PPF’s protection on door edges prevents chips from open the doorcollisions, a common high-wear area on daily-driven cars.,Shields paint from scratches with durable TPU material.,Factory Alliance: Premium PPF, Amplified Business Reach.

The differentiated user group needs matching of PPF:

- Ambulance Fleets – Need chemical-resistant PPF to withstand disinfectant exposure, maintaining markings and paint integrity during emergencies.

- Desert Off-Road Racers – Require sand-resistant PPF with anti-abrasion topcoats, preventing paint damage from blowing sand during races.

- Mountain Bike Shuttle Vans – Choose mud-resistant PPF for lower panels, withstanding dirt and debris from bike transport and trail access.

- Vintage Scooter Collectors – Use ultra-thin 5mil PPF to conform to curved fenders and fuel tanks, preserving retro paint jobs from scratches.

- Electric Boat Owners – Select marine-grade PPF resistant to saltwater and UV, protecting hulls from dock scratches and sun damage.

- Rally Racing Teams – Prioritize puncture-resistant PPF with 600% elongation, withstanding extreme terrain impacts during cross-country rallies.

- Custom Paint Owners – Choose color-stable PPF that preserves matte, chameleon, or metallic finishes without altering hue or texture.

- Mobile Bookstore Vans – Select scratch-resistant PPF for door edges, withstanding frequent customer entry/exit and book cart impacts.

The user perception and consumption misconceptions of PPF:

- Correct Perception: Professional Installation Worth Cost – 90% of satisfied users attribute results to certified installers, valuing dust-free environments and precision tools.

- Correct Perception: Climate-Specific Formulas – Users in deserts seek UV-enhanced PPF, while coastal buyers prioritize saltwater resistance, matching products to environments.

- Correct Perception: Environmental Adaptability – Users in coastal areas correctly prioritize saltwater-resistant PPF, reducing corrosion-related repairs by 60%.

- Consumer Misconception: “Once Applied, No Maintenance Needed” – A common myth that PPF requires zero upkeep, ignoring the need for pH-neutral cleaning to preserve hydrophobicity.

- Correct Perception: Ceramic Coating Synergy – Savvy users pair PPF with ceramic topcoats, enhancing hydrophobicity and scratch resistance by 40%.

- Correct Perception: Self-Healing Efficacy – Most users recognize PPF can repair minor scratches (≤3μm) with heat, though many underestimate the need for 40°C activation temperatures.

TPU PPF VS PET PPF:

- Ease of Repositioning – TPU PPF allows 3–5 repositioning attempts, whereas PET PPF’s adhesive activates permanently after initial contact.

- Low-Light Visibility – TPU PPF’s clarity enhances nighttime visibility for headlights, while PET PPF can create slight haze reducing light output.

- Storm Resilience – TPU PPF withstands hailstones up to 12mm, whereas PET PPF cracks under 8mm hail impacts.

- Printability – TPU PPF accepts UV-curable inks for custom graphics, while PET PPF’s surface resists ink adhesion, causing premature fading.

- Thermal Expansion Coefficient – TPU PPF’s low expansion reduces edge lifting in heat, while PET PPF’s higher expansion causes 2x more seasonal lifting.

- Installation Time – TPU PPF full-vehicle installs take 1–2 days, while PET PPF requires 1 day but with higher risk of rework.

- Lightweight Advantage – TPU PPF’s strength-to-weight ratio is 2x higher than PET PPF, allowing thinner films with equivalent protection.

- Temperature Tolerance – TPU PPF withstands -40°C to 80°C without cracking, unlike PET PPF which becomes brittle below 0°C.

- Solvent Resistance – TPU PPF resists gasoline and brake fluid spills, while PET PPF shows swelling within 10 minutes of exposure.

The horizontal comparison of PPF with other protection methods:

- PPF vs. Silicone Spray – Silicone spray repels water temporarily but attracts dust, unlike PPF’s long-lasting hydrophobicity that resists dirt buildup.

- PPF vs. Anti-Corrosion Sprays – Sprays inhibit rust on bare metal but don’t protect paint, whereas PPF blocks corrosion triggers (salt, moisture) from reaching painted surfaces.

