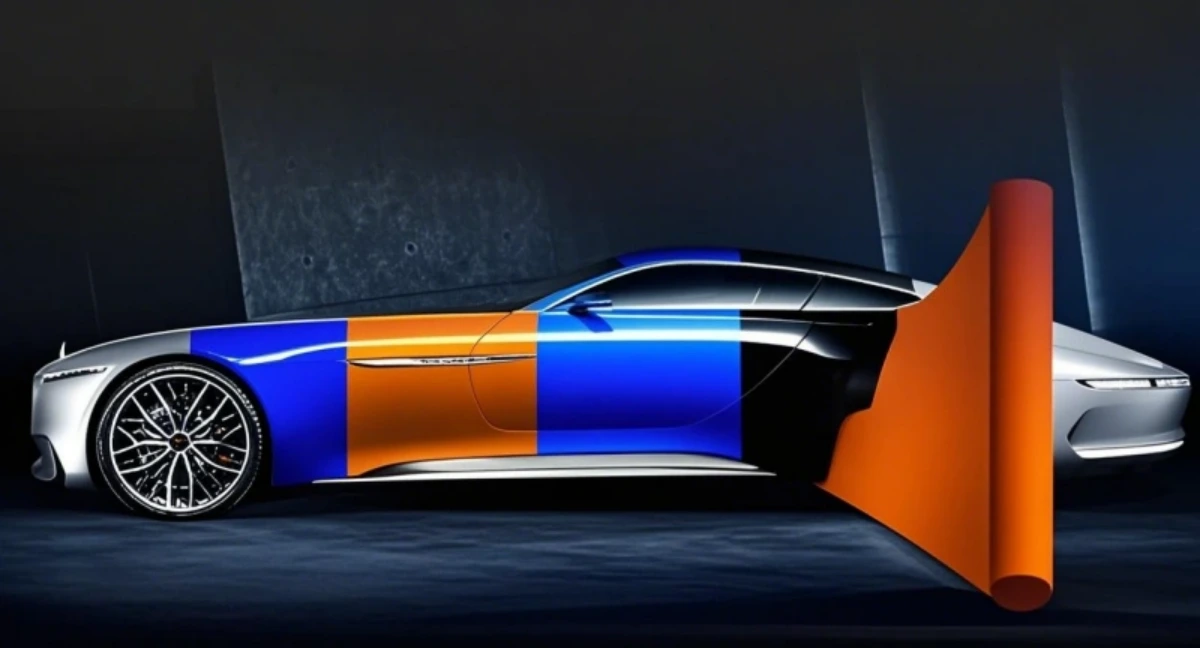

PPF’s AI-cutting tech ensures ±0.3mm precision, achieving 95% fit on curved surfaces like EVs’ sloped roofs with seamless edges.,Slight air resistance reduction for efficiency.,Join Hands: Experience Fast – Tracked Deliveries, Style Variety, and Trusted Certifications.

The construction and maintenance of PPF:

- Storage Protection – Covering vehicles with breathable car covers in storage prevents dust buildup and UV overexposure.

- Heat Gun Distance Control – Keeping heat guns 15–20cm from edges prevents film shrinkage during edge sealing.

- UV-Protection Boosters – Applying UV-resistant sprays in high-sun regions extends anti-yellowing performance.

- Monthly Top-Coat Boost – Applying a PPF-specific sealant enhances hydrophobicity and restores gloss over time.

- Oxidation Correction Pre-Install – Polishing oxidized paint ensures PPF adheres smoothly to uniform surfaces.

- Soft Rubber Squeegees for Curves – Flexible squeegees conform to rounded surfaces like fenders, reducing edge lifting risk during application.

- Edge Lifting Fix – Applying heat (60–80°C) and pressing edges with a microfiber cloth restores adhesion if lifting occurs.

The production supply chain and quality control system of PPF:

- Defect Classification System – Categorization of flaws (pinholes, bubbles, streaks) by severity to guide corrective actions.

- FIFO Inventory Rotation – First-in, first-out storage to ensure PPF rolls are shipped within optimal shelf life (12–18 months).

