PPF’s self-healing at room temp over time fixes micro-scratches, maintaining a smooth finish without intervention.,Resists road salt corrosion in winter.,Factory – Backed Deals: Abundant Styles, Swift Business Expansion.

The production supply chain and quality control system of PPF:

- Packaging Optimization – Collaborative design with logistics firms for space-efficient palletization, reducing transport emissions.

- Root Cause Analysis – 5 Whys methodology applied to recurring defects to prevent reoccurrence.

- Statistical Process Control (SPC) – Real-time monitoring of extrusion parameters with control charts to maintain CpK ≥ 1.33.

- Waste Management Partnerships – Collaboration with recycling firms to process production scrap into secondary TPU materials.

- Audit Schedules – Internal audits quarterly, external audits annually to verify QMS effectiveness.

- Technology Partnerships – Collaboration with IoT firms for real-time supply chain visibility tools.

- New Supplier Onboarding – 6–12 month qualification process including trial runs before full-scale material adoption.

- Packaging Material Supply – Partnerships with recyclable packaging manufacturers to align with sustainability goals.

- Strategic Stockpiles – 3–6 month reserves of critical materials during high-demand periods or supply chain disruptions.

The product classification and selection logic of PPF:

- UV Exposure Assessment – Prioritizing UV-stabilized PPF for vehicles parked outdoors full-time in sunny climates.

- UV Index Alignment – Upgrading to high-UV protection PPF for equatorial regions with intense sunlight.

- Repair Ease Consideration – Selecting patchable PPF for owners preferring DIY fixes for minor damage.

- Brand Support Evaluation – Opting for brands offering installer training and technical support for complex applications.

- Multi-Surface Compatibility – Selecting PPF safe for paint, plastic, and chrome to enable full-vehicle protection with one product.

- Budget-Driven Selection – Prioritizing economy-tier PPF for cost-sensitive buyers, balancing protection with affordability.

The market trends and industry changes of PPF:

- Consumer Education and Awareness – Social media campaigns and in-store demos are educating buyers on PPF benefits, with 72% of new luxury car owners now considering PPF as a must-have accessory.

- Supply Chain Localization – Regional production hubs in Asia-Pacific are emerging to reduce reliance on Western suppliers, with China and India scaling TPU film manufacturing to meet domestic demand.

- Standardization of Installation Training – Industry-wide certifications (e.g., XPEL’s Accredited Installer Program) ensure consistency in application techniques, reducing warranty claims due to improper installation.

- Recyclable Packaging Mandates – 80% of PPF brands now use recycled cardboard and biodegradable film wrap for packaging, aligning with EU packaging laws.

- Premiumization Amid Inflation – Luxury PPF prices rose 12% in 2024, while budget options stayed stable, as brands prioritize high-margin segments.

- Insurance Partnerships and Bundling – EV manufacturers like BYD are integrating PPF into insurance packages, offering discounted rates for customers who opt for factory-installed protection.

The user pain points of PPF and their solutions:

- Fading in Extreme Sunlight – Fixed by 99% UV-blocking films with enhanced carbon black pigments for tropical climates.

- Difficulty Matching Vehicle Contours – Addressed by 3D-scanned, vehicle-specific pre-cut patterns for complex curves (fenders, mirrors).

- Edge Lifting – Addressed through heat-sealed edges and nano-adhesive technology, reducing lifting by 75% in car washes.

- Mold Growth in Humid Climates – Prevented by antimicrobial additives and breathable film designs allowing moisture evaporation.

- Complex Maintenance – Simplified via pH-neutral cleaning kits, hydrophobic topcoats, and quarterly sealant boosters.

- Expensive Repairs for Damage – Reduced via self-healing technology (repairs 3μm scratches with heat) and patchable film sections.

The protective performance of PPF:

- Off-Road Impact Protection – Thick films like Suntek Ultra Defense shield against branches, mud, and gravel in rugged terrains.

- Interior Resale Preservation – Reduces interior wear and tear, boosting resale value by keeping surfaces pristine.