- PPF vs. Stone Guard Films (Thin) – Thin stone guards protect against small debris but lack self-healing, while PPF handles larger impacts and repairs minor damage automatically.

- PPF vs. Anti-Fade Treatments – Anti-fade treatments slow UV damage but don’t prevent scratches, unlike PPF which blocks UV rays and shields against physical wear.

- PPF vs. Anti-Static Sprays – Sprays reduce dust attraction temporarily, while PPF’s anti-static properties last for years, with both aiding cleanliness but PPF offering more durability.

- PPF vs. Truck Bed Liners – Liners protect cargo areas from heavy impacts, while PPF shields exterior panels from road debris, with distinct application zones and purposes.

- PPF vs. Liquid Glass Coatings – Liquid glass offers 6–12 months of chemical resistance but lacks physical impact protection, while PPF combines 5 years of scratch defense with self-healing capabilities.

- PPF vs. Fabric Protectors – Fabric protectors repel stains on interiors, while PPF defends exterior paint, with both using hydrophobic tech but on different materials.

- PPF vs. Polyurethane Sprays – Polyurethane sprays form a hard, brittle layer prone to chipping, while PPF’s flexible TPU base absorbs impacts without cracking.

The materials and technologies of PPF:

- Shape-memory alloy reinforcement: Restores film shape after severe impacts through embedded Ni-Ti alloys.

- Fire-resistant coating: Passes UL94 V-0 certification with flame spread rate <10mm/min, meeting automotive safety standards.

- Smart damage detection layer: Embeds micro-sensors that interact with smartphone apps to alert users of hidden impacts or coating wear via subtle color shifts.

- Thickness gradient optimization design: The thickness is differentiated according to the protection requirements of different vehicle parts (e.g., thicker for the hood to resist impact and thinner for the sides for easier adhesion), balancing protection and workability.

- Anti-static surface treatment: Incorporates permanent anti-static agents to reduce dust adhesion by 70%, extending the time between washes.

- Salt spray resistance anti-corrosion technology: By adding marine-grade anti-corrosion additives, it undergoes 5,000 hours of salt spray tests without rusting, resisting the erosion of the membrane material by the high-salt environment in coastal areas, and extending the protection lifespan of vehicles near the sea.

The regulations of PPF and after-sales services:

- Class Action Liability – Manufacturers face potential litigation for non-compliant PPFs, as seen in cases involving PFAS contamination or false warranty claims .

- DIY Installation Void Policies – Most warranties, including PurePPF and 3M, void coverage for self-installed films, emphasizing the need for certified professional application .

- EU Digital Product Passport – PPF manufacturers must disclose material composition and recycling details via the EU’s Digital Product Passport, enhancing supply chain transparency .

- 3M’s Warranty Exclusions – 3M’s warranty explicitly excludes watermarks, improper maintenance, and non-authorized products, emphasizing the need for professional installation and genuine materials .

- Cross-Industry Regulatory Alignment – PPFs used in electronics or aerospace must comply with sector-specific standards (e.g., FCC for electronics), expanding regulatory complexity .

- Lifetime Warranty Programs – Premium PPF brands like 3M offer 7-year warranties on Pro Series films, covering defects like delamination and yellowing, while excluding wear and tear or improper installation .

The cost structure and price composition of PPF:

- Raw Material Costs – TPU resin constitutes 35–45% of total production costs, with premium grades (self-healing) costing 2x standard TPU.

- Customer Acquisition Costs – Average $200–$500 per new client, factored into initial service pricing.

- Loyalty Program Discounts – Repeat customers receive 5–15% off, reducing margins but increasing retention.

- OEM Partnership Pricing – Factory-installed PPF sold at 15–20% below aftermarket due to bulk production deals.

- Topcoat Quality Impact – Ceramic-infused topcoats add $0.50–$1.00 per square foot but enable 10–15% price premiums.

- Technical Support Costs – Installer hotlines and training materials add $0.10–$0.20 per square foot.

- Warranty Add-Ons – Extending warranties from 5 to 10 years increases prices by 15–20% with minimal cost increase.

