PPF’s application on carbon fiber parts prevents UV-induced fading, preserving the weave’s appearance on high-end cars.,Resists gasoline spills on paint surfaces.,Our Factory’s PPF: Propelling Your Profit Growth at Breakneck Speed.

The cost structure and price composition of PPF:

- Insurance Partnerships – Bundling with auto insurance reduces customer costs by 5–10% via insurer subsidies.

- Lease Protection Premium – Lease-specific PPF (removable) costs 10–15% more due to residue-free adhesive requirements.

- Financing Options – Monthly payment plans include 8–12% interest, increasing total customer cost.

- Sample Costs – Free or low-cost samples (5–10 sq ft) add 1–2% to marketing expenses but drive sales.

- Import Duties & Tariffs – Regional tariffs (e.g., 10% in EU) increase landed costs by 5–12% for imported PPF.

- Raw Material Costs – TPU resin constitutes 35–45% of total production costs, with premium grades (self-healing) costing 2x standard TPU.

- Aftermarket Service Margins – Maintenance kits (cleaners, sealants) carry 60–70% margins, boosting overall profitability.

- Warranty Reserves – 2–3% of revenue is allocated to warranty claims, higher for lifetime warranty products.

- Lead Time Premiums – Rush orders add 20–30% to prices to prioritize production and shipping.

- Referral Program Incentives – $50–$100 discounts for referrals reduce net prices by 3–5% but lower acquisition costs.

The materials and technologies of PPF:

- Low-VOCs production certification: Meets global eco-standards like GREENGUARD Gold, ensuring volatile organic compound emissions below 50μg/m3 during manufacturing.

- Anti-icing coating: Reduces ice adhesion by 60% through superhydrophobic surfaces, improving safety in winter conditions.

- Anti-chemical corrosion technology: Incorporating acid and alkali resistant components to resist erosion from substances like acid rain, bird droppings, and tree sap, protecting the vehicle paint from chemical damage.

- Energy-harvesting film: Integrates photovoltaic cells to generate 0.5W/m2 of power for vehicle electronics.

- Water resistance stability technology: By adding water resistance agents to the TPU base material, it inhibits the breakage of molecular chains in humid environments, extending the service life of the film material in high-humidity areas.

- Unique surface-cutting algorithm for vehicle models: Based on 3D vehicle model scanning data, an adaptive cutting logic has been developed to precisely match the body’s waistline, curvature, and other complex surfaces, reducing manual trimming errors.

- Hydrographic printing integration: Allows custom patterns (e.g., carbon fiber, brushed metal) to be embedded within the film without compromising clarity.

The long-term monitoring and maintenance system after the installation of PPF:

- Cold-Weather Adhesive Care – Avoiding pressure washing in sub-zero temperatures to prevent thermal shock to adhesives.

- Annual Adhesion Testing – Performing tape pull tests on inconspicuous areas to verify adhesive strength remains within factory specifications.

- High-Altitude Adjustments – Increasing sealant applications in thin air (≥2000m elevation) where UV exposure is intensified.

- Quarterly Edge Seal Audits – Inspecting heat-sealed edges with 10x magnification to detect early lifting before water ingress occurs.

- Monthly Impact Zone Inspections – Focusing on high-risk areas (front bumper, hood leading edge) for rock chip accumulation and self-healing effectiveness.

The production supply chain and quality control system of PPF:

- Raw Material Testing Protocols – Incoming TPU resin inspections for melt flow rate, tensile strength, and impurity levels.

- Material Innovation Collaboration – Joint R&D with suppliers for next-gen TPU formulations (e.g., bio-based, high-heat resistant).

- Audit Schedules – Internal audits quarterly, external audits annually to verify QMS effectiveness.

- Strategic Stockpiles – 3–6 month reserves of critical materials during high-demand periods or supply chain disruptions.

- Sustainability Audits – Annual assessments of suppliers’ carbon footprints and waste reduction efforts for eco-friendly sourcing.

