PPF’s self-healing works on car wash scratches, reducing the need for frequent polishing to remove swirl marks.,Matte variant reduces swirl marks (Ra 0.8-1.6μm).,The Key to Business Prosperity: Partner with Our Factory’s Diverse – Style PPF.

TPU PPF VS PET PPF:

- Color Stability – TPU PPF retains tinted colors for 5 years, while PET PPF tint fades 40% within 18 months.

- Weight Difference – TPU PPF adds 1.2kg per vehicle (full wrap), while PET PPF adds 0.8kg due to lower density but reduced coverage efficiency.

- Custom Thickness Matching – TPU PPF tailors thickness to vehicle zones (e.g., 10mil for hoods), while PET PPF uses uniform thickness due to manufacturing limits.

- Installation Time – TPU PPF full-vehicle installs take 1–2 days, while PET PPF requires 1 day but with higher risk of rework.

- Cost Per Square Foot – TPU PPF averages $8–$15/sq ft, compared to PET PPF’s $3–$7/sq ft price point.

- Material Memory – TPU PPF returns to original shape after stretching, while PET PPF retains deformation from installation stress.

The user scenarios and value validation of PPF:

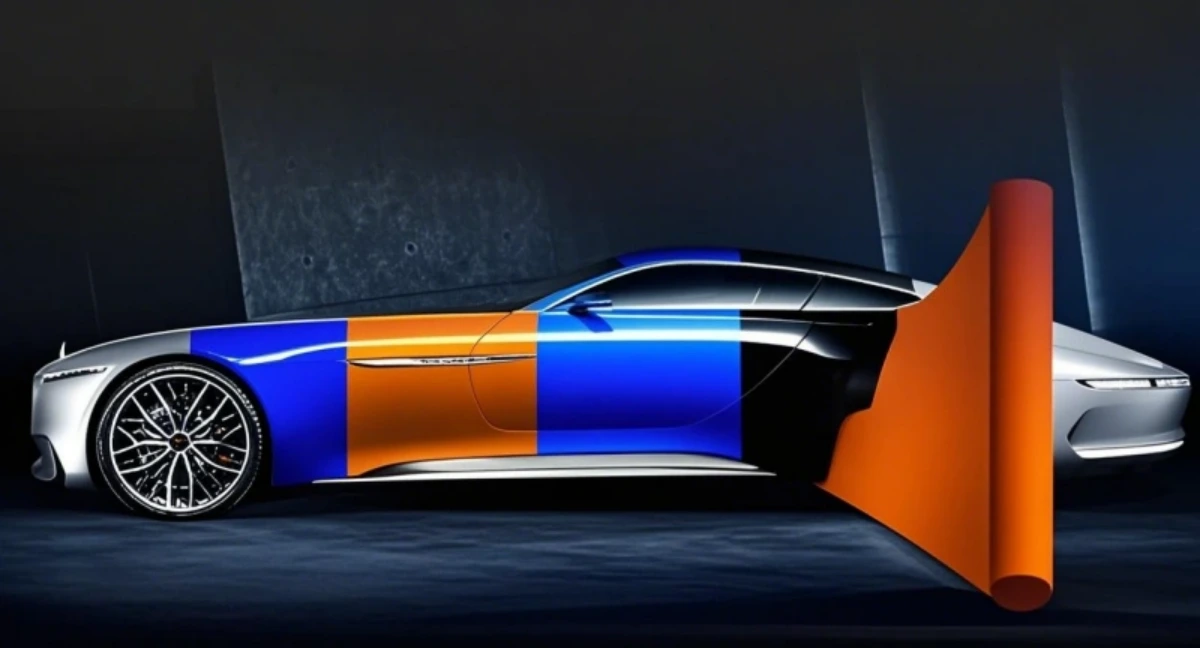

- Art Car Enthusiasts – Preserves custom murals and decals from weathering, with removable PPF allowing art updates without damaging the base design.

- Off-Road Enthusiasts – Shields Jeep Wrangler and Ford Bronco fenders from trail rocks and branches, reducing paint repair costs by $800 annually.

- Construction Managers’ Trucks – Shields Ford F-150s from concrete splatters and tool drops, extending time between repaints from 12 to 24 months.

- Solar Farm Maintenance Trucks – Resists dust and chemical exposure in desert solar sites, keeping vehicles operational with 25% less detailing.

- Photography Vehicle Owners – Maintains clean white backdrops on vans for photoshoots, as PPF resists dirt staining during outdoor location shoots.

- Ride-Share Drivers – Protects Uber and Lyft vehicles from passenger-related scratches, with 90% of drivers avoiding “excessive wear” lease penalties.

- Off-Grid Adventurers – Shields overland vehicles from brush scratches during remote expeditions, avoiding costly field repairs in inaccessible areas.

