PPF’s scratch depth reduction by 60% via “hard-soft segment” TPU structure minimizes damage from keys or accidental scrapes.,High resale appeal with unmarked paint.,Waterproof PPF Film – Bulk Discounts, 24H Quote.

The user pain points of PPF and their solutions:

- Salt Corrosion in Coastal Areas – Mitigated by anti-corrosion additives and salt-resistant adhesives reducing rust under film.

- Damage from Road Debris – Mitigated by impact-dispersing multi-layer films, reducing stone chips by 70% at highway speeds.

- Uncertainty About Product Quality – Resolved by third-party certifications (ECOCERT, ISO 9001) and transparent material disclosure.

- Fading in Extreme Sunlight – Fixed by 99% UV-blocking films with enhanced carbon black pigments for tropical climates.

- Mold Growth in Humid Climates – Prevented by antimicrobial additives and breathable film designs allowing moisture evaporation.

- Expensive Repairs for Damage – Reduced via self-healing technology (repairs 3μm scratches with heat) and patchable film sections.

The regulations of PPF and after-sales services:

- Heat-Activated Self-Healing Warranties – Brands guarantee self-healing performance (e.g., 98% micro-scratch repair within 8 minutes at 45°C) under warranty, reflecting confidence in material durability .

- Class Action Liability – Manufacturers face potential litigation for non-compliant PPFs, as seen in cases involving PFAS contamination or false warranty claims .

- Regional Warranty Variations – PPF warranties often differ by region; for example, monsoon-prone areas may offer extended coverage for water ingress issues .

- Blockchain Warranty Verification – 3M utilizes blockchain to secure digital warranties, enabling traceable ownership transfers and fraud prevention .

- EU Digital Product Passport – PPF manufacturers must disclose material composition and recycling details via the EU’s Digital Product Passport, enhancing supply chain transparency .

- Supply Chain Traceability – EU PPWR mandates tracking PPF materials from production to disposal, ensuring compliance with recycled content targets (e.g., 30% by 2030) .

- NAR Auto Film’s Compensation Policy – NAR PPF provides 1:1 pre-installation and 1:2 post-installation defect compensation, backed by factory insurance covering up to 100% of replacement costs .

- IoT-Enabled Performance Monitoring – Emerging PPFs with embedded sensors monitor UV exposure and damage levels, providing real-time data for predictive maintenance and warranty claims .

- China’s Consumer Complaint Channels – PPF buyers in China can file quality-related disputes through the national 12315 hotline, facilitating regulatory oversight and resolution .

The user perception and consumption misconceptions of PPF:

- Correct Perception: Impact Absorption Benefits – Off-road enthusiasts correctly rely on PPF to disperse rock impacts, reducing paint chipping by 75%.

- Correct Perception: Partial Coverage Value – Many opt for high-impact areas (hood, fenders) over full wraps, balancing protection and cost effectively.

- Correct Perception: Long-Term Cost Savings – 68% of users understand PPF reduces repaint costs over 5 years, aligning with data showing $2,000 savings on luxury vehicles.

- Consumer Misconception: “All PPFs Are Identical” – Many buyers assume no quality difference between $500 and $3,000 PPF, neglecting TPU vs. PVC material distinctions.

- Correct Perception: PPF Preserves Custom Paint Investments – Owners of $5k custom paint jobs use PPF, avoiding costly touch-ups from minor damage.

- Correct Perception: Self-Healing Efficacy – Most users recognize PPF can repair minor scratches (≤3μm) with heat, though many underestimate the need for 40°C activation temperatures.

- Consumer Misconception: “Thicker PPF = Better Protection” – Assuming 10mil PPF is always superior, ignoring that excessive thickness can cause edge lifting on curved surfaces.

- Correct Perception: Multi-Surface Application – Users increasingly apply PPF to headlights and trim, reducing fogging and scratches on high-wear areas.

The cost structure and price composition of PPF:

- Price Matching Adjustments – Competitive price matching reduces margins by 5–10% but preserves market share.

- Raw Material Costs – TPU resin constitutes 35–45% of total production costs, with premium grades (self-healing) costing 2x standard TPU.

- Professional Installation Premium – Labor adds $500–$1,500 to vehicle costs, 2–3x material costs for complex installs.

- Warranty Reserves – 2–3% of revenue is allocated to warranty claims, higher for lifetime warranty products.

- High-Demand Model Premiums – PPF for popular vehicles (e.g., Tesla Model Y) costs 5–10% more due to demand.

- Matte Finish Premium – Matte-specific PPF costs 15–20% more than gloss due to specialized topcoat formulations.

- Currency Fluctuation Impact – Dollar/Euro volatility adds 3–5% price variability for cross-border transactions.

- End-of-Line Discounts – Discontinued models sold at 20–30% off to clear inventory.

- Environmental Certification Premiums – Eco-friendly PPF costs 5–10% more due to sustainable material sourcing.