- Extrusion Line Suppliers – Collaboration with machinery firms (e.g., Reifenh?user) for precision extrusion equipment.

- Batch Testing Protocols – Random sampling of finished rolls (1 per 50) for full performance characterization.

- Non-Conforming Material Handling – Quarantine, segregation, and disposition processes for defective materials/finished goods.

- Waste Management Partnerships – Collaboration with recycling firms to process production scrap into secondary TPU materials.

- Machine Vision Inspection – High-resolution cameras detecting micro-defects (≥20μm) in TPU films during production.

The user perception and consumption misconceptions of PPF:

- Correct Perception: Multi-Surface Application – Users increasingly apply PPF to headlights and trim, reducing fogging and scratches on high-wear areas.

- Correct Perception: Partial Coverage Value – Many opt for high-impact areas (hood, fenders) over full wraps, balancing protection and cost effectively.

- Correct Perception: Professional Installation Worth Cost – 90% of satisfied users attribute results to certified installers, valuing dust-free environments and precision tools.

- Correct Perception: UV Testing Validates Anti-Yellowing Claims – Checking for 1,000 hours of UV testing data, ensuring films resist discoloration in real-world use.

- Correct Perception: Temperature Tolerance – Cold-climate users seek flexible PPF, avoiding cracking in sub-zero conditions unlike rigid alternatives.

- Correct Perception: Climate-Specific Formulas – Users in deserts seek UV-enhanced PPF, while coastal buyers prioritize saltwater resistance, matching products to environments.

- Consumer Misconception: “Once Applied, No Maintenance Needed” – A common myth that PPF requires zero upkeep, ignoring the need for pH-neutral cleaning to preserve hydrophobicity.

- Consumer Misconception: “New Cars Don’t Need PPF Immediately” – Delaying installation, unaware that factory paint is most vulnerable to damage in the first 6 months of ownership.

The market trends and industry changes of PPF:

- Photocatalytic Self-Cleaning PPF – TiO?-infused films decompose 80% of surface dirt under UV light, reducing washing needs by 50% in real-world testing.

- Southeast Asia Market Surge**- Indonesia and Vietnam’s PPF markets are growing at 11% CAGR, driven by rising middle-class car ownership and demand for affordable protection packages.

- Circular Economy Initiatives – Closed-loop recycling programs for end-of-life PPF are being piloted, with companies like MBA Polymers achieving 80% carbon reduction in recycled PP production.

- Water-Based Adhesive Adoption – PPF manufacturers are shifting to water-based adhesives, reducing VOC emissions by 60% to meet EU and California air quality regulations.

- Competitive Pricing Pressures – Market saturation in North America and Europe is driving price reductions, with entry-level PPF options now 20% cheaper than premium products, appealing to cost-conscious consumers.

- Supply Chain Localization – Regional production hubs in Asia-Pacific are emerging to reduce reliance on Western suppliers, with China and India scaling TPU film manufacturing to meet domestic demand.

