PPF’s transparency allows paint’s natural depth to show through, unlike thick films that dull the finish.,Reduces wash frequency to 4-6 weeks.,Factory – Powered Success: PPF in Rich Hues, Propel Your Brand Forward.

The cost structure and price composition of PPF:

- Bundle Pricing Discounts – PPF ceramic coating bundles reduce total cost by 10–15% vs. separate purchases.

- Seasonal Pricing Fluctuations – Demand spikes in spring increase prices by 5–10% in temperate regions.

- Replacement Part Pricing – Small repair patches cost 2–3x per square foot vs. full rolls due to handling costs.

- Packaging Costs – Recyclable cardboard rolls and protective liners contribute 1–3% of total product costs.

- Full Vehicle Wrap Pricing – Complete coverage costs $2,000–$8,000, with labor accounting for 60–70% of total.

- Freight & Logistics – International shipping adds $0.50–$1.50 per square foot, higher for expedited delivery.

How TPU Redefines PPF:

- Smart Film Potential – TPU’s compatibility with sensors redefined PPF from passive protectors to IoT-enabled systems monitoring wear and impacts.

- Sustainable End-of-Life – TPU’s recyclability redefined PPF from landfill-bound waste to closed-loop products reusable in secondary applications.

- DIY Accessibility – TPU’s user-friendly installation redefined PPF from professional-only services to accessible DIY projects with pre-cut kits.

- EV Compatibility – Heat-resistant TPU redefined PPF from standard protectors to EV-specific solutions withstanding battery zone temperatures up to 120°C.

- Scratch Resistance – TPU’s 9H hardness topcoats redefined PPF from basic shields to high-wear solutions resisting key scratches and shopping cart impacts.

- Low-Labor Requirements – TPU’s forgiving installation redefined PPF from skilled-labor-dependent products to accessible services requiring less training.

- Repairability Focus – TPU’s patchable design redefined PPF from full-replacement products to partially repairable systems cutting maintenance costs.

- Aging Gracefully – TPU’s slow degradation redefined PPF from quickly obsolescent products to long-term investments maintaining performance over decades.

- Winter Resilience – TPU’s resistance to ice scrapers and de-icing salts redefined PPF from seasonal products to winter-ready protectors in cold regions.

TPU PPF VS PET PPF:

- High-Speed Performance – TPU PPF resists stone chips at 120km/h, while PET PPF fails at 80km/h in highway tests.

- Visibility in Direct Sunlight – TPU PPF’s low glare reduces sun reflection, while PET PPF can create glare spots on sunny days.

- Cleaning Compatibility – TPU PPF works with pH-neutral cleaners, while PET PPF is sensitive to alcohol-based products, causing clouding.

- Printability – TPU PPF accepts UV-curable inks for custom graphics, while PET PPF’s surface resists ink adhesion, causing premature fading.

- User Satisfaction – 90% of TPU PPF users report satisfaction after 3 years, compared to 60% satisfaction with PET PPF.

- Impact Indication – Some TPU PPF uses color-changing layers to show hidden damage, a feature unavailable in PET PPF.

- Warranty Claims – TPU PPF has 30% fewer warranty claims than PET PPF due to superior durability and performance consistency.

- Repair Potential – TPU PPF allows spot patching of damaged areas, while PET PPF requires full panel replacement for localized damage.

- Thermal Cycling Performance – TPU PPF survives 500 freeze-thaw cycles, while PET PPF shows cracking after 200 cycles.

- Installation Waste – TPU PPF generates 30% less scrap during installation than PET PPF due to better cutability.

The product classification and selection logic of PPF:

- Bulk vs. Pre-Cut Decision – Choosing bulk rolls for professional installers vs. pre-cut kits for consistent DIY results.

- Chemical Resistance Needs – Selecting acid-resistant PPF for regions with heavy bird droppings or industrial pollution.

- Function-Centric Categories – Segmented into self-healing, UV-resistant, anti-yellowing, and hydrophobic variants based on core benefits.

- Regional Regulation Compliance – Selecting REACH/FDA-compliant PPF for markets with strict chemical safety standards.

- Environmental Value Selection – Prioritizing bio-based or recyclable PPF for eco-conscious buyers despite higher upfront costs.

- Customization Flexibility – Choosing printable PPF for commercial vehicles requiring brand graphics over paint.

- Specialty Function Lines – Categorized for ADAS compatibility, fire resistance, or antimicrobial properties for niche needs.

