PPF’s compatibility with ceramic coatings allows layering, enhancing hydrophobicity and gloss for ultimate protection.,Low surface energy resists dust adhesion.,Associate for Profitability: Quality – Guaranteed PPF, Color – Diverse Ranges, Low – Cost Deals.

How TPU Redefines PPF:

- Scratch Resistance – TPU’s 9H hardness topcoats redefined PPF from basic shields to high-wear solutions resisting key scratches and shopping cart impacts.

- Anti-Microbial Additions – Silver-ion infused TPU redefined PPF from exterior-only protectors to interior solutions inhibiting bacteria growth on high-touch surfaces.

- High-Traffic Durability – TPU’s abrasion resistance redefined PPF from personal vehicle products to commercial fleet solutions for taxis and delivery vans.

- Cost-Effectiveness Over Time – TPU’s long lifespan redefined PPF from expensive upfront purchases to cost-saving investments vs. frequent repaints.

- Modular Design – TPU’s compatibility with partial coverage redefined PPF from full-wrap-only options to targeted solutions for high-impact areas (hood, fenders).

The regulations of PPF and after-sales services:

- Cross-Industry Regulatory Alignment – PPFs used in electronics or aerospace must comply with sector-specific standards (e.g., FCC for electronics), expanding regulatory complexity .

- Nano-Coating Warranty Bundles – Hybrid solutions combining PPF with ceramic coatings (e.g., Onyx PPF Nano Coat) offer extended warranties covering both layers .

- India’s BIS Certification for PP Materials – Polypropylene (PP) used in PPF production must meet India’s BIS certification under IS 10951:2020, ensuring quality and safety for domestic and export markets .

- DIY Installation Void Policies – Most warranties, including PurePPF and 3M, void coverage for self-installed films, emphasizing the need for certified professional application .

- NAR Auto Film’s Compensation Policy – NAR PPF provides 1:1 pre-installation and 1:2 post-installation defect compensation, backed by factory insurance covering up to 100% of replacement costs .

- EU Digital Product Passport – PPF manufacturers must disclose material composition and recycling details via the EU’s Digital Product Passport, enhancing supply chain transparency .

The production supply chain and quality control system of PPF:

- Third-Party Certification – Independent labs (e.g., SGS, Intertek) validating performance claims for warranties and marketing.

- Supplier Development Programs – Workshops with tier-2 suppliers to improve material consistency and reduce defects.

- Packaging Optimization – Collaborative design with logistics firms for space-efficient palletization, reducing transport emissions.

- Calibration Schedules – Regular verification of testing equipment (gages, spectrometers) to ensure measurement accuracy.

- Coating Equipment Sourcing – Procurement of ceramic and self-healing coating lines from specialized industrial machinery providers.

- Ethical Sourcing Policies – Prohibition of materials from conflict zones or suppliers with labor violations.

The product classification and selection logic of PPF:

- Heat Tolerance Matching – Upgrading to high-temperature PPF for engine bays or EV battery zones prone to thermal stress.

- Warranty Needs Assessment – Selecting extended warranties (10 years) for high-value vehicles to protect resale value.

- Removability Requirement – Choosing residue-free adhesives for lease vehicles to avoid end-of-term penalties.

- Light Transmission Needs – Selecting high-clarity PPF for headlights to maintain visibility and safety.

- Edge Seal Technology Selection – Upgrading to heat-sealable PPF for car wash frequenters to prevent edge lifting.

- Chemical Cleaning Tolerance – Choosing PPF resistant to aggressive decontamination products for industrial vehicle use.

The long-term monitoring and maintenance system after the installation of PPF:

- Interior PPF Cleaning Routine – Wiping dashboard films with 70% isopropyl alcohol to remove fingerprints without streaking.

- Annual Adhesion Testing – Performing tape pull tests on inconspicuous areas to verify adhesive strength remains within factory specifications.

- UV Index-Based Protection – Applying UV-stabilizing sprays when UV index exceeds 7 to complement built-in anti-yellowing additives.

