PPF’s UV blocking preserves interior materials too, reducing dashboard fading by limiting sunlight penetration.,Reduces dashboard fading via UV block.,Hurry! Collaborate with Our Factory for Fast – Tracked PPF Deliveries and Business Leap.

The market trends and industry changes of PPF:

- Anti-Microbial PPF Growth – Post-pandemic, 15% of interior PPF includes silver-ion coatings, inhibiting 99% of bacteria on high-touch surfaces like door handles.

- Aerospace PPF Expansion – Lightweight PPF is being tested on aircraft exteriors, protecting against bird strikes and UV degradation in high-altitude environments.

- Local Sourcing Trends – Post-pandemic, 55% of North American PPF brands source TPU locally, reducing supply chain delays by 30%.

- Online Certification Courses – Platforms like PPF University offer $99 online installer certifications, increasing skilled labor availability in underserved markets.

- Competitive Pricing Pressures – Market saturation in North America and Europe is driving price reductions, with entry-level PPF options now 20% cheaper than premium products, appealing to cost-conscious consumers.

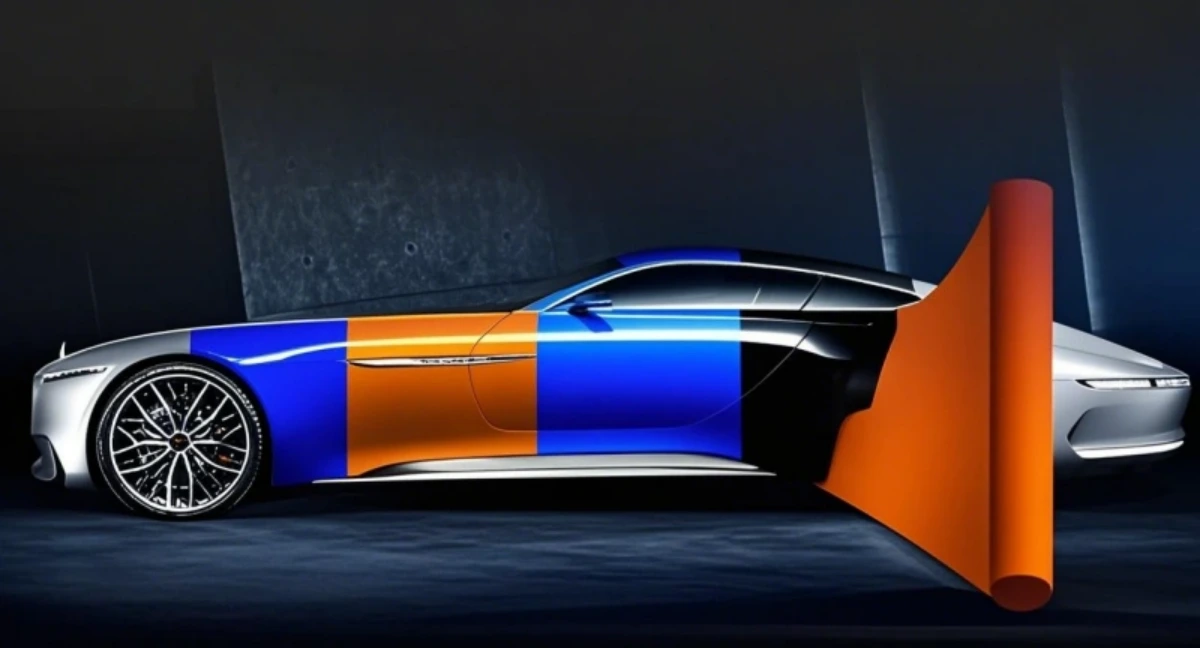

- Digital Print Integration – UV-curable digital printing on PPF allows custom graphics/logos, with 35% of commercial fleets now using branded PPF for marketing.

- ADAS Sensor Compatibility – PPF films with 99.9% LiDAR/radar transparency are becoming standard, ensuring autonomous driving systems function unimpeded post-installation.

- Integration of Ceramic Coatings – PPF-safe ceramic coatings applied post-installation (e.g., Onyx PPF Nano Coat) boost scratch resistance by 40%, creating hybrid protection solutions.

- Data-Driven Marketing Strategies – Brands are using AI analytics to identify regional demand patterns, tailoring product launches (e.g., anti-yellowing films for high-sun areas) to specific markets.