- Damage Risk Evaluation – Upgrading to impact-resistant PPF for off-road vehicles or high-debris work environments.

The user scenarios and value validation of PPF:

- Vintage Motorcycle Collectors – Preserves patina on 1950s Triumphs while preventing further wear, with reversible PPF allowing original condition display.

- Lease Vehicle Users – Avoids lease-end paint repair fees (average $500) by protecting against minor damage, with 95% passing inspections without charges.

- Mobile Library Vans – Protects children’s book transport vehicles from graffiti and bumps, maintaining community-friendly aesthetics for outreach programs.

- Food Truck Operators – Protects mobile kitchen exteriors from road grime and food splatters, maintaining brand aesthetics for customer appeal.

- Family Car Owners – Protects minivan door sills from kids’ shoes and pet claws, with 80% reporting “like-new” interior/exterior after 3 years of use.

- Photography Vehicle Owners – Maintains clean white backdrops on vans for photoshoots, as PPF resists dirt staining during outdoor location shoots.

- Cold-Climate Users – Prevents salt and ice melt damage in Stockholm and Toronto, with PPF-treated bumpers showing 50% less winter-related etching.

The market trends and industry changes of PPF:

- Detailing Chain Partnerships – PPF brands are collaborating with chains like Detail Garage, offering co-branded training and product bundles to expand reach.

- Regulatory Push for Transparency – The EU’s Digital Product Passport initiative requires PPF manufacturers to disclose material composition and recycling options, driving supply chain accountability.

