PPF’s softness allows it to “give” under impact, then return to shape, unlike rigid films that crack on impact.,Hydrophobic coating repels acid rain and bird droppings.,Secure Your Business Future: Partner with Our Factory’s Value – Driven PPF.

The cost structure and price composition of PPF:

- Production Labor Costs – Skilled operators for extrusion lines contribute 12–18% of total manufacturing expenses.

- Warranty Add-Ons – Extending warranties from 5 to 10 years increases prices by 15–20% with minimal cost increase.

- Custom Cut Fees – Vehicle-specific laser cuts add $100–$300 to total costs vs. generic patterns.

- Warranty Reserves – 2–3% of revenue is allocated to warranty claims, higher for lifetime warranty products.

- OEM Partnership Pricing – Factory-installed PPF sold at 15–20% below aftermarket due to bulk production deals.

The long-term monitoring and maintenance system after the installation of PPF:

- Avoid Parking Under Trees – Minimizing exposure to sap, berries, and bird droppings that require frequent cleaning.

- Abrasive Product Bans – Prohibiting use of clay bars, polishes with abrasives, or acidic cleaners that wear topcoats.

- Avoid Circular Wiping Motions – Using straight, back-and-forth strokes to minimize swirl marks during cleaning.

- Professional Edge Re-Sealing – Having certified installers re-heat seal edges at 12–18 months to prevent early lifting.

- Post-Wash Drying Technique – Starting from the top and working down to avoid water pooling at edges, which can cause lifting.

- Monthly Visual Inspections – Regular checks using LED lights to identify edge lifting, micro-scratches, or water intrusion around panel seams.

- Annual Adhesion Testing – Performing tape pull tests on inconspicuous areas to verify adhesive strength remains within factory specifications.

- Hand-Drying Post-Wash – Patting dry instead of air-drying to eliminate water spots, especially in hard-water regions.

- UV Degradation Monitoring – Using colorimeters to measure ΔE values (ΔE 3 requires evaluation).

- Annual Topcoat Thickness Testing – Using coating thickness gauges to ensure topcoat retains ≥80% original thickness.

The market trends and industry changes of PPF:

- Blockchain Warranty Verification – Brands like 3M use blockchain to secure digital warranties, preventing fraud and simplifying transfers between vehicle owners.

- TPU Dominance in Material Innovation – Thermoplastic polyurethane (TPU) films now account for 25% of global PPF installations, with self-healing TPU shipments rising 38% since 2021 due to superior scratch resistance and durability.

- Rise of Mobile Installation Services – On-demand PPF installation units equipped with portable dust-free booths are gaining traction, targeting busy urban consumers who prefer doorstep service.

- Regulatory Compliance in Manufacturing – Stringent environmental regulations (e.g., EU REACH) are pushing PPF producers to adopt solvent-free adhesives and energy-efficient production processes, reducing carbon footprints by up to 80%.

- E-Bike/Scooter PPF Demand – 40% of e-mobility retailers offer PPF for scooter bodies, protecting against urban scratches and extending resale value.

- Local Sourcing Trends – Post-pandemic, 55% of North American PPF brands source TPU locally, reducing supply chain delays by 30%.

The user scenarios and value validation of PPF:

- Tropical Region Owners – Resists acid rain etching in Bangkok and Rio, with PPF maintaining 90% paint clarity vs. 60% for unprotected vehicles after 2 years.

- EV Owners – Protects Tesla and Rivian battery hoods from stone chips, maintaining thermal efficiency and avoiding warranty-related paint damage claims.

- Food Truck Operators – Protects mobile kitchen exteriors from road grime and food splatters, maintaining brand aesthetics for customer appeal.

- Off-Road Enthusiasts – Shields Jeep Wrangler and Ford Bronco fenders from trail rocks and branches, reducing paint repair costs by $800 annually.

- Senior Drivers – Reduces anxiety about minor parking mishaps, with PPF hiding 90% of small dents and scratches from low-speed impacts.

- Performance Car Drivers – Shields Porsche GT3 and BMW M4 hoods from brake dust and tire debris during track days, reducing post-event detailing time by 2 hours.

- Family Car Owners – Protects minivan door sills from kids’ shoes and pet claws, with 80% reporting “like-new” interior/exterior after 3 years of use.

- Vintage Camper Van Enthusiasts – Preserves 1960s VW Bus paint while camping, with PPF resisting tree sap and rain stains during outdoor trips.

- Snowmobile Trail Groomers – Resists ice and salt corrosion on heavy machinery, reducing rust formation by 55% in cold-weather operations.

- Custom Paint Owners – Preserves expensive matte or chameleon finishes, with PPF preventing swirl marks that would ruin $5,000 custom paint jobs.

The environmental protection and sustainability of PPF:

- Reduced Microplastic Shedding – Durable TPU sheds 90% less microplastics than short-lived waxes or sealants that degrade quickly.