- Warranty Claim Analysis – Tracking failure patterns to identify systemic issues requiring process adjustments.

- Machine Vision Inspection – High-resolution cameras detecting micro-defects (≥20μm) in TPU films during production.

- Additive Supply Chain – Strategic partnerships with specialty chemical firms for UV stabilizers, self-healing agents, and nano-ceramic additives.

- Strategic Stockpiles – 3–6 month reserves of critical materials during high-demand periods or supply chain disruptions.

The cutting-edge technology research and development of PPF:

- High-Aspect-Ratio Nanofibers – Electrospun TPU nanofibers with 100:1 aspect ratio enhance puncture resistance by 400% in industrial applications.

- Bio-Based Flame Retardants – Chitosan-functionalized ammonium polyphosphate (CS-APP) and phenylphosphonic difurfurylamine (PPDF) provide V-0 rating in UL 94 tests with <1% loading.

- Smart UV Indicators – Photochromic dyes in PPF change color when UV exposure exceeds safe levels, alerting users to replacement needs.

- AI-Powered Quality Control – Machine vision systems with deep learning algorithms detect sub-micron defects in real-time, achieving 99.9% accuracy in production lines.

- Multifunctional Self-Healing Films – Microcapsules containing both healing agents and antimicrobial silver ions offer dual functionality for medical devices.

- Bio-Based Flame Retardant Coatings – Chitosan and ammonium polyphosphate composites provide V-0 rating in UL 94 tests with <1% loading.

The market trends and industry changes of PPF:

- Commercial Fleet Adoption – Delivery giants like Amazon and JD.com are equipping 70% of new vans with PPF, reducing fleet repaint costs by $300 per vehicle annually.

- Ceramic-PPF Hybrid Kits – Pre-packaged ceramic coating PPF bundles now account for 25% of aftermarket sales, simplifying multi-layer protection for consumers.

- Competitive Pricing Pressures – Market saturation in North America and Europe is driving price reductions, with entry-level PPF options now 20% cheaper than premium products, appealing to cost-conscious consumers.

- 15-Year Anti-Yellowing Warranties – Premium brands now offer 15-year guarantees against yellowing, using advanced HALS stabilizers to outlast traditional 10-year warranties.

- Nano-Coating Enhancements – Nano-based topcoats (e.g., Nasiol FCC) improve hydrophobicity and chemical resistance, extending PPF lifespan while maintaining self-healing capabilities.

- Thinner Yet Stronger Films – 6-mil PPF films now match the durability of 8-mil predecessors, reducing material use by 25% while maintaining impact resistance.

- Rise of Mobile Installation Services – On-demand PPF installation units equipped with portable dust-free booths are gaining traction, targeting busy urban consumers who prefer doorstep service.

- ADAS Sensor Compatibility – PPF films with 99.9% LiDAR/radar transparency are becoming standard, ensuring autonomous driving systems function unimpeded post-installation.

The user scenarios and value validation of PPF:

- Mountain Road Drivers – Shields Subaru Outbacks and Toyota 4Runners from rock slides, with PPF reducing windshield and fender chip repairs by 65%.

- Dirt Bike Racers – Shields plastic fenders from rock impacts during motocross events, with PPF extending part life by 2 seasons.

- Exotic Car Owners – Guards Lamborghini and McLaren carbon fiber panels from rock chips, as replacement costs for damaged panels exceed $10,000.

- Low-Maintenance Users – Minimizes washing frequency for busy professionals, as hydrophobic PPF keeps vehicles 30% cleaner between washes.

- Exotic Car Owners – Guards Lamborghini and McLaren carbon fiber panels from rock chips, as replacement costs for damaged panels exceed $10,000.

- Car Rental Companies – Reduces “damage waiver” claims for Hertz and Avis by 40%, as PPF hides minor scratches from renters.

- Solar Farm Maintenance Trucks – Resists dust and chemical exposure in desert solar sites, keeping vehicles operational with 25% less detailing.

The cost structure and price composition of PPF:

- Post-Install Inspection Fees – 24-hour quality checks add $50–$100 per vehicle but reduce warranty claims by 20%.

