PPF safeguards car paint from stone chips and scratches via durable TPU, absorbing over 90% of daily impact energy to preserve the original finish.,Compatible with all vehicle types (EVs, SUVs).,Bulk Gloss/Matt PPF – TüV Tested, Export Ready.

The horizontal comparison of PPF with other protection methods:

- PPF vs. Wax Sprays – Wax sprays enhance gloss for 2–4 weeks but offer no scratch protection, while PPF provides long-term defense with minimal maintenance.

- PPF vs. Anti-Fade Treatments – Anti-fade treatments slow UV damage but don’t prevent scratches, unlike PPF which blocks UV rays and shields against physical wear.

- PPF vs. Matte Paint Sealants – PPF preserves matte paint texture while adding scratch resistance, whereas matte sealants focus on maintaining finish but lack impact defense.

- PPF vs. UV-Blocking Window Tints – Tints reduce interior UV exposure, while PPF blocks exterior paint UV damage, with both addressing UV risks but on different surfaces.

- PPF vs. Glass Polish – Polish removes water spots from glass, while PPF on paint prevents spots via hydrophobicity, with distinct surface applications.

- PPF vs. Graphite Coatings – Graphite coatings reduce friction on metal parts but don’t protect paint, unlike PPF which shields exterior surfaces from physical damage.

- PPF vs. Leather Protectors – Leather treatments guard against spills/cracking, while interior PPF shields dash/console plastics from UV fading and scratches, with separate material focuses.

- PPF vs. Anti-Static Sprays – Sprays reduce dust attraction temporarily, while PPF’s anti-static properties last for years, with both aiding cleanliness but PPF offering more durability.

- PPF vs. Liquid Glass Coatings – Liquid glass offers 6–12 months of chemical resistance but lacks physical impact protection, while PPF combines 5 years of scratch defense with self-healing capabilities.

- PPF vs. Plastic Trim Restorers – Restorers revive faded trim, while PPF prevents UV damage and scratches on trim, maintaining appearance without frequent reapplication.

TPU PPF VS PET PPF:

- UV Stability – TPU PPF with HALS additives resists yellowing for 10 years, while PET PPF typically yellows within 2–3 years of UV exposure.

- Production Efficiency – TPU PPF’s continuous extrusion reduces waste by 40%, while PET PPF’s batch production generates 25% more scrap.

- Weather Adaptability – TPU PPF performs in coastal salt spray, while PET PPF shows corrosion under film in high-humidity environments.

- Removability – TPU PPF peels cleanly after 5 years, whereas PET PPF often leaves adhesive residue requiring professional removal.

- Custom Cutting – TPU PPF laser-cuts cleanly for complex curves, while PET PPF tends to crack during precision cutting on sharp angles.

- Heat Dissipation – TPU PPF’s thermal conductivity reduces under-hood temperatures by 3–5°C, while PET PPF traps 10% more heat.

- Chemical Cleaning Compatibility – TPU PPF tolerates iron removers and tar cleaners, while PET PPF may discolor with aggressive decontamination products.

- Cleaning Compatibility – TPU PPF works with pH-neutral cleaners, while PET PPF is sensitive to alcohol-based products, causing clouding.

The cost structure and price composition of PPF:

- Partial Coverage Costs – Hood/fender kits at $800–$2,000, with higher per-square-foot pricing than full wraps.

- Environmental Certification Premiums – Eco-friendly PPF costs 5–10% more due to sustainable material sourcing.

- Scrap Recycling Revenue – Production scrap sold for recycling offsets 1–2% of raw material costs.

- Loyalty Program Discounts – Repeat customers receive 5–15% off, reducing margins but increasing retention.

- Premium PPF Costs – 10mil multi-layer films with lifetime warranties retail at $12–$20 per square foot, 50–60% margins.

- Insurance Partnerships – Bundling with auto insurance reduces customer costs by 5–10% via insurer subsidies.

- Referral Program Incentives – $50–$100 discounts for referrals reduce net prices by 3–5% but lower acquisition costs.

The horizontal comparison of PPF with other protection methods:

- PPF vs. Wax Sprays – Wax sprays enhance gloss for 2–4 weeks but offer no scratch protection, while PPF provides long-term defense with minimal maintenance.

- PPF vs. Anti-Fade Treatments – Anti-fade treatments slow UV damage but don’t prevent scratches, unlike PPF which blocks UV rays and shields against physical wear.

- PPF vs. Matte Paint Sealants – PPF preserves matte paint texture while adding scratch resistance, whereas matte sealants focus on maintaining finish but lack impact defense.