- Crystal-Clear Clarity – Maintains original interior aesthetics without distortion, preserving factory finishes.

- Abrasion Resistance – Resists wear and tear from repeated contact with car wash brushes, dirt, and sand.

- Longevity – Offers long-term protection, with warranties ranging from 5 to 10 years depending on the product.

- Low-Friction Surface – Smooth texture reduces friction from日常 use, minimizing abrasions and scratches.

- Gasoline Spill Resistance – Withstands accidental fuel spills without swelling or discoloration, crucial for fuel-efficient vehicles.

- Nano-Ceramic Reinforcement – Hybrid films combine TPU with ceramic particles for increased hardness (9H) and scratch resistance.

- Anti-Static for Electronics – Reduces dust accumulation on touchscreens and interiors by minimizing static charge attraction.

The user perception and consumption misconceptions of PPF:

- Correct Perception: Professional Installation Worth Cost – 90% of satisfied users attribute results to certified installers, valuing dust-free environments and precision tools.

- Consumer Misconception: “PPF Yellowing Is Visible Immediately” – Expecting instant discoloration, not realizing quality films take 5 years to show subtle yellowing.

- Correct Perception: Impact Absorption Benefits – Off-road enthusiasts correctly rely on PPF to disperse rock impacts, reducing paint chipping by 75%.

- Correct Perception: Climate-Specific Formulas – Users in deserts seek UV-enhanced PPF, while coastal buyers prioritize saltwater resistance, matching products to environments.

- Correct Perception: Interior PPF Benefits – Users protect dashboards and touchscreens, reducing UV fading and scratch visibility by 80%.

- Correct Perception: UV Protection Value – Users increasingly link PPF to preventing paint fading, with 72% citing UV resistance as a key purchase driver.

- Correct Perception: Matte Finish Compatibility – Educated buyers seek matte-specific PPF, avoiding gloss films that ruin specialty paint textures.

- Correct Perception: Thickness Depends on Use Case – Off-roaders choose 10mil PPF, while daily drivers opt for 8mil to balance protection and flexibility.

- Consumer Misconception: “New Car Paint Is ‘Protected’ from Factory” – Trusting factory clear coats alone, unaware they lack the impact resistance of PPF.

The long-term monitoring and maintenance system after the installation of PPF:

- Microfiber Cloth Protocol – Using lint-free, 300 GSM cloths for drying to avoid micro-scratches from debris in cheaper fabrics.

- Coastal Region Salt Damage Checks – Monthly inspections for corrosion under PPF in saltwater zones, focusing on metal trim edges.

- Cold-Weather Adhesive Care – Avoiding pressure washing in sub-zero temperatures to prevent thermal shock to adhesives.

- DIY Bubble Repair Guidelines – Using a needle to puncture bubbles, then applying heat and gentle pressure with a microfiber cloth.

- Bi-Monthly Edge Lifting Checks – Inspecting door edges, hood seams, and wheel arches with a feeler gauge to detect 0.1mm lifts before water intrusion.

- Color-Enhancing Cleaners for Gloss PPF – Using polymer-enhanced cleaners to boost shine without abrasives on glossy finishes.

The horizontal comparison of PPF with other protection methods:

- PPF vs. Multi-Surface Sealants – Multi-surface sealants offer mild protection across materials, while PPF provides specialized, high-impact defense for painted surfaces alone.

- PPF vs. Anti-Graffiti Coatings – Anti-graffiti treatments focus on easy stain removal, while PPF adds physical barrier defense against scratches from graffiti tools.

- PPF vs. Clear Bra (PVC) – Modern TPU PPF offers self-healing and flexibility, outperforming rigid PVC clear bras that crack in cold weather and lack repair capabilities.

- PPF vs. Matte Paint Sealants – PPF preserves matte paint texture while adding scratch resistance, whereas matte sealants focus on maintaining finish but lack impact defense.

- PPF vs. Bug Remover Coatings – Bug coatings make cleanup easier, while PPF resists insect acid etching, with PPF offering proactive protection vs. reactive cleaning aid.