- Financing Options – Monthly payment plans include 8–12% interest, increasing total customer cost.

- Insurance Partnerships – Bundling with auto insurance reduces customer costs by 5–10% via insurer subsidies.

- Packaging Costs – Recyclable cardboard rolls and protective liners contribute 1–3% of total product costs.

- Bio-Based TPU Premium – Plant-derived TPU increases raw material costs by 15–20% but supports premium pricing.

- Research & Development – New formulations (e.g., anti-yellowing) add 2–4% to unit costs but enable 10–15% price premiums.

- Sales Commission – Dealer and distributor margins add 15–25% to wholesale prices before retail markup.

- Energy Consumption – Extrusion and curing processes account for 8–15% of production costs, higher for multi-layer films.

- Minimum Order Quantities – MOQs (500 sq ft) reduce per-unit costs by 10–15% for commercial buyers.

- Bundle Pricing Discounts – PPF ceramic coating bundles reduce total cost by 10–15% vs. separate purchases.

The horizontal comparison of PPF with other protection methods:

- PPF vs. Ceramic Coatings – PPF offers physical impact protection (resisting rocks/chips) while ceramic coatings focus on chemical resistance and hydrophobicity, with PPF lasting 5–10 years vs. 2–5 for ceramics.

- PPF vs. Teflon Coatings – Teflon coatings reduce friction but lack self-healing, unlike PPF which repairs micro-scratches and resists abrasion better in high-wear areas.

- PPF vs. Bug Remover Coatings – Bug coatings make cleanup easier, while PPF resists insect acid etching, with PPF offering proactive protection vs. reactive cleaning aid.

- PPF vs. Chrome Polish – Chrome polish removes tarnish but doesn’t prevent future damage, while PPF on chrome trims resists scratches and maintains shine long-term.

- PPF vs. Plastic Trim Restorers – Restorers revive faded trim, while PPF prevents UV damage and scratches on trim, maintaining appearance without frequent reapplication.

- PPF vs. Graphite Coatings – Graphite coatings reduce friction on metal parts but don’t protect paint, unlike PPF which shields exterior surfaces from physical damage.

- PPF vs. Fiberglass Coatings – Fiberglass coatings add rigid strength to surfaces but can’t conform to curves, unlike PPF which adapts to vehicle contours seamlessly.

- PPF vs. Car Covers – PPF provides 24/7 protection during driving/parking, unlike covers that only work when stationary and risk scratching paint during removal.

TPU PPF VS PET PPF:

- Global Compliance – TPU PPF meets REACH, FDA, and CARB standards, while some PET PPF formulations exceed VOC limits in strict regions.

- High-Speed Performance – TPU PPF resists stone chips at 120km/h, while PET PPF fails at 80km/h in highway tests.

- Industrial Chemical Resistance – TPU PPF resists oil and coolant spills, while PET PPF swells and discolors upon contact with industrial fluids.

- Material Memory – TPU PPF returns to original shape after stretching, while PET PPF retains deformation from installation stress.

- Storm Resilience – TPU PPF withstands hailstones up to 12mm, whereas PET PPF cracks under 8mm hail impacts.

- Cost Structure – TPU PPF costs 2–3x more upfront than PET PPF but offers 3–5x longer service life, reducing long-term costs.

- Warranty Claims – TPU PPF has 30% fewer warranty claims than PET PPF due to superior durability and performance consistency.

AUTOLI(CN) PPF(Paint Protection Film) manufacturer

autoli TPU PPF Applied to all brand car models as binli、Porsche、bmw、Lexus.Our factory cooperates with PPF brand、PPF installer、PPF agent and all so in many countries and regions around the world,like Romania,Uruguay,Portugal,Peru,Madagascar,Norway,Warranty: 10 years.Our advantages:Large stock of styles for you to choose from;Unlock Business Growth with Our Factory’s PPF;Collaborate for Lucrative Returns: Source factory.Our factory also provides Car Wrap Vinyl、Car Wraps、Car Paint Protection Film、Vinyl wrapping.