PPF’s matte variants (Ra 0.8-1.6μm) create premium abrazine texture, reducing swirl marks and enhancing dark car depth.,Protects hood from bug splatter damage.,Upgrade to Our Factory’s PPF: Quality Beyond Compare, Business Growth Guaranteed.

The horizontal comparison of PPF with other protection methods:

- PPF vs. Wheel Protective Films – PPF is designed for large painted panels, while specialized wheel films handle brake dust/heat, with PPF offering broader impact resistance.

- PPF vs. Silicone Coatings – Silicone coatings repel water but degrade quickly (1–2 years) under UV exposure, whereas PPF maintains hydrophobicity for 5 years with UV stabilizers.

- PPF vs. Clear Bra (Old-Generation) – Modern PPF offers self-healing and flexibility, outperforming rigid old-gen clear bras that crack in cold weather and lack repair abilities.

- PPF vs. Tire Dressing – Dressing enhances tire shine, while PPF has no role in tire care, illustrating their focus on separate vehicle components.

- PPF vs. Clear Bra (PVC) – Modern TPU PPF offers self-healing and flexibility, outperforming rigid PVC clear bras that crack in cold weather and lack repair capabilities.

- PPF vs. Rubberized Undercoating – Undercoating protects metal from rust, while PPF defends painted surfaces from road debris, with non-overlapping application zones.

- PPF vs. Vinyl Wraps – PPF prioritizes paint protection with self-healing properties, while vinyl wraps focus on aesthetic customization, with PPF being more durable against abrasion.

- PPF vs. Plastic Trim Restorers – Restorers revive faded trim, while PPF prevents UV damage and scratches on trim, maintaining appearance without frequent reapplication.

The product classification and selection logic of PPF:

- Brand Support Evaluation – Opting for brands offering installer training and technical support for complex applications.

- Saltwater Exposure Protection – Choosing marine-grade PPF for coastal vehicles to resist salt-induced corrosion.

- Seasonal Use Logic – Opting for temporary biodegradable PPF for seasonal vehicles (convertibles, snowmobiles).

- Debris Type Evaluation – Selecting sand-resistant PPF for desert regions vs. gravel-resistant variants for rural areas.

- Installation Time Consideration – Selecting pre-cut kits to reduce professional installation time for fleet vehicles.

- Multi-Surface Compatibility – Selecting PPF safe for paint, plastic, and chrome to enable full-vehicle protection with one product.

The user perception and consumption misconceptions of PPF:

- Correct Perception: Lease Protection Value – Leaseholders use PPF to avoid $500 end-of-term fees, with 95% passing inspections without paint-related charges.

- Consumer Misconception: “New Cars Don’t Need PPF Immediately” – Delaying installation, unaware that factory paint is most vulnerable to damage in the first 6 months of ownership.

- Consumer Misconception: “All PPF Self-Heals the Same” – Assuming budget films repair as well as premium ones, unaware that microcapsule density varies by price point.

- Correct Perception: Temperature Tolerance – Cold-climate users seek flexible PPF, avoiding cracking in sub-zero conditions unlike rigid alternatives.

- Correct Perception: Ceramic Coating Synergy – Savvy users pair PPF with ceramic topcoats, enhancing hydrophobicity and scratch resistance by 40%.

- Consumer Misconception: “Thicker PPF = Better Protection” – Assuming 10mil PPF is always superior, ignoring that excessive thickness can cause edge lifting on curved surfaces.

- Correct Perception: Ceramic Coating Enhances PPF Life – Users layer ceramic coatings over PPF, extending topcoat longevity by 2–3 years.

Say Goodbye to Car Scratches: Self-Healing PPF Revealed!:

- Scratches from automatic car washes—even with soft brushes—heal quickly, eliminating the need to avoid convenient cleaning options.

- EV owners get scratch repair around charging ports, where frequent plugging/unplugging can cause minor damage.

- Heat-activated repair eliminates the need for abrasive polishes that thin your car’s paint or degrade protective layers over time.

- “Touchless” car wash high-pressure nozzles leave no lasting marks, as self-healing PPF erases pressure-related scratches.

- Pet transport vehicles get cargo area scratch repair, where animal movement can cause minor damage.

The cost structure and price composition of PPF:

- Topcoat Quality Impact – Ceramic-infused topcoats add $0.50–$1.00 per square foot but enable 10–15% price premiums.

- Seasonal Pricing Fluctuations – Demand spikes in spring increase prices by 5–10% in temperate regions.

- Online vs. Offline Pricing – E-commerce channels offer 5–10% lower prices due to reduced physical store overhead.