- PPF vs. UV-Blocking Window Tints – Tints reduce interior UV exposure, while PPF blocks exterior paint UV damage, with both addressing UV risks but on different surfaces.

- PPF vs. Glass Polish – Polish removes water spots from glass, while PPF on paint prevents spots via hydrophobicity, with distinct surface applications.

- PPF vs. Graphite Coatings – Graphite coatings reduce friction on metal parts but don’t protect paint, unlike PPF which shields exterior surfaces from physical damage.

- PPF vs. Leather Protectors – Leather treatments guard against spills/cracking, while interior PPF shields dash/console plastics from UV fading and scratches, with separate material focuses.

- PPF vs. Anti-Static Sprays – Sprays reduce dust attraction temporarily, while PPF’s anti-static properties last for years, with both aiding cleanliness but PPF offering more durability.

- PPF vs. Liquid Glass Coatings – Liquid glass offers 6–12 months of chemical resistance but lacks physical impact protection, while PPF combines 5 years of scratch defense with self-healing capabilities.

- PPF vs. Plastic Trim Restorers – Restorers revive faded trim, while PPF prevents UV damage and scratches on trim, maintaining appearance without frequent reapplication.

The market trends and industry changes of PPF:

- Ceramic-PPF Hybrid Kits – Pre-packaged ceramic coating PPF bundles now account for 25% of aftermarket sales, simplifying multi-layer protection for consumers.

- Commercial Fleet Adoption – Delivery giants like Amazon and JD.com are equipping 70% of new vans with PPF, reducing fleet repaint costs by $300 per vehicle annually.

- Regulatory Push for Transparency – The EU’s Digital Product Passport initiative requires PPF manufacturers to disclose material composition and recycling options, driving supply chain accountability.

- Data-Driven Marketing Strategies – Brands are using AI analytics to identify regional demand patterns, tailoring product launches (e.g., anti-yellowing films for high-sun areas) to specific markets.

- Automotive Designer Collaborations – PPF brands work with OEM designers to create pre-cut patterns for concept cars, ensuring seamless protection on unique contours.

- Insurance Partnerships and Bundling – EV manufacturers like BYD are integrating PPF into insurance packages, offering discounted rates for customers who opt for factory-installed protection.

- Integration of Ceramic Coatings – PPF-safe ceramic coatings applied post-installation (e.g., Onyx PPF Nano Coat) boost scratch resistance by 40%, creating hybrid protection solutions.

- Sustainability-Driven Material Shifts – The EU’s Packaging and Packaging Waste Regulation (PPWR) mandates recyclable materials by 2030, prompting PPF manufacturers to adopt bio-based TPU and recycled polypropylene (PP) to reduce environmental impact.

- Cross-Industry Collaborations – Material suppliers (e.g., Lubrizol) are partnering with PPF manufacturers to develop specialized films for extreme climates, such as heat-resistant variants for desert regions.

The differentiated user group needs matching of PPF:

- Luxury Yacht Tenders – Choose marine-grade PPF resistant to saltwater and UV, protecting fiberglass hulls from dock collisions and sun damage.

- Daily Urban Commuters – Seek 7–8mil UV-stabilized PPF for scratch resistance against parking lot dings and road debris during city driving.

- Art Car Enthusiasts – Select removable, customizable PPF that protects murals/decals from weathering while allowing design updates without damage.

- Senior Drivers – Prefer easy-maintenance PPF with hydrophobic properties to reduce washing frequency and hide minor parking mishaps.

- Coastal Residents – Choose saltwater-resistant PPF with anti-corrosion additives to combat salt spray and humidity-induced oxidation.

- Classic Car Dealers – Opt for showroom-grade PPF that enhances paint gloss for displays, with easy removal for test drives and sales.

The long-term monitoring and maintenance system after the installation of PPF:

- Monthly Impact Zone Inspections – Focusing on high-risk areas (front bumper, hood leading edge) for rock chip accumulation and self-healing effectiveness.

- Annual Topcoat Thickness Testing – Using coating thickness gauges to ensure topcoat retains ≥80% original thickness.

- Bug Splatter Removal Steps – Soaking splatters with bug remover spray for 2 minutes before gently wiping to prevent staining.

- Quarterly Tar and Sap Removal – Using citrus-based solvents to dissolve road tar and tree sap without damaging adhesives.

- Adhesive Migration Checks – Using UV lights to detect adhesive bleed-out along edges, a precursor to delamination.

- Humidity-Triggered Cleaning Adjustments – Increasing cleaning frequency by 50% in ≥70% humidity to prevent mold under PPF.

- Daily Dust Removal – Using a static-free microfiber duster to remove surface dust, preventing scratches during wiping.