- Bio-Based TPU Premium – Plant-derived TPU increases raw material costs by 15–20% but supports premium pricing.

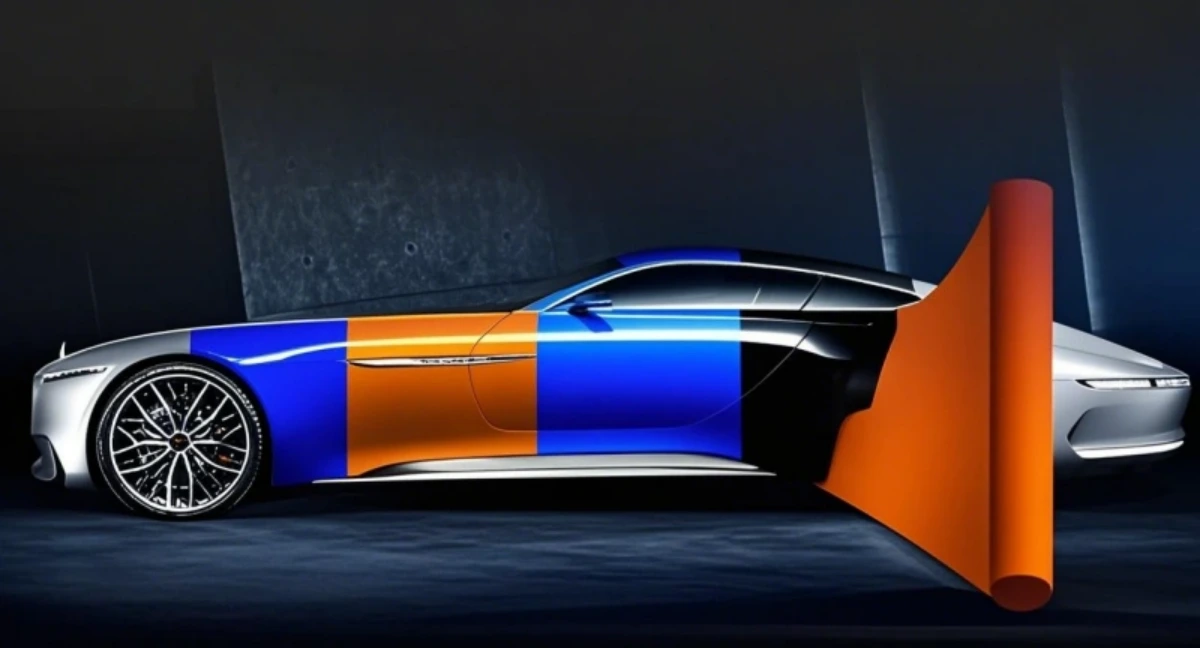

How TPU Redefines PPF:

- Industrial Versatility – Heavy-duty TPU redefined PPF from automotive-only products to industrial solutions for machinery, boats, and aerospace equipment.

- Flexibility Breakthrough – TPU’s 500% elongation redefined PPF from rigid covers to conformable films that hug complex vehicle contours without cracking.

- Low-VOC Production – TPU’s solvent-free manufacturing redefined PPF from high-emission products to eco-friendly options meeting CARB and REACH standards.

- Future-Proofing – TPU’s adaptability to new technologies redefined PPF from static products to evolving solutions compatible with AI, IoT, and next-gen vehicle systems.

- Color Stability – TPU’s pigment-retention properties redefined PPF from clear-only products to color-stable tinted films for subtle aesthetic enhancement.

- Chemical Resistance – TPU’s resistance to bird droppings, road salt, and fuels redefined PPF from basic shields to multi-hazard barriers.

- Disaster Recovery – TPU’s protection during storms redefined PPF from daily-use products to emergency preparedness tools reducing post-storm repair costs.

Say Goodbye to Car Scratches: Self-Healing PPF Revealed!:

- Family cars stay presentable as scratches from children’s toys or pet claws heal quickly, even with daily use.

- Unlike temporary scratch removers that wash off, self-healing PPF’s repairs are permanent, with no reapplication needed.

- Hard-to-reach areas like wheel arches and bumper edges receive the same healing benefits, ensuring uniform appearance across your vehicle.

- Light scratches from tree branches, gravel, or dust buildup heal quickly, preserving your car’s appearance between professional details.

- Car owners report a 70% reduction in visible scratches after installing self-healing PPF, boosting vehicle pride and resale value.

- Unlike touch-up paints that create color mismatches, self-healing PPF repairs scratches while preserving your car’s original hue.

- UV-stable formulas ensure self-healing PPF resists yellowing while still repairing sun-induced micro-scratches.

- Car dealerships keep demo vehicles looking new with self-healing PPF, reducing reconditioning costs between test drives.

- Self-healing PPF reduces the need for expensive “paint correction” services, saving hundreds annually in maintenance.

The differentiated user group needs matching of PPF:

- Matte Paint Owners – Select matte-specific PPF (20–30% gloss) to preserve texture without altering the factory matte finish or causing shine spots.

- Mobile Farmers Market Vans – Need produce-safe PPF that resists fruit/vegetable juice stains, maintaining clean exteriors during market days.

- College Students – Choose affordable 6mil PPF kits for first cars, balancing basic scratch protection with budget constraints.

- Photography Vehicle Owners – Select high-gloss white PPF for van exteriors, maintaining clean backdrops for on-location photo shoots.

- Ride-Share Drivers – Opt for durable 8mil PPF with quick-healing properties to resist passenger-related scratches and maintain vehicle appearance.

- Mobile Science Lab Vans – Prefer chemical-resistant PPF for interior and exterior surfaces, withstanding spills and equipment movement during demonstrations.

The long-term monitoring and maintenance system after the installation of PPF:

- Impact-Resistant Record Keeping – Logging maintenance dates, issues, and repairs to track performance over the warranty period.

- Interior PPF Cleaning Routine – Wiping dashboard films with 70% isopropyl alcohol to remove fingerprints without streaking.

- Drying Cloth Maintenance – Washing microfiber cloths in mild detergent (no fabric softener) to preserve lint-free properties.

- Seasonal Storage Preparation – Cleaning thoroughly, applying sealant, and using breathable covers before 30 day storage periods.

- Avoid Automated Brush Washes – Opting for touchless or hand washes to prevent brush-induced swirl marks on topcoats.

- Warranty Claim Documentation – Collecting photos, receipts, and inspection reports to support warranty claims for premature wear.

The horizontal comparison of PPF with other protection methods:

- PPF vs. Nano Glass Coatings – Glass coatings excel on windows for water repellency, while PPF protects painted surfaces from physical damage, with minimal overlap in application.

- PPF vs. Glass Polish – Polish removes water spots from glass, while PPF on paint prevents spots via hydrophobicity, with distinct surface applications.

- PPF vs. Chassis Undercoating – Undercoating protects metal from rust, while PPF defends visible painted surfaces from chips, with both addressing different vehicle vulnerability areas.

- PPF vs. Tire Dressing – Dressing enhances tire shine, while PPF has no role in tire care, illustrating their focus on separate vehicle components.

- PPF vs. Fabric Protectors – Fabric protectors repel stains on interiors, while PPF defends exterior paint, with both using hydrophobic tech but on different materials.

- PPF vs. Paint Correction – Paint correction fixes existing swirls/scratches, while PPF prevents future damage, with PPF often applied post-correction to preserve results.

- PPF vs. Paint Sealants – Sealants provide 6–12 months of chemical resistance, while PPF adds physical barrier protection against impacts, with both enhancing gloss but PPF lasting longer.

- PPF vs. Glass Coatings – Glass coatings excel on windows for clarity but don’t protect paint, whereas PPF is engineered specifically for automotive painted surfaces.

- PPF vs. Rubber Sealants – Rubber sealants protect gaskets from drying but have no role in paint protection, highlighting PPF’s focus on exterior surfaces.

The user perception and consumption misconceptions of PPF:

- Correct Perception: Impact Absorption Benefits – Off-road enthusiasts correctly rely on PPF to disperse rock impacts, reducing paint chipping by 75%.

- Correct Perception: Partial Coverage Value – Many opt for high-impact areas (hood, fenders) over full wraps, balancing protection and cost effectively.

- Correct Perception: Long-Term Cost Savings – 68% of users understand PPF reduces repaint costs over 5 years, aligning with data showing $2,000 savings on luxury vehicles.

- Consumer Misconception: “All PPFs Are Identical” – Many buyers assume no quality difference between $500 and $3,000 PPF, neglecting TPU vs. PVC material distinctions.

- Correct Perception: PPF Preserves Custom Paint Investments – Owners of $5k custom paint jobs use PPF, avoiding costly touch-ups from minor damage.

- Correct Perception: Self-Healing Efficacy – Most users recognize PPF can repair minor scratches (≤3μm) with heat, though many underestimate the need for 40°C activation temperatures.

- Consumer Misconception: “Thicker PPF = Better Protection” – Assuming 10mil PPF is always superior, ignoring that excessive thickness can cause edge lifting on curved surfaces.

- Correct Perception: Multi-Surface Application – Users increasingly apply PPF to headlights and trim, reducing fogging and scratches on high-wear areas.

AUTOLI(CN) PPF(Paint Protection Film) oem manufacturer

autoli TPU PPF Applied to all brand car models as Bugatti、Chrysler、ford、Lincoln.Our factory cooperates with PPF trading、Auto Spa、Auto Repair Center and all so in many countries and regions around the world,like Australia,VietNam,Germany,United States,Warranty: 10 years.Our advantages:Our customers are all over the world;Strict quality control system;Your Key to Profitable PPF Ventures;Our customers are all over the world;Perfect after-sales service.Our factory also provides Car PPF、PPF FILM.