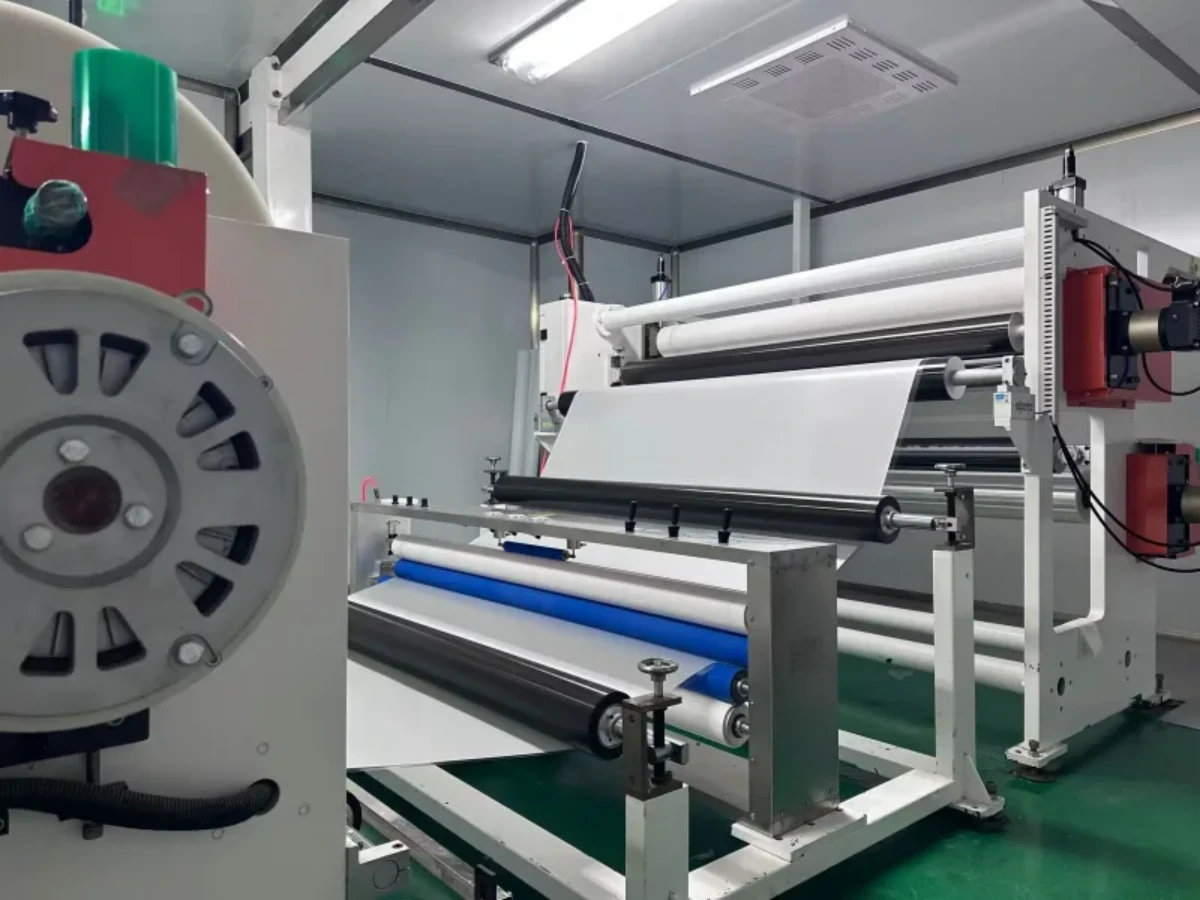

- Equipment Depreciation – Extrusion machines (5–10 year lifespan) contribute 5–7% to per-unit costs annually.

- Material Thickness Pricing – Each mil increase (6→10mil) adds $1–$2 per square foot due to higher material usage.

- Marketing Expenses – Brand advertising and influencer partnerships contribute 5–8% to retail price markup.

- Financing Options – Monthly payment plans include 8–12% interest, increasing total customer cost.

- High-Demand Model Premiums – PPF for popular vehicles (e.g., Tesla Model Y) costs 5–10% more due to demand.

- Export Pricing Adjustments – FOB prices 10–15% lower than domestic to remain competitive in global markets.

- Regulatory Compliance – REACH/EPA certifications add $0.20–$0.40 per square foot for market access in strict regions.

The market trends and industry changes of PPF:

- OEM Integration and EV Demand – Original equipment manufacturers (OEMs) are increasingly factory-installing PPF, particularly for electric vehicles (EVs), which represent 19% of OEM PPF applications due to their premium paint protection needs.

- Data-Driven Marketing Strategies – Brands are using AI analytics to identify regional demand patterns, tailoring product launches (e.g., anti-yellowing films for high-sun areas) to specific markets.