- Reduced Landfill Contributions – 10-year PPF generates 75% less waste than 1-year sealants over a vehicle’s lifetime.

- Auto Recycler Partnerships – Programs with auto recyclers ensure 85% of end-of-life PPF is collected for recycling, not landfilled.

- Reusable Shipping Crates – Replacing single-use boxes with returnable crates cuts packaging waste by 80% in B2B distribution.

- LED Lighting in Factories – Energy-efficient LED lighting cuts factory electricity use by 40% compared to fluorescent systems.

- End-of-Life Takeback Programs – Manufacturers like XPEL offer PPF recycling initiatives, collecting old films for repurposing into new polymer products.

The regulations of PPF and after-sales services:

- Solvent-Free Adhesive Requirements – EU REACH and California CARB regulations push PPF producers to adopt solvent-free adhesives, reducing carbon footprints by up to 80% .

- 3M’s Warranty Exclusions – 3M’s warranty explicitly excludes watermarks, improper maintenance, and non-authorized products, emphasizing the need for professional installation and genuine materials .

- Class Action Liability – Manufacturers face potential litigation for non-compliant PPFs, as seen in cases involving PFAS contamination or false warranty claims .

- Cross-Industry Regulatory Alignment – PPFs used in electronics or aerospace must comply with sector-specific standards (e.g., FCC for electronics), expanding regulatory complexity .

- 3M’s Warranty Exclusions – 3M’s warranty explicitly excludes watermarks, improper maintenance, and non-authorized products, emphasizing the need for professional installation and genuine materials .

- Lifetime Warranty Programs – Premium PPF brands like 3M offer 7-year warranties on Pro Series films, covering defects like delamination and yellowing, while excluding wear and tear or improper installation .

- California CARB VOC Limits – PPF adhesives sold in California must comply with CARB’s strict VOC regulations, reducing harmful emissions during installation to align with regional air quality standards .

- Post-Installation Inspections – Professional installers like NAR PPF conduct post-installation checks to ensure edge sealing and material adherence, minimizing warranty claims .

The horizontal comparison of PPF with other protection methods:

- PPF vs. Acrylic Paint Sealants – Acrylic sealants harden into a rigid layer prone to peeling, while PPF remains flexible, reducing edge lifting in temperature changes.

- PPF vs. Clear Bra (PVC) – Modern TPU PPF offers self-healing and flexibility, outperforming rigid PVC clear bras that crack in cold weather and lack repair capabilities.

- PPF vs. Ceramic Coatings – PPF offers physical impact protection (resisting rocks/chips) while ceramic coatings focus on chemical resistance and hydrophobicity, with PPF lasting 5–10 years vs. 2–5 for ceramics.

- PPF vs. Chassis Undercoating – Undercoating protects metal from rust, while PPF defends visible painted surfaces from chips, with both addressing different vehicle vulnerability areas.

- PPF vs. Polymer Sealants – Polymer sealants offer 3–6 months of chemical resistance but no physical defense, while PPF provides both for 5 years.

- PPF vs. Rubberized Undercoating – Undercoating protects metal from rust, while PPF defends painted surfaces from road debris, with non-overlapping application zones.

- PPF vs. Wax Sprays – Wax sprays enhance gloss for 2–4 weeks but offer no scratch protection, while PPF provides long-term defense with minimal maintenance.

