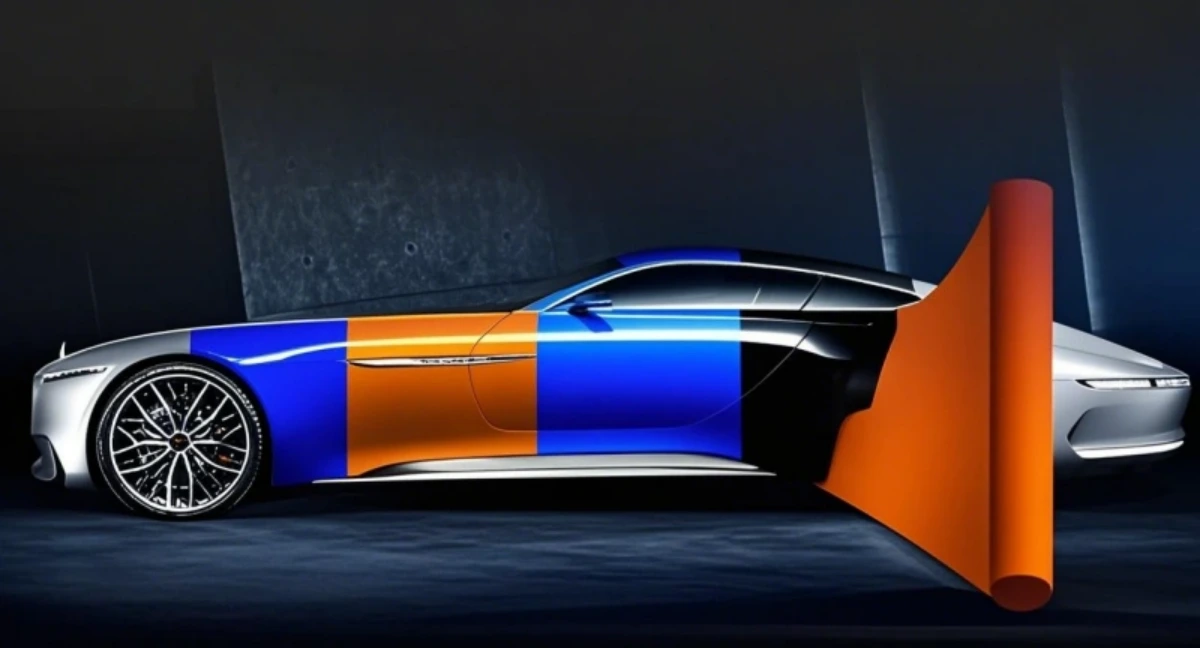

PPF’s protection on door edges prevents chips from open the doorcollisions, a common high-wear area on daily-driven cars.,Maintains 90% color saturation after 5 years.,Factory-Direct PPF Film – 50% Lower Price, ISO 9001 Certified.

The horizontal comparison of PPF with other protection methods:

- PPF vs. Paint Sealant Sprays – Sealant sprays offer 6–9 months of UV protection but no scratch defense, while PPF combines both for extended durability.

- PPF vs. Metal Polish – Metal polish restores shine to chrome/alloys but offers no protection, while PPF on metal trims prevents future scratches and tarnishing.

- PPF vs. Car Covers – PPF provides 24/7 protection during driving/parking, unlike covers that only work when stationary and risk scratching paint during removal.

- PPF vs. Liquid Glass Coatings – Liquid glass offers 6–12 months of chemical resistance but lacks physical impact protection, while PPF combines 5 years of scratch defense with self-healing capabilities.

- PPF vs. Fiberglass Coatings – Fiberglass coatings add rigid strength to surfaces but can’t conform to curves, unlike PPF which adapts to vehicle contours seamlessly.

- PPF vs. Truck Bed Liners – Liners protect cargo areas from heavy impacts, while PPF shields exterior panels from road debris, with distinct application zones and purposes.

- PPF vs. Matte Paint Sealants – PPF preserves matte paint texture while adding scratch resistance, whereas matte sealants focus on maintaining finish but lack impact defense.

- PPF vs. Anti-Corrosion Sprays – Sprays inhibit rust on bare metal but don’t protect paint, whereas PPF blocks corrosion triggers (salt, moisture) from reaching painted surfaces.