- PPF vs. Spray-On Protective Coatings – PPF is removable and repairable, unlike permanent spray coatings that require full repaint for damage correction.

- PPF vs. Chassis Undercoating – Undercoating protects metal from rust, while PPF defends visible painted surfaces from chips, with both addressing different vehicle vulnerability areas.

The cost structure and price composition of PPF:

- High-Demand Model Premiums – PPF for popular vehicles (e.g., Tesla Model Y) costs 5–10% more due to demand.

- Raw Material Costs – TPU resin constitutes 35–45% of total production costs, with premium grades (self-healing) costing 2x standard TPU.

- Scrap Recycling Revenue – Production scrap sold for recycling offsets 1–2% of raw material costs.

- OEM Partnership Pricing – Factory-installed PPF sold at 15–20% below aftermarket due to bulk production deals.

- Topcoat Quality Impact – Ceramic-infused topcoats add $0.50–$1.00 per square foot but enable 10–15% price premiums.

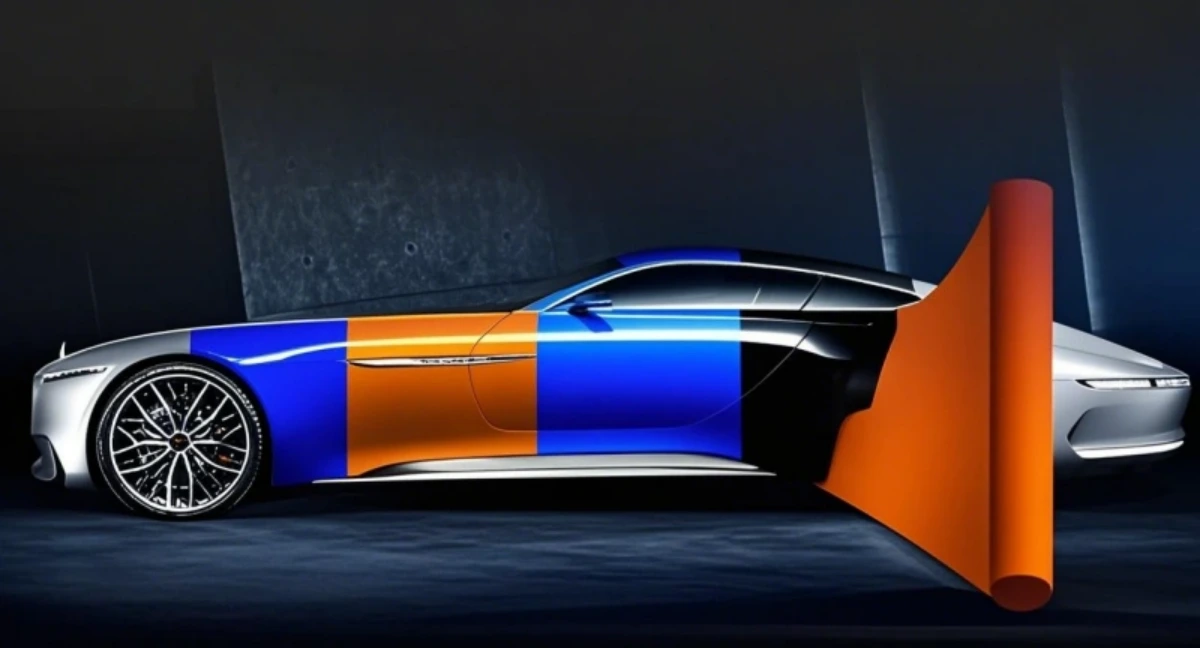

AUTOLI(CN) PPF(Paint Protection Film) factory

autoli TPU PPF Applied to all brand car models as Nissan、Toyota、byd、acura.Our factory cooperates with Auto Detailing service、Auto Spa、PPF trading and all so in many countries and regions around the world,like Madagascar,Switzerland,Austria,Iraq,Norway,Egypt,Warranty: 10 years.Our advantages:Unlock Business Growth with Our Factory’s PPF;Short production cycle, quick delivery;Your Key to Profitable PPF Ventures.Our factory also provides PET FILM、Window tint.