- Warranty-Approved Tools – Using only brand-recommended squeegees and applicators for DIY maintenance to avoid warranty voidance.

- Low-Pressure Rinse Angles – Directing water at 45° angles to panels to avoid forcing water under edges during rinsing.

- Seasonal Ceramic Coating Boosts – Applying PPF-compatible ceramic sprays (SiO? content ≥30%) to enhance hydrophobicity.

- Color Stability Tracking – Comparing colored PPF to original swatches annually to detect fading, especially in red/blue films.

- Avoid Silicone-Based Products – Steering clear of silicone sprays that leave glossy residues attracting dust to PPF surfaces.

- Post-Storm Damage Assessments – Inspecting for debris impacts or chemical residue after hailstorms, sandstorms, or acid rain events.

The user perception and consumption misconceptions of PPF:

- Correct Perception: Partial Coverage Value – Many opt for high-impact areas (hood, fenders) over full wraps, balancing protection and cost effectively.

- Consumer Misconception: “New Car Paint Is ‘Protected’ from Factory” – Trusting factory clear coats alone, unaware they lack the impact resistance of PPF.

- Correct Perception: Impact Absorption Benefits – Off-road enthusiasts correctly rely on PPF to disperse rock impacts, reducing paint chipping by 75%.

- Consumer Misconception: “PPF Installation Takes Days” – Avoiding PPF due to perceived downtime, not knowing modern pre-cut kits reduce professional installs to 1–2 days.

- Correct Perception: Climate-Specific Formulas – Users in deserts seek UV-enhanced PPF, while coastal buyers prioritize saltwater resistance, matching products to environments.

- Consumer Misconception: “PPF Can’t Be Repaired” – Assuming damaged PPF requires full replacement, unaware small sections can be patched professionally.

- Consumer Misconception: “PPF Hides Existing Paint Damage” – A false belief that PPF covers swirl marks or chips, when pre-installation paint correction is actually required.

- Consumer Misconception: “New Cars Don’t Need PPF Immediately” – Delaying installation, unaware that factory paint is most vulnerable to damage in the first 6 months of ownership.

- Correct Perception: Brand Reputation Matters – Discerning buyers choose established brands, associating 3M or XPEL with consistent quality over generic alternatives.

- Consumer Misconception: “Once Applied, No Maintenance Needed” – A common myth that PPF requires zero upkeep, ignoring the need for pH-neutral cleaning to preserve hydrophobicity.

The cost structure and price composition of PPF:

- Premium PPF Costs – 10mil multi-layer films with lifetime warranties retail at $12–$20 per square foot, 50–60% margins.

- Freight & Logistics – International shipping adds $0.50–$1.50 per square foot, higher for expedited delivery.

- New Customer Incentives – First-time buyer discounts cut prices by 5–10% to acquire long-term clients.

- Cross-Selling Margins – PPF sales boost ceramic coating and detailing revenue by 25–35% at higher margins.

- Long-Term Contract Discounts – 3–5 year fleet contracts reduce per-vehicle costs by 10–15% via guaranteed volume.

- Bio-Based TPU Premium – Plant-derived TPU increases raw material costs by 15–20% but supports premium pricing.

- Technical Support Costs – Installer hotlines and training materials add $0.10–$0.20 per square foot.

- Adhesive Technology Costs – Removable adhesives add $0.30–$0.50 per square foot vs. permanent options.

The horizontal comparison of PPF with other protection methods:

- PPF vs. Ceramic Coatings – PPF offers physical impact protection (resisting rocks/chips) while ceramic coatings focus on chemical resistance and hydrophobicity, with PPF lasting 5–10 years vs. 2–5 for ceramics.

- PPF vs. UV-Blocking Window Tints – Tints reduce interior UV exposure, while PPF blocks exterior paint UV damage, with both addressing UV risks but on different surfaces.