- PPF vs. Stone Chip Resistant Paint – Factory chip-resistant paint offers minimal defense, while PPF adds a flexible layer that absorbs impacts, reducing chips by 75%.

- PPF vs. Rust Inhibitors – Inhibitors slow metal corrosion but don’t protect paint, whereas PPF acts as a moisture barrier preserving both paint and underlying metal.

The product classification and selection logic of PPF:

- Specialty Function Lines – Categorized for ADAS compatibility, fire resistance, or antimicrobial properties for niche needs.

- Damage Risk Evaluation – Upgrading to impact-resistant PPF for off-road vehicles or high-debris work environments.

- Heat Tolerance Matching – Upgrading to high-temperature PPF for engine bays or EV battery zones prone to thermal stress.

- Budget-Driven Selection – Prioritizing economy-tier PPF for cost-sensitive buyers, balancing protection with affordability.

- Public Perception Consideration – Choosing invisible PPF over colored variants for professional or fleet vehicles.

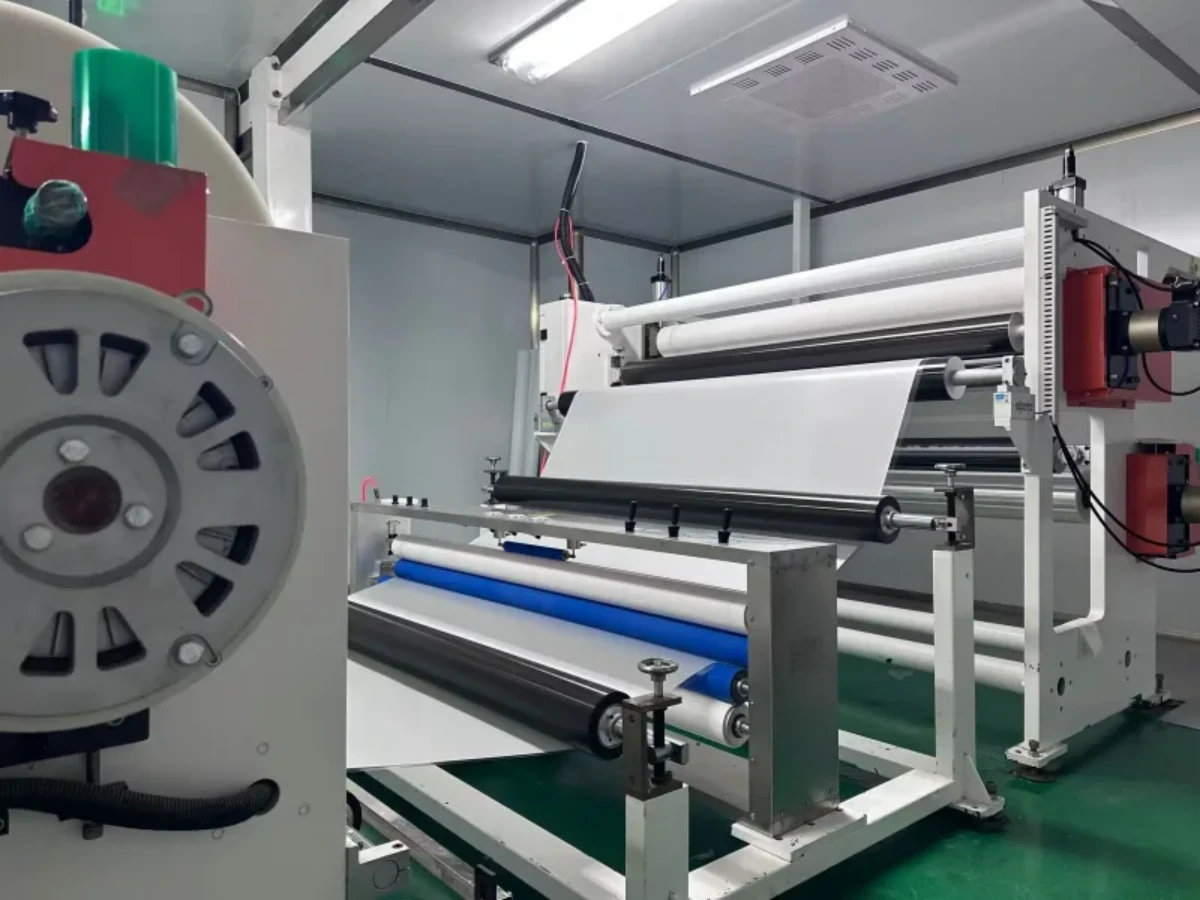

- Bulk vs. Pre-Cut Decision – Choosing bulk rolls for professional installers vs. pre-cut kits for consistent DIY results.