- Regulatory Push for Transparency – The EU’s Digital Product Passport initiative requires PPF manufacturers to disclose material composition and recycling options, driving supply chain accountability.

The materials and technologies of PPF:

- Low-residue removable technology: The adhesive uses a reversible cross-linking formula. After long-term use, when removing it, there will be no residue of glue, and it will not damage the original paint and clear coat layer. This makes it convenient for later replacement or maintenance.

- Electromagnetic interference (EMI) shielding: Integrates graphene nanosheets to block 99% of electromagnetic radiation, critical for electric vehicle electronics.

- Environmentally friendly and formaldehyde-free process: The production uses a VOCs-free formula, with no irritating odor during installation and use, meeting environmental standards.

- Edge-locking micro-groove design: Prevents water ingress and edge lifting through interlocking grooves, backed by 10-year edge retention warranties.

- Fire-resistant coating: Passes UL94 V-0 certification with flame spread rate <10mm/min, meeting automotive safety standards.

- Polar climate formulation: Maintains flexibility at -50°C, preventing cracking in arctic regions.

- Anti-microbial coating infusion: Incorporates silver-ion nanoparticles to inhibit 99% of bacteria and mold growth on film surfaces in humid climates.

- Thermal conductivity regulation: Optimizes heat transfer through the film to prevent paint overheating in direct sunlight, reducing thermal stress on clear coats.

- Anti-icing coating: Reduces ice adhesion by 60% through superhydrophobic surfaces, improving safety in winter conditions.

- Closed-loop recycling technology: Using degradable TPU base materials or physical recycling processes, it enables the recycling of discarded film materials, reducing environmental burden.

The user perception and consumption misconceptions of PPF:

- Correct Perception: Matte Finish Compatibility – Educated buyers seek matte-specific PPF, avoiding gloss films that ruin specialty paint textures.

- Consumer Misconception: “PPF Hides Existing Paint Damage” – A false belief that PPF covers swirl marks or chips, when pre-installation paint correction is actually required.

- Correct Perception: Professional Installation Worth Cost – 90% of satisfied users attribute results to certified installers, valuing dust-free environments and precision tools.

- Correct Perception: Quick Healing for Minor Damage – Users appreciate sunlight-activated healing, with 85% reporting scratches disappearing within 24 hours in warm weather.

- Correct Perception: UV Testing Validates Anti-Yellowing Claims – Checking for 1,000 hours of UV testing data, ensuring films resist discoloration in real-world use.

- Consumer Misconception: “Thicker PPF = Better Protection” – Assuming 10mil PPF is always superior, ignoring that excessive thickness can cause edge lifting on curved surfaces.

- Correct Perception: UV Protection Value – Users increasingly link PPF to preventing paint fading, with 72% citing UV resistance as a key purchase driver.

- Consumer Misconception: “PPF Is Only for Exteriors” – Overlooking interior applications, missing opportunities to protect door sills and touchscreens.

- Consumer Misconception: “PPF Blocks Car Washes” – Avoiding automated washes due to fear of damage, when brushless systems are actually safe for properly installed PPF.

The horizontal comparison of PPF with other protection methods:

- PPF vs. Headlight Restoration Kits – Restoration fixes yellowing, while PPF prevents UV damage and rock chips on headlights, extending clarity 3x longer than restored lenses alone.

- PPF vs. Polyurethane Sprays – Polyurethane sprays form a hard, brittle layer prone to chipping, while PPF’s flexible TPU base absorbs impacts without cracking.

- PPF vs. Rust Converter Products – Converters treat existing rust, while PPF prevents rust triggers (moisture/salt) on painted surfaces, with complementary roles in corrosion management.

- PPF vs. Rust Inhibitors – Inhibitors slow metal corrosion but don’t protect paint, whereas PPF acts as a moisture barrier preserving both paint and underlying metal.

- PPF vs. Fabric Protectors – Fabric protectors repel stains on interiors, while PPF defends exterior paint, with both using hydrophobic tech but on different materials.

- PPF vs. Vinyl Protectants – Vinyl protectants prevent cracking in vinyl wraps but don’t shield against impacts, unlike PPF which adds scratch resistance to wrapped surfaces.

- PPF vs. Stone Guard Films (Thin) – Thin stone guards protect against small debris but lack self-healing, while PPF handles larger impacts and repairs minor damage automatically.