The market trends and industry changes of PPF:

- Integration of Ceramic Coatings – PPF-safe ceramic coatings applied post-installation (e.g., Onyx PPF Nano Coat) boost scratch resistance by 40%, creating hybrid protection solutions.

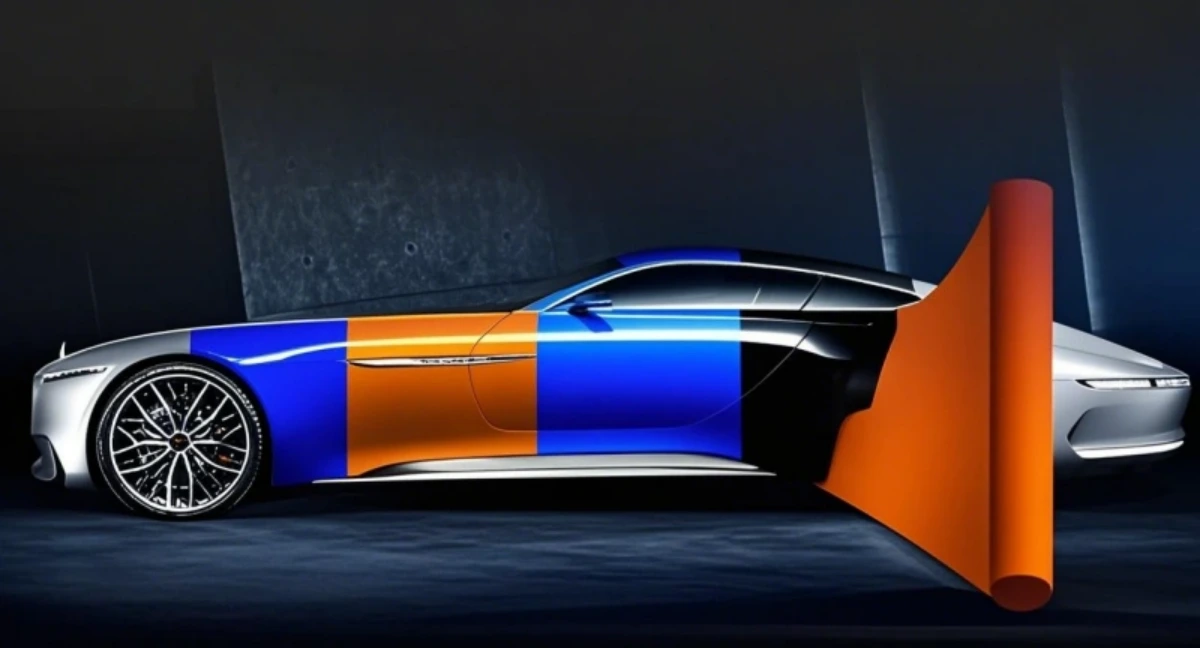

- Digital Print Integration – UV-curable digital printing on PPF allows custom graphics/logos, with 35% of commercial fleets now using branded PPF for marketing.

- Nano-Edge Sealing – Nanoscale adhesives in edge layers prevent water ingress, reducing edge lifting by 75% compared to traditional sealing methods.

- Commercial Fleet Adoption – Delivery giants like Amazon and JD.com are equipping 70% of new vans with PPF, reducing fleet repaint costs by $300 per vehicle annually.

- Deep Scratch Self-Healing – Advanced films repair 5μm-deep scratches (vs. 3μm previously) using microcapsule technology, activated by body heat or sunlight.

AUTOLI(CN) PPF(Paint Protection Film) oem manufacturer

autoli TPU PPF Applied to all brand car models as bmw、Maserati、Cadillac、Land Rover、Volkswagen、mini.Our factory cooperates with Auto Detailing、PPF distributor、ppf installation and all so in many countries and regions around the world,like United States,Korea,Poland,Slovakia,Singapore,Warranty: 10 years.Our advantages:SGS, ASTM, REACH, UL and other certifications;Raw material purchasing advantage;High quality raw materials and advanced technology;Strict quality control system;Large stock of styles for you to choose from.Our factory also provides PPF FILM、Car Wrap、Vinyl Car Wrap.