- Removability Requirement – Choosing residue-free adhesives for lease vehicles to avoid end-of-term penalties.

- Warranty Duration Classes – Segmented by warranty terms (1–15 years), reflecting durability and manufacturer confidence in performance.

The construction and maintenance of PPF:

- Storage Protection – Covering vehicles with breathable car covers in storage prevents dust buildup and UV overexposure.

- Avoid Automated Car Washes with Brushes – Brushless washes prevent abrasive contact that can scratch PPF.

- Low-Temperature Cleaning – Using warm (not hot) water in winter prevents thermal shock to the PPF and adhesives.

- UV-Protection Boosters – Applying UV-resistant sprays in high-sun regions extends anti-yellowing performance.

- Pre-Installation Paint Thickness Gauging – Using a paint meter ensures PPF application won’t exceed safe layers on thin factory paint finishes.

- Deionized Water for Washing – Mineral-free water reduces water spot residue on PPF surfaces after drying.

- Slow Installation in Hot Climates – Working at a reduced pace in ≥30°C conditions prevents adhesives from setting prematurely.

The extension of PPF’s functions:

- Before: Tailgate latch area with paint worn from opening/closing; After: PPF covers latch perimeter, hiding wear and reducing friction-related damage.

- Before: Faded red paint with uneven color from UV exposure; After: UV-blocking PPF revives depth and uniformity, making the color pop like fresh factory paint.

- Before: Rear bumper reflectors with scratched lenses; After: Clear PPF covers reflectors, hiding scratches and maintaining visibility for safety.

- Before: Exhaust tip surrounds with heat discoloration; After: High-temperature PPF covers blueing and resists heat damage, maintaining appearance.

- Before: A-pillars with tree branch scratches from off-road use; After: PPF’s scratch-resistant topcoat hides marks and protects during future trail adventures.

The user perception and consumption misconceptions of PPF:

- Consumer Misconception: “Matte PPF Holds More Dirt” – Avoiding matte finishes due to perceived maintenance issues, not realizing their texture repels dust better than gloss.

- Consumer Misconception: “PPF Hides Existing Paint Damage” – A false belief that PPF covers swirl marks or chips, when pre-installation paint correction is actually required.

- Consumer Misconception: “All PPFs Are Identical” – Many buyers assume no quality difference between $500 and $3,000 PPF, neglecting TPU vs. PVC material distinctions.

- Consumer Misconception: “All PPF Installers Are Equal” – Choosing based on price alone, ignoring differences in training, tools, and workspace quality.

- Correct Perception: Matte Finish Compatibility – Educated buyers seek matte-specific PPF, avoiding gloss films that ruin specialty paint textures.

- Consumer Misconception: “All PPF Self-Heals the Same” – Assuming budget films repair as well as premium ones, unaware that microcapsule density varies by price point.

- Consumer Misconception: “New Cars Don’t Need PPF Immediately” – Delaying installation, unaware that factory paint is most vulnerable to damage in the first 6 months of ownership.

- Consumer Misconception: “PPF Removes Easily Without Residue” – Assuming all PPF peels cleanly, neglecting that old or low-quality films often leave adhesive residue requiring professional removal.

- Correct Perception: Climate-Specific Formulas – Users in deserts seek UV-enhanced PPF, while coastal buyers prioritize saltwater resistance, matching products to environments.

- Consumer Misconception: “DIY Installation Saves Money” – Consumers underestimate skill requirements, with 45% of DIY installs requiring professional correction due to bubbles or misalignment.

The regulations of PPF and after-sales services:

- Regulatory Updates for EVs – EV-specific PPFs must comply with OEM heat resistance standards (e.g., 120°C for battery zones) to avoid delamination .

- Supply Chain Traceability – EU PPWR mandates tracking PPF materials from production to disposal, ensuring compliance with recycled content targets (e.g., 30% by 2030) .

