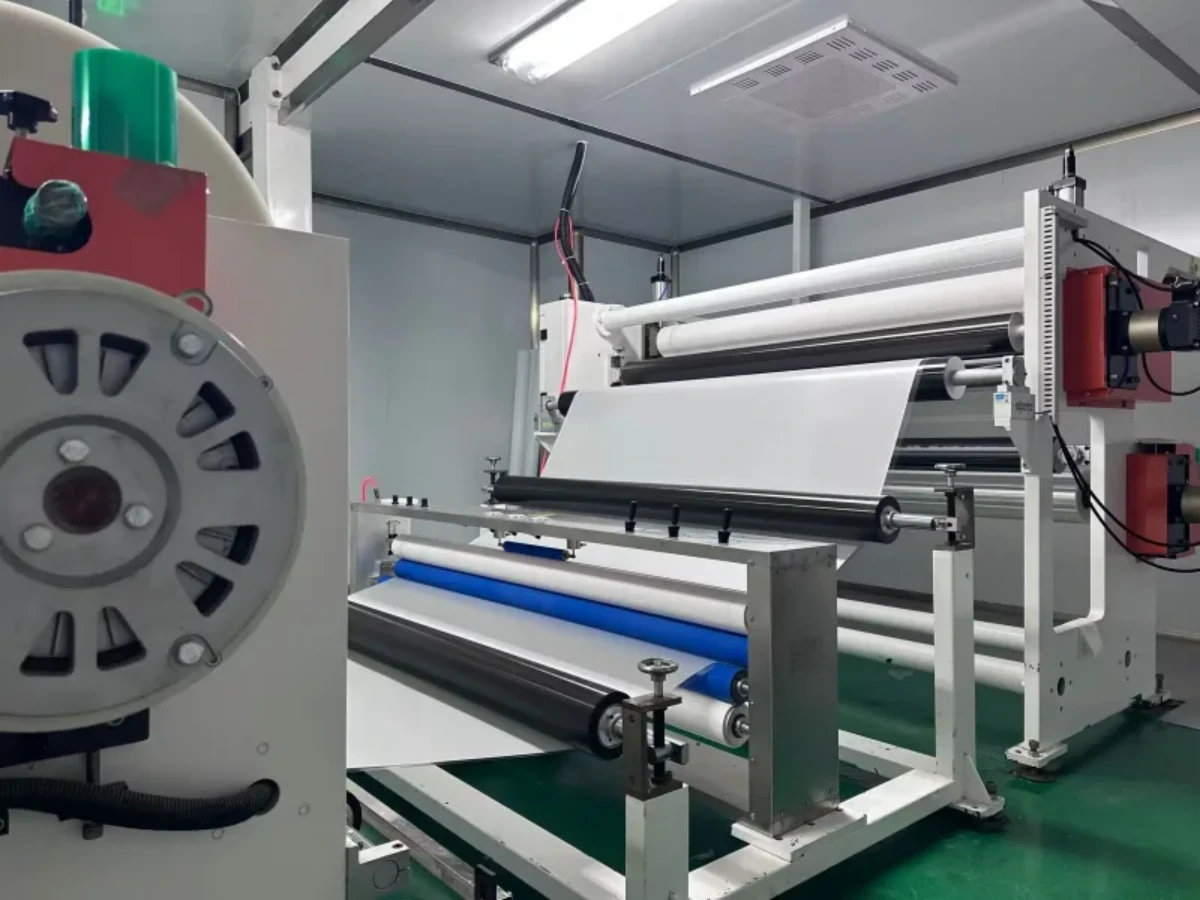

The production supply chain and quality control system of PPF:

- Adhesion Testing – Peel strength measurements (180°/90°) on sample cuts to verify adhesive bond strength.

- Warranty Claim Analysis – Tracking failure patterns to identify systemic issues requiring process adjustments.

- Dual-Sourcing Strategy – Critical materials (e.g., high-performance TPU) sourced from 2 suppliers to prevent production delays.

- Just-In-Time Inventory – Raw material delivery aligned with production schedules, reducing warehouse costs by 20–30%.

- Failure Mode and Effects Analysis (FMEA) – Proactive risk assessment of production processes to prevent failures.

- Thickness Gauging – Laser sensors measuring film thickness every 0.5 seconds, ensuring ±0.1mil tolerance.

The horizontal comparison of PPF with other protection methods:

- PPF vs. Leather Protectors – Leather treatments guard against spills/cracking, while interior PPF shields dash/console plastics from UV fading and scratches, with separate material focuses.

- PPF vs. Plastic Trim Restorers – Restorers revive faded trim, while PPF prevents UV damage and scratches on trim, maintaining appearance without frequent reapplication.