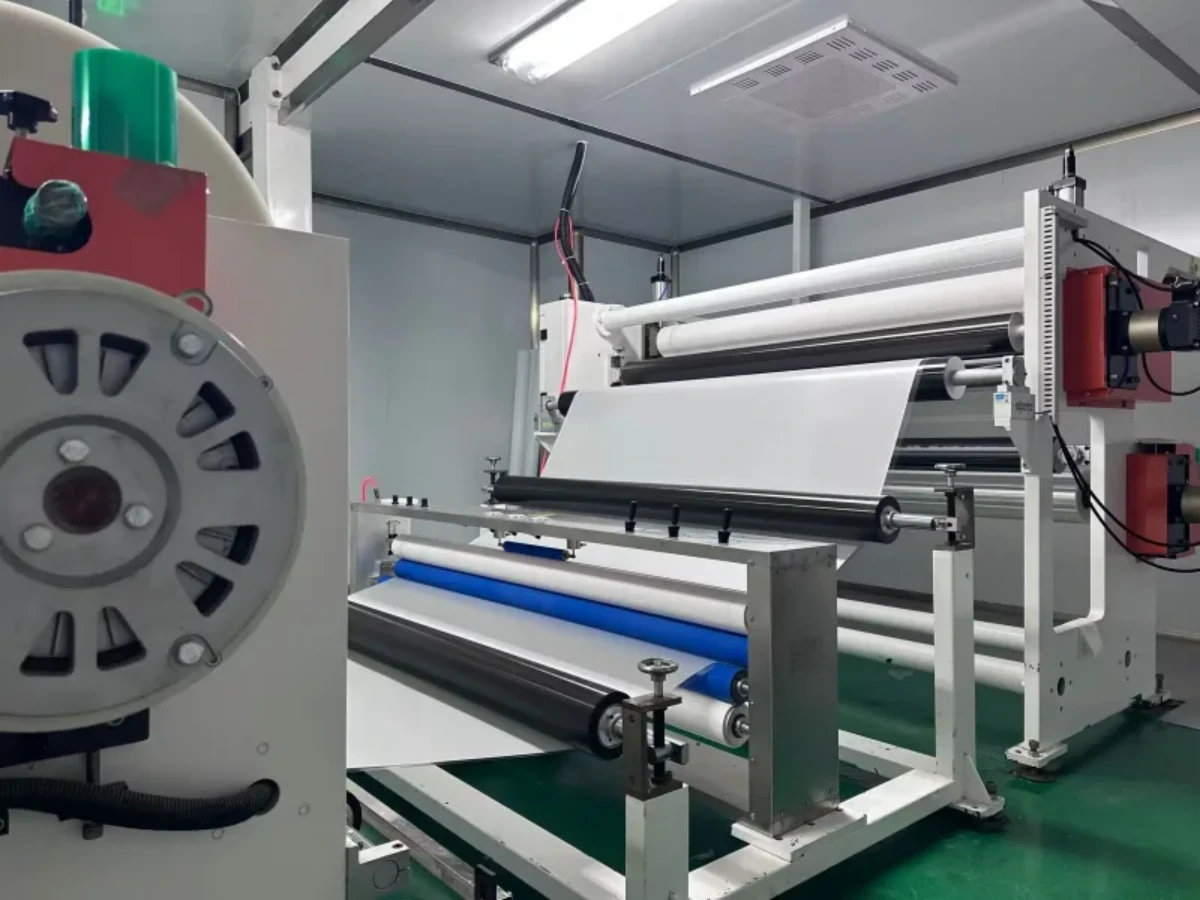

The production supply chain and quality control system of PPF:

- Design for Quality (DFQ) – Quality requirements integrated into new product development from concept stage.

- Packaging Material Supply – Partnerships with recyclable packaging manufacturers to align with sustainability goals.

- Transportation Logistics – Temperature-controlled trucking and ocean freight for long-distance shipments to prevent adhesive degradation.

- Batch Testing Protocols – Random sampling of finished rolls (1 per 50) for full performance characterization.

- Thickness Gauging – Laser sensors measuring film thickness every 0.5 seconds, ensuring ±0.1mil tolerance.

- Distribution Network Optimization – Regional hubs in NA, EU, and APAC reducing delivery times to installers by 30–40%.

- Localization Strategies – Regional production for large markets (e.g., China, US) to reduce shipping costs and tariffs.

- Audit Schedules – Internal audits quarterly, external audits annually to verify QMS effectiveness.

- Continuous Improvement Teams – Cross-functional groups analyzing quality data to implement process enhancements.

The materials and technologies of PPF:

- UL ECOLOGO Certification: Validates environmental sustainability and low chemical emissions.

- Antibacterial and mold-resistant coating technology: Silver ion antibacterial agent is added to the membrane surface, which inhibits the growth of mold and bacteria in humid environments. This technology is particularly suitable for long-term use in areas with frequent rainfall and high humidity.

- Matte finish technology: Achieves 20-30° gloss levels with a velvet-like texture, ideal for luxury vehicles and matte paint protection.

- Environmentally friendly and formaldehyde-free process: The production uses a VOCs-free formula, with no irritating odor during installation and use, meeting environmental standards.

- EV-specific lightweight optimization: Reduces base material density by 15% for electric vehicles, minimizing added weight impact on battery range.

- The core substrate is thermoplastic polyurethane (TPU): It is highly flexible and impact-resistant, serving as the fundamental material for PPF to provide protection and self-repair capabilities, outperforming traditional PVC.

AUTOLI(CN) PPF(Paint Protection Film) manufacturer

autoli TPU PPF Applied to all brand car models as Benz、Rolls-Royce、byd、Lamborghini.Our factory cooperates with Auto Detailing、PPF brand、AutoZone、Auto Spa、PPF trading and all so in many countries and regions around the world,like SriLanka,Netherlands,New Zealand,Singapore,Sweden,Warranty: 10 years.Our advantages:Unlock Business Growth with Our Factory’s PPF;SGS, ASTM, REACH, UL and other certifications;Your Key to Profitable PPF Ventures;Large stock of styles for you to choose from;Efficient production reduces costs.Our factory also provides Paint Protection Film、PPF.