- Blockchain Warranty Verification – 3M utilizes blockchain to secure digital warranties, enabling traceable ownership transfers and fraud prevention .

- India’s BIS Certification for PP Materials – Polypropylene (PP) used in PPF production must meet India’s BIS certification under IS 10951:2020, ensuring quality and safety for domestic and export markets .

- Japan’s Window Tinting Restrictions – Japanese regulations ban PPF installation on front driver/passenger windows and mandate partial windshield film transparency to ensure unobstructed visibility .

- California CARB VOC Limits – PPF adhesives sold in California must comply with CARB’s strict VOC regulations, reducing harmful emissions during installation to align with regional air quality standards .

- IoT-Enabled Performance Monitoring – Emerging PPFs with embedded sensors monitor UV exposure and damage levels, providing real-time data for predictive maintenance and warranty claims .

- Post-Installation Inspections – Professional installers like NAR PPF conduct post-installation checks to ensure edge sealing and material adherence, minimizing warranty claims .

The user scenarios and value validation of PPF:

- Industrial Vehicle Operators – Shields construction truck cabs from gravel and debris, extending time between repaints from 18 to 36 months.

- Car Rental Companies – Reduces “damage waiver” claims for Hertz and Avis by 40%, as PPF hides minor scratches from renters.

- First-Time Car Owners – Provides peace of mind for new drivers, with 75% avoiding costly lessons in “how to fix a key scratch” on their first vehicle.

- New Car Buyers – Guards fresh factory paint on brand-new vehicles, with 98% of users avoiding “first scratch” frustration in the first 6 months.

- Electric Scooter Fleets – Shields shared e-scooter bodies from urban abuse, reducing repair frequency by 55% for companies like Bird and Lime.

- Urban Commuters – Resists parking lot dings and shopping cart scratches in cities like Tokyo, with 85% of users reporting no visible paint damage after 1 year.

- Performance Car Drivers – Shields Porsche GT3 and BMW M4 hoods from brake dust and tire debris during track days, reducing post-event detailing time by 2 hours.

The market trends and industry changes of PPF:

- Rapid Growth of High-End PPF Market – The high-end PPF market is projected to reach $4.2 billion by 2033 at an 8% CAGR, driven by luxury vehicle ownership and demand for advanced protection features like self-healing technology.

- Regulatory Compliance in Manufacturing – Stringent environmental regulations (e.g., EU REACH) are pushing PPF producers to adopt solvent-free adhesives and energy-efficient production processes, reducing carbon footprints by up to 80%.

- Rise of Mobile Installation Services – On-demand PPF installation units equipped with portable dust-free booths are gaining traction, targeting busy urban consumers who prefer doorstep service.

- Insurance Partnerships and Bundling – EV manufacturers like BYD are integrating PPF into insurance packages, offering discounted rates for customers who opt for factory-installed protection.

- Ceramic-PPF Hybrid Kits – Pre-packaged ceramic coating PPF bundles now account for 25% of aftermarket sales, simplifying multi-layer protection for consumers.

- Detailing Chain Partnerships – PPF brands are collaborating with chains like Detail Garage, offering co-branded training and product bundles to expand reach.

- 3D Scanning and Custom Fitment – Laser-precut films using 3D vehicle scanning technology ensure seamless alignment, reducing installation time by 30% compared to traditional hand-cut methods.

- Regional Finish Preferences – Matte PPF dominates Europe (45% of sales) while glossy finishes lead in North America (60%), reflecting aesthetic cultural differences.

- Heat-Activated Self-Healing Advancements – Next-gen TPU films activate self-healing at lower temperatures (45°C), repairing 98% of micro-scratches within 8 minutes, enhancing consumer appeal.

AUTOLI(CN) PPF(Paint Protection Film) factory

autoli TPU PPF Applied to all brand car models as Land Rover、Lamborghini、Volkswagen、McLaren.Our factory cooperates with Auto Detailing service、Car Customization Shop、Auto Repair Center and all so in many countries and regions around the world,like Denmark,Iraq,Turkey,Indonesia,Warranty: 10 years.Our advantages:Efficient production reduces costs;Raw material purchasing advantage;Perfect after-sales service;Your Key to Profitable PPF Ventures;High quality raw materials and advanced technology.Our factory also provides Window Film、Car Wrap.