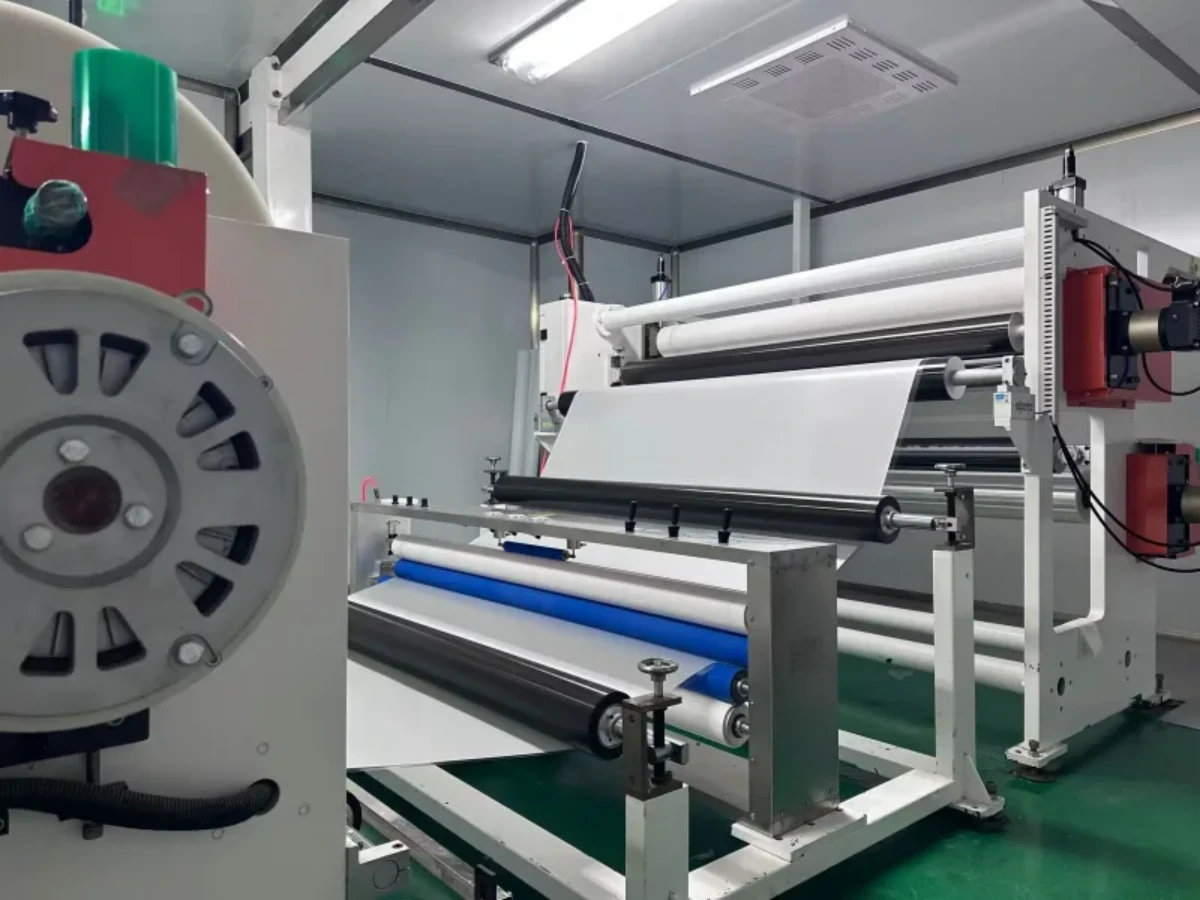

- Shift Toward Touchless Installations – Automated robotic systems are being adopted in high-volume shops to minimize human error, particularly in edge trimming and heat-sealing processes.

- AI Quality Control in Production – Machine vision systems inspect 100% of PPF rolls for defects, reducing post-installation warranty claims by 45%.

- Ceramic-PPF Hybrid Kits – Pre-packaged ceramic coating PPF bundles now account for 25% of aftermarket sales, simplifying multi-layer protection for consumers.

- China’s ECOCERT Compliance – Chinese PPF producers now meet ECOCERT standards, with 40% of exports to Europe using recycled TPU blends.

- Digital Print Integration – UV-curable digital printing on PPF allows custom graphics/logos, with 35% of commercial fleets now using branded PPF for marketing.

- Premiumization Amid Inflation – Luxury PPF prices rose 12% in 2024, while budget options stayed stable, as brands prioritize high-margin segments.

- Local Sourcing Trends – Post-pandemic, 55% of North American PPF brands source TPU locally, reducing supply chain delays by 30%.

TPU PPF VS PET PPF:

- High-Speed Performance – TPU PPF resists stone chips at 120km/h, while PET PPF fails at 80km/h in highway tests.

- Visibility in Direct Sunlight – TPU PPF’s low glare reduces sun reflection, while PET PPF can create glare spots on sunny days.

- Cleaning Compatibility – TPU PPF works with pH-neutral cleaners, while PET PPF is sensitive to alcohol-based products, causing clouding.

- Printability – TPU PPF accepts UV-curable inks for custom graphics, while PET PPF’s surface resists ink adhesion, causing premature fading.

- User Satisfaction – 90% of TPU PPF users report satisfaction after 3 years, compared to 60% satisfaction with PET PPF.

- Impact Indication – Some TPU PPF uses color-changing layers to show hidden damage, a feature unavailable in PET PPF.

- Warranty Claims – TPU PPF has 30% fewer warranty claims than PET PPF due to superior durability and performance consistency.

- Repair Potential – TPU PPF allows spot patching of damaged areas, while PET PPF requires full panel replacement for localized damage.

- Thermal Cycling Performance – TPU PPF survives 500 freeze-thaw cycles, while PET PPF shows cracking after 200 cycles.

- Installation Waste – TPU PPF generates 30% less scrap during installation than PET PPF due to better cutability.

The user perception and consumption misconceptions of PPF:

- Consumer Misconception: “PPF Removes Easily Without Residue” – Assuming all PPF peels cleanly, neglecting that old or low-quality films often leave adhesive residue requiring professional removal.

- Correct Perception: Resale Value Boost – 81% of luxury car owners recognize PPF-preserved paint enhances resale value by 5–10% in pre-owned markets.

- Correct Perception: Multi-Surface Application – Users increasingly apply PPF to headlights and trim, reducing fogging and scratches on high-wear areas.

- Consumer Misconception: “PPF Makes Car Washes Obsolete” – Thinking hydrophobic properties eliminate washing, not realizing heavy grime still requires cleaning.

- Correct Perception: Temperature Tolerance – Cold-climate users seek flexible PPF, avoiding cracking in sub-zero conditions unlike rigid alternatives.

- Consumer Misconception: “PPF Installation Requires Paint Removal” – Fearing sanding or stripping, unaware professional installs use gentle cleaning without paint removal.

AUTOLI(CN) PPF(Paint Protection Film) manufacturer

autoli TPU PPF Applied to all brand car models as Nissan、Lamborghini、Benz、Tesla.Our factory cooperates with PPF distributor、ppf installation、Auto Detailing Shop and all so in many countries and regions around the world,like Sudan,Madagascar,Colombia,Poland,Warranty: 10 years.Our advantages:Our customers are all over the world;Unlock Business Growth with Our Factory’s PPF;Perfect after-sales service;Your Key to Profitable PPF Ventures;Raw material purchasing advantage.Our factory also provides Car Wrap、car wrapping.