- Police and Emergency Vehicles – Extends service life of patrol car paint by 2 years, reducing taxpayer costs for fleet repaints by $200k annually per department.

- Desert Dwellers – Blocks UV-induced fading in Dubai and Phoenix, keeping paint vibrant 3x longer than unprotected vehicles in 45°C heat.

The market trends and industry changes of PPF:

- Local Sourcing Trends – Post-pandemic, 55% of North American PPF brands source TPU locally, reducing supply chain delays by 30%.

- Thinner Yet Stronger Films – 6-mil PPF films now match the durability of 8-mil predecessors, reducing material use by 25% while maintaining impact resistance.

- Circular Economy Initiatives – Closed-loop recycling programs for end-of-life PPF are being piloted, with companies like MBA Polymers achieving 80% carbon reduction in recycled PP production.

- Rapid Growth of High-End PPF Market – The high-end PPF market is projected to reach $4.2 billion by 2033 at an 8% CAGR, driven by luxury vehicle ownership and demand for advanced protection features like self-healing technology.

- Detailing Chain Partnerships – PPF brands are collaborating with chains like Detail Garage, offering co-branded training and product bundles to expand reach.

- Rise of Professional Detailing Chains – Organized car care franchises in India and Thailand are offering PPF as a core service, bundling it with ceramic coatings and detailing packages to attract premium customers.

- Automotive Designer Collaborations – PPF brands work with OEM designers to create pre-cut patterns for concept cars, ensuring seamless protection on unique contours.

- Automation in Production Processes – Laser cutting technologies (e.g., GCC RX II) with 600g cutting force enable precise, waste-reducing PPF customization, improving material utilization efficiency to 94%.

- EV Battery Heat Resistance Focus – Next-gen PPF films are engineered to withstand 120°C from EV battery systems, preventing delamination in high-heat zones like undercarriages.

Before & After: How PPF Transforms a 10-Year-Old Car:

- Before: Trunk lid with key scratches and luggage scuffs; After: PPF’s self-healing properties erase fine scratches, creating a flawless surface for loading/unloading.

- Before: Hood insulation with paint stains from oil leaks; After: PPF on adjacent metal covers stains and creates a barrier against future leaks.

- Before: Sunroof surround with cracked paint from thermal expansion; After: Flexible PPF accommodates temperature changes, covering cracks and preventing new ones.

- Before: Rear wiper blade pivot point with rust; After: PPF seals the pivot, covering rust and preventing water from accelerating corrosion.

- Before: Hood covered in rock chips from a decade of highway driving; After: PPF’s impact-resistant layer conceals existing chips and prevents new ones, creating a smooth surface.

- Before: Exhaust tip surrounds with heat discoloration; After: High-temperature PPF covers blueing and resists heat damage, maintaining appearance.

The regulations of PPF and after-sales services:

- EU PPWR Packaging Mandates – The EU’s Packaging and Packaging Waste Regulation (PPWR) requires PPF packaging to be recyclable by 2030 and prohibits PFAS in food-contact packaging, impacting material choices and disposal practices .

- Australia’s UV Protection Standards – PPFs sold in Australia/NZ must comply with AS/NZS 4399 for UV protection, requiring UPF ratings ≥15 and transparency in labeling .

- Solvent-Free Adhesive Requirements – EU REACH and California CARB regulations push PPF producers to adopt solvent-free adhesives, reducing carbon footprints by up to 80% .

- NAR Auto Film’s Compensation Policy – NAR PPF provides 1:1 pre-installation and 1:2 post-installation defect compensation, backed by factory insurance covering up to 100% of replacement costs .

- Blockchain Warranty Verification – 3M utilizes blockchain to secure digital warranties, enabling traceable ownership transfers and fraud prevention .

- Supply Chain Traceability – EU PPWR mandates tracking PPF materials from production to disposal, ensuring compliance with recycled content targets (e.g., 30% by 2030) .

The horizontal comparison of PPF with other protection methods:

- PPF vs. Wheel Protective Films – PPF is designed for large painted panels, while specialized wheel films handle brake dust/heat, with PPF offering broader impact resistance.

- PPF vs. Stone Guard Films (Thin) – Thin stone guards protect against small debris but lack self-healing, while PPF handles larger impacts and repairs minor damage automatically.

- PPF vs. Paint Sealants – Sealants provide 6–12 months of chemical resistance, while PPF adds physical barrier protection against impacts, with both enhancing gloss but PPF lasting longer.

- PPF vs. Stone Chip Resistant Paint – Factory chip-resistant paint offers minimal defense, while PPF adds a flexible layer that absorbs impacts, reducing chips by 75%.

- PPF vs. Acrylic Sealants – Acrylic sealants offer temporary gloss (3–6 months) without impact resistance, while PPF adds a physical layer shielding against chips and scratches.