- PPF vs. Ceramic Coatings – PPF offers physical impact protection (resisting rocks/chips) while ceramic coatings focus on chemical resistance and hydrophobicity, with PPF lasting 5–10 years vs. 2–5 for ceramics.

- PPF vs. Rubberized Undercoating – Undercoating protects metal from rust, while PPF defends painted surfaces from road debris, with non-overlapping application zones.

- PPF vs. Rust Converter Products – Converters treat existing rust, while PPF prevents rust triggers (moisture/salt) on painted surfaces, with complementary roles in corrosion management.

- PPF vs. Liquid Glass Coatings – Liquid glass offers 6–12 months of chemical resistance but lacks physical impact protection, while PPF combines 5 years of scratch defense with self-healing capabilities.

The market trends and industry changes of PPF:

- Nano-Coating Enhancements – Nano-based topcoats (e.g., Nasiol FCC) improve hydrophobicity and chemical resistance, extending PPF lifespan while maintaining self-healing capabilities.

- Cross-Industry Collaborations – Material suppliers (e.g., Lubrizol) are partnering with PPF manufacturers to develop specialized films for extreme climates, such as heat-resistant variants for desert regions.

- Ceramic-PPF Hybrid Kits – Pre-packaged ceramic coating PPF bundles now account for 25% of aftermarket sales, simplifying multi-layer protection for consumers.

- Cross-Industry Collaborations – Material suppliers (e.g., Lubrizol) are partnering with PPF manufacturers to develop specialized films for extreme climates, such as heat-resistant variants for desert regions.

- Local Sourcing Trends – Post-pandemic, 55% of North American PPF brands source TPU locally, reducing supply chain delays by 30%.

- Maintenance App Ecosystems – Brands like XPEL offer apps with PPF care reminders and digital warranty tracking, boosting customer retention by 28%.

- Commercial Fleet Adoption – Delivery giants like Amazon and JD.com are equipping 70% of new vans with PPF, reducing fleet repaint costs by $300 per vehicle annually.

The environmental protection and sustainability of PPF:

- Recycled Packaging – 90% of premium PPF brands use recycled cardboard and biodegradable film wrap, reducing packaging waste by 75%.

- Heavy Metal-Free Pigments – Colored PPF uses organic pigments, eliminating lead, cadmium, and chromium from formulations.

- Extended Product Lifespan – 10 year durability reduces replacement frequency, lowering overall material consumption compared to annual waxing or sealants.

- Recycled Water in Production – Closed-loop water systems reuse 90% of process water, limiting freshwater withdrawals.

- Local Raw Material Sourcing – Sourcing TPU from regional suppliers cuts transportation emissions by 25% versus global supply chains.

The user perception and consumption misconceptions of PPF:

- Correct Perception: Temperature Tolerance – Cold-climate users seek flexible PPF, avoiding cracking in sub-zero conditions unlike rigid alternatives.

- Correct Perception: Lease Protection Value – Leaseholders use PPF to avoid $500 end-of-term fees, with 95% passing inspections without paint-related charges.

- Correct Perception: Brand Certification Matters – Buyers seek installers certified by brands like XPEL, linking training to better long-term results.

- Consumer Misconception: “PPF Hides Existing Paint Damage” – A false belief that PPF covers swirl marks or chips, when pre-installation paint correction is actually required.

- Consumer Misconception: “PPF Yellowing Is Visible Immediately” – Expecting instant discoloration, not realizing quality films take 5 years to show subtle yellowing.

- Consumer Misconception: “PPF Can’t Be Repaired” – Assuming damaged PPF requires full replacement, unaware small sections can be patched professionally.

- Consumer Misconception: “All PPF Self-Heals the Same” – Assuming budget films repair as well as premium ones, unaware that microcapsule density varies by price point.

- Consumer Misconception: “PPF Makes Car Washes Obsolete” – Thinking hydrophobic properties eliminate washing, not realizing heavy grime still requires cleaning.

- Correct Perception: Resale Value Boost – 81% of luxury car owners recognize PPF-preserved paint enhances resale value by 5–10% in pre-owned markets.

- Consumer Misconception: “New Cars Don’t Need PPF Immediately” – Delaying installation, unaware that factory paint is most vulnerable to damage in the first 6 months of ownership.

AUTOLI(CN) PPF(Paint Protection Film) manufacturer

autoli TPU PPF Applied to all brand car models as byd、Jaguar、AstonMartin、ford.Our factory cooperates with PPF agent、PPF brand、PPF distributor and all so in many countries and regions around the world,like Norway,Pakistan,Italy,Maldives,SouthAfrica,Austria,Warranty: 10 years.Our advantages:SGS, ASTM, REACH, UL and other certifications;Collaborate for Lucrative Returns: Source factory;Large stock of styles for you to choose from.Our factory also provides Vinyl Car Wrap、Car PPF.