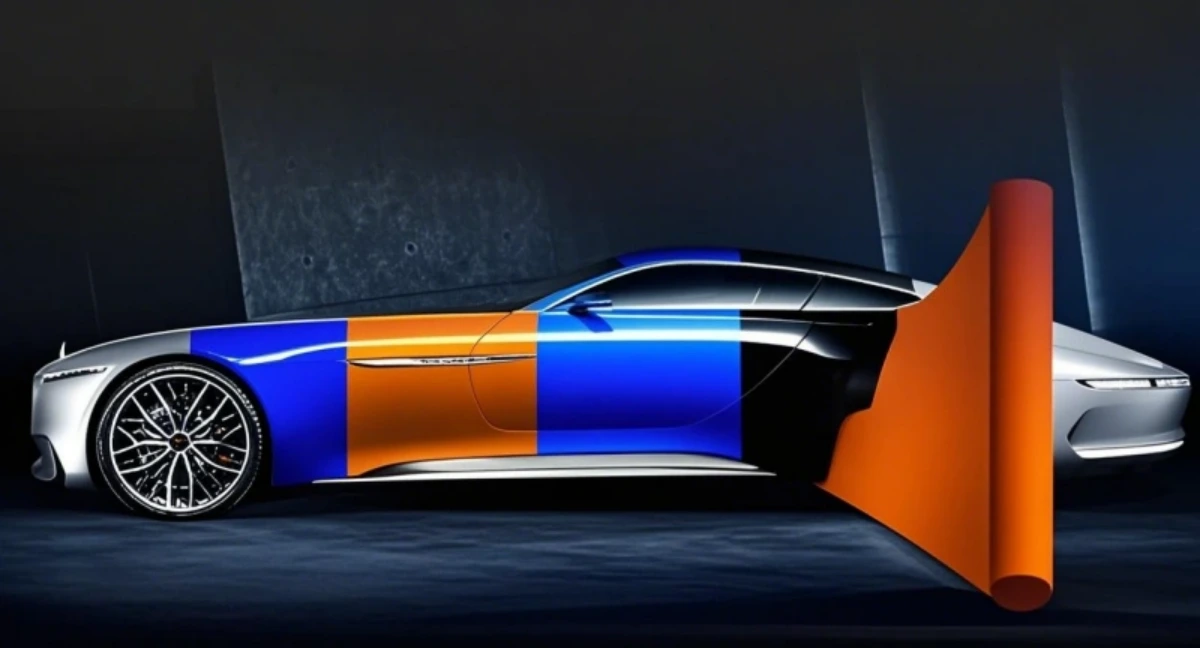

- Automotive Designer Collaborations – PPF brands work with OEM designers to create pre-cut patterns for concept cars, ensuring seamless protection on unique contours.

How TPU Redefines PPF:

- Future-Proofing – TPU’s adaptability to new technologies redefined PPF from static products to evolving solutions compatible with AI, IoT, and next-gen vehicle systems.

- Cold-Weather Flexibility – TPU’s resistance to brittleness in sub-zero temperatures redefined PPF from seasonal products to year-round protection in cold climates.

- Temperature Tolerance – TPU’s -40°C to 80°C stability redefined PPF from climate-limited products to all-weather solutions for extreme hot and cold regions.

- High-Speed Protection – TPU’s impact-dispersing properties redefined PPF from urban-use products to highway-ready shields resisting high-velocity rock chips.

- Production Efficiency – TPU’s extrusion-friendly properties redefined PPF manufacturing from batch processes to continuous production reducing costs.

- Cost-Effectiveness Over Time – TPU’s long lifespan redefined PPF from expensive upfront purchases to cost-saving investments vs. frequent repaints.

- Minimal Waste – TPU’s pre-cut precision redefined PPF from high-waste products to material-efficient options with 40% less scrap vs. hand-cut sheets.

- Weather Adaptability – TPU’s resistance to rain, snow, and sand redefined PPF from climate-specific products to global solutions for diverse environments.

- Light Transmission – High-clarity TPU redefined PPF from headlight-dimming films to optical-grade protectors preserving 98% light output for visibility.

AUTOLI(CN) PPF(Paint Protection Film) manufacturer

autoli TPU PPF Applied to all brand car models as Benz、Nissan、Chevrolet、Audi、Alfa Romeo.Our factory cooperates with Car Customization Shop、PPF distributor、Auto Detailing Shop、PPF wholesaler and all so in many countries and regions around the world,like Venezuela,England,Japan,Denmark,Warranty: 10 years.Our advantages:Your Key to Profitable PPF Ventures;Unlock Business Growth with Our Factory’s PPF;Raw material purchasing advantage;Short production cycle, quick delivery;Efficient production reduces costs.Our factory also provides Window tint、Windshield Protection Film、Car Wraps、car wrapping.