- PPF vs. Paint Sealants – Sealants provide 6–12 months of chemical resistance, while PPF adds physical barrier protection against impacts, with both enhancing gloss but PPF lasting longer.

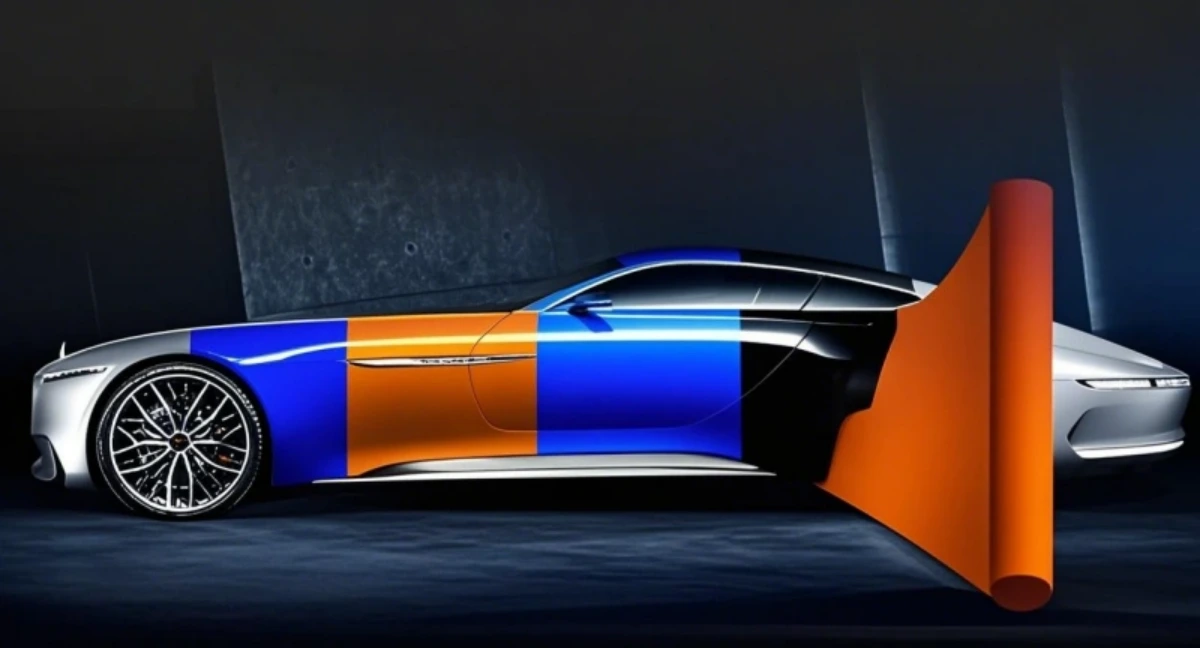

- PPF vs. Vinyl Wraps – PPF prioritizes paint protection with self-healing properties, while vinyl wraps focus on aesthetic customization, with PPF being more durable against abrasion.

- PPF vs. Rust Converter Products – Converters treat existing rust, while PPF prevents rust triggers (moisture/salt) on painted surfaces, with complementary roles in corrosion management.

- PPF vs. Truck Bed Liners – Liners protect cargo areas from heavy impacts, while PPF shields exterior panels from road debris, with distinct application zones and purposes.

- PPF vs. Metal Polish – Metal polish restores shine to chrome/alloys but offers no protection, while PPF on metal trims prevents future scratches and tarnishing.

AUTOLI(CN) PPF(Paint Protection Film) oem manufacturer

autoli TPU PPF Applied to all brand car models as Lamborghini、byd、AstonMartin、binli.Our factory cooperates with PPF trading、PPF distributor、ppf installation and all so in many countries and regions around the world,like Indonesia,New Zealand,Sweden,Italy,Czech,Portugal,Warranty: 10 years.Our advantages:Efficient production reduces costs;Strict quality control system;Large stock of styles for you to choose from.Our factory also provides TPU PPF、vinyl Wrap、Car Wrap.