- Maintenance App Ecosystems – Brands like XPEL offer apps with PPF care reminders and digital warranty tracking, boosting customer retention by 28%.

- Regulatory Push for Transparency – The EU’s Digital Product Passport initiative requires PPF manufacturers to disclose material composition and recycling options, driving supply chain accountability.

- Cross-Industry Collaborations – Material suppliers (e.g., Lubrizol) are partnering with PPF manufacturers to develop specialized films for extreme climates, such as heat-resistant variants for desert regions.

- Digital Print Integration – UV-curable digital printing on PPF allows custom graphics/logos, with 35% of commercial fleets now using branded PPF for marketing.

- Personalization Trends in Aesthetics – Demand for matte finishes, colored PPF, and custom textures is surging, with TPU-based films offering UV-resistant, self-healing properties to meet consumer preferences for vehicle customization.

- Commercial Fleet Adoption – Delivery giants like Amazon and JD.com are equipping 70% of new vans with PPF, reducing fleet repaint costs by $300 per vehicle annually.

- Regional Market Expansion in Asia-Pacific – The Asia-Pacific PPF market is growing at a 6.6% CAGR, led by China and India, where rising vehicle ownership and premium car sales drive demand for long-lasting protection solutions.

- E-Bike/Scooter PPF Demand – 40% of e-mobility retailers offer PPF for scooter bodies, protecting against urban scratches and extending resale value.

How TPU Redefines PPF:

- Modular Design – TPU’s compatibility with partial coverage redefined PPF from full-wrap-only options to targeted solutions for high-impact areas (hood, fenders).

- High-Speed Protection – TPU’s impact-dispersing properties redefined PPF from urban-use products to highway-ready shields resisting high-velocity rock chips.

- Chemical Resistance – TPU’s resistance to bird droppings, road salt, and fuels redefined PPF from basic shields to multi-hazard barriers.

- Bio-Based Options – Plant-derived TPU redefined PPF from petroleum-reliant products to sustainable alternatives with 50% renewable content.

- Long-Term Value – TPU’s preservation of resale value redefined PPF from expense to investment, increasing vehicle resale prices by 5–10%.

- Sustainable End-of-Life – TPU’s recyclability redefined PPF from landfill-bound waste to closed-loop products reusable in secondary applications.

- Lightweight Shipping – TPU’s low density redefined PPF from high-freight-cost products to cost-efficient options reducing transportation emissions by 30%.

Why TPU PPF:

- Smart Home Integration – Compatible with motorized louvers controlled via app or voice commands.

- Anti-Slip Flooring Support – Structurally sound for stone, wood, or composite decking installations.

- Anti-Glare Options – Matte finishes reduce sun glare on adjacent windows and surfaces.

- Sustainable Material – Aluminum is 100% recyclable, with 75% of new aluminum made from recycled content.

- Ergonomic Design – Comfortable headroom (minimum 2.2m) for standing and moving underneath.

- Multi-Zone Use – Can cover dining, lounging, and cooking areas in large outdoor spaces.

The materials and technologies of PPF:

- Antibacterial and mold-resistant coating technology: Silver ion antibacterial agent is added to the membrane surface, which inhibits the growth of mold and bacteria in humid environments. This technology is particularly suitable for long-term use in areas with frequent rainfall and high humidity.

- Anti-microbial coating infusion: Incorporates silver-ion nanoparticles to inhibit 99% of bacteria and mold growth on film surfaces in humid climates.

- Anti-yellowing technology: Antioxidants and UV absorbers are added to inhibit oxidation and yellowing under long-term exposure to light, extending the appearance stability of the protective film.

- Energy-harvesting film: Integrates photovoltaic cells to generate 0.5W/m2 of power for vehicle electronics.

- SAE J2527 Stone Chip Resistance Certification: Passes 120 km/h gravel impact testing without film penetration.

- Low-temperature shaping flexible technology: Through optimizing the molecular structure of the substrate, it enables curved surface shaping at temperatures ranging from 0 to 15 degrees Celsius, suitable for complex arc-shaped bodywork construction, and reducing stress damage caused by heating contraction.

AUTOLI(CN) PPF(Paint Protection Film) manufacturer

autoli TPU PPF Applied to all brand car models as Toyota、Nissan、acura、Tesla.Our factory cooperates with Auto Detailing、PPF wholesale、Car Customization Shop、Auto Spa、PPF distributor and all so in many countries and regions around the world,like Ireland,Iran,Ireland,Sudan,Luxembourg,Warranty: 10 years.Our advantages:SGS, ASTM, REACH, UL and other certifications;Strict quality control system;Your Key to Profitable PPF Ventures;High quality raw materials and advanced technology;Large stock of styles for you to choose from.Our factory also provides Window Film、carwraps、PPF Vinyl Car Wrap.