- PPF vs. Polymer Sealants – Polymer sealants offer 3–6 months of chemical resistance but no physical defense, while PPF provides both for 5 years.

- PPF vs. Rubberized Undercoating – Undercoating protects metal from rust, while PPF defends painted surfaces from road debris, with non-overlapping application zones.

Why TPU PPF:

- Termite Resistance – Impervious to insect damage, unlike wooden pergolas vulnerable to termites and carpenter ants.

- Anti-Slip Flooring Support – Structurally sound for stone, wood, or composite decking installations.

- Heritage Site Compatible – Discreet designs suitable for historic districts with preservation guidelines.

- Non-Toxic Materials – Free from formaldehyde, arsenic, or other harmful chemicals in wood treatments.

- Aesthetic Versatility – Can mimic wood grain via powder coating for traditional looks with modern durability.

The cost structure and price composition of PPF:

- Post-Install Inspection Fees – 24-hour quality checks add $50–$100 per vehicle but reduce warranty claims by 20%.

- Adhesive Technology Costs – Removable adhesives add $0.30–$0.50 per square foot vs. permanent options.

- Supply Chain Premiums – Post-pandemic, material shortages increased prices by 10–15% in 2023–2024.

- Small-Batch Premium – Custom colors or finishes cost 30–50% more due to low-volume production inefficiencies.

- Long-Term Contract Discounts – 3–5 year fleet contracts reduce per-vehicle costs by 10–15% via guaranteed volume.

- Warranty Administration Fees – Digital warranty systems add $0.05–$0.10 per square foot but reduce claim processing time.

- Quality Control Expenses – Automated inspection systems add 3–5% to production costs but reduce warranty claims by 40%.

- Material Thickness Pricing – Each mil increase (6→10mil) adds $1–$2 per square foot due to higher material usage.

- Regulatory Compliance – REACH/EPA certifications add $0.20–$0.40 per square foot for market access in strict regions.

- Insurance Partnerships – Bundling with auto insurance reduces customer costs by 5–10% via insurer subsidies.

The environmental protection and sustainability of PPF:

- Non-Toxic Disposal – PVC-free PPF avoids toxic chlorine release during incineration, making disposal safer for waste management workers.

- Sustainable Adhesive Removers – Plant-based solvents for PPF removal replace harsh chemicals, reducing groundwater contamination risks.

- Compostable Instruction Guides – Manuals printed on seed paper grow into plants, eliminating paper waste from disposal.

- Eco-Label Transparency – Clear labeling of recycled content (e.g., “30% recycled TPU”) helps consumers make environmentally informed choices.

- PFAS-Free Formulations – Eliminating per- and polyfluoroalkyl substances reduces environmental persistence, aligning with EU PFAS restrictions (2025 phase-out).

- WEEE Directive Compliance – PPF recycling aligns with EU WEEE standards, ensuring proper disposal of polymer waste to prevent soil contamination.

- Biodegradable Edge Trims – Paper-based edge trims on PPF rolls decompose naturally, avoiding plastic trim waste.

- Low-VOC Coatings – Topcoats with <50g/L VOCs meet strict EU limits, minimizing air pollution during curing and extending environmental compliance.

How TPU Redefines PPF:

- Installation Ease – TPU’s air-release adhesives and repositionable properties redefined PPF installation from labor-intensive to DIY-friendly with minimal bubbles.

- Material Safety Shift – TPU’s non-toxic composition redefined PPF from PVC-based films (with harmful plasticizers) to eco-friendly options meeting global safety standards.

- Low-VOC Production – TPU’s solvent-free manufacturing redefined PPF from high-emission products to eco-friendly options meeting CARB and REACH standards.

- Global Regulatory Compliance – TPU’s meet REACH, FDA, and OEM standards redefined PPF from region-limited products to globally marketable solutions.

- Anti-Static Properties – Carbon-infused TPU redefined PPF from dust-attracting films to static-dissipating solutions reducing dirt buildup.

- Eco-Friendly Evolution – Recyclable TPU redefined PPF from single-use plastic waste to circular economy products with end-of-life material recovery.

- Lightweight Shipping – TPU’s low density redefined PPF from high-freight-cost products to cost-efficient options reducing transportation emissions by 30%.

AUTOLI(CN) PPF(Paint Protection Film) manufacturer

autoli TPU PPF Applied to all brand car models as Land Rover、Alfa Romeo、Lexus、Mazda.Our factory cooperates with PPF installer、car Detail、Auto Detailing service and all so in many countries and regions around the world,like Denmark,Brazil,Morocco,Indonesia,Uruguay,Germany,Warranty: 10 years.Our advantages:Large stock of styles for you to choose from;High quality raw materials and advanced technology;Perfect after-sales service.Our factory also provides Car Wraps、Window tint.