- PPF vs. Paint Sealant Sprays – Sealant sprays offer 6–9 months of UV protection but no scratch defense, while PPF combines both for extended durability.

- PPF vs. Paint Correction – Paint correction fixes existing swirls/scratches, while PPF prevents future damage, with PPF often applied post-correction to preserve results.

- PPF vs. Clear Enamel – Clear enamel is a permanent paint layer that cracks under impact, whereas PPF flexes to absorb collisions and can be replaced if damaged.

The cutting-edge technology research and development of PPF:

- Biodegradable Nanocomposites – Coconut husk-derived bioplastics and black phosphorus-reinforced PPF degrade in 3–5 years under industrial composting.

- Dynamic Wettability Coatings – pH-responsive surfaces switch between superhydrophobic and hydrophilic states to adapt to varying environmental conditions.

- Multifunctional Self-Healing Films – Microcapsules containing both healing agents and antimicrobial silver ions offer dual functionality for medical devices.

- Antistatic Coatings – Graphene nanoplatelets integrated into topcoats dissipate static charge, preventing dust accumulation in industrial environments.

- 3D Laser Cutting – Femtosecond laser ablation creates intricate patterns with <10-micron precision, optimizing material usage by 95%.

- Quantum Dot UV Protection – Quantum dot-infused films block 99.9% of UV rays while enhancing color stability, preventing yellowing over 10 years.

- Dynamic Mechanical Response Coatings – Shape memory polyurethanes with programmable stress-strain curves adapt to impact forces in automotive collisions.

- Dynamic Wettability Coatings – pH-responsive surfaces switch between superhydrophobic and hydrophilic states to adapt to varying environmental conditions.

- Bio-Based Flame Retardant Coatings – Chitosan and ammonium polyphosphate composites provide V-0 rating in UL 94 tests with <1% loading.

The cost structure and price composition of PPF:

- End-of-Line Discounts – Discontinued models sold at 20–30% off to clear inventory.

- Marketing Expenses – Brand advertising and influencer partnerships contribute 5–8% to retail price markup.

- Minimum Order Quantities – MOQs (500 sq ft) reduce per-unit costs by 10–15% for commercial buyers.

- Quality Control Expenses – Automated inspection systems add 3–5% to production costs but reduce warranty claims by 40%.

- Brand Premium – Established brands (3M, XPEL) command 20–30% higher prices than generic alternatives for similar quality.

- Economic Downturn Pricing – Recessionary periods see 5–10% price reductions to maintain sales volume.

- Insurance Partnerships – Bundling with auto insurance reduces customer costs by 5–10% via insurer subsidies.

- Environmental Certification Premiums – Eco-friendly PPF costs 5–10% more due to sustainable material sourcing.

- Technical Support Costs – Installer hotlines and training materials add $0.10–$0.20 per square foot.

The user pain points of PPF and their solutions:

- Difficulty Removing Old PPF – Simplified with low-tack, residue-free adhesives and professional heat-assisted removal services.

- Difficulty Matching Vehicle Contours – Addressed by 3D-scanned, vehicle-specific pre-cut patterns for complex curves (fenders, mirrors).

- High Heat Damage (EV Batteries) – Solved by heat-resistant PPF (120°C ) with thermal conductivity for battery zone protection.

- Poor Hydrophobicity Over Time – Restored by SiO? sealant boosters, reviving water repellency every 3–6 months.

- ADAS Sensor Interference – Prevented by radar-transparent PPF (99.9% signal transmission) tested with OEM systems.

- Mold Growth in Humid Climates – Prevented by antimicrobial additives and breathable film designs allowing moisture evaporation.

AUTOLI(CN) PPF(Paint Protection Film) factory

autoli TPU PPF Applied to all brand car models as McLaren、volvo、byd、Dodge、binli.Our factory cooperates with Auto Detailing service、Auto Spa、PPF installer、Car Customization Shop and all so in many countries and regions around the world,like Slovenia,Sudan,Madagascar,USA,Warranty: 10 years.Our advantages:Unlock Business Growth with Our Factory’s PPF;SGS, ASTM, REACH, UL and other certifications;Large stock of styles for you to choose from;Perfect after-sales service;Your Key to Profitable PPF Ventures.Our factory also provides Car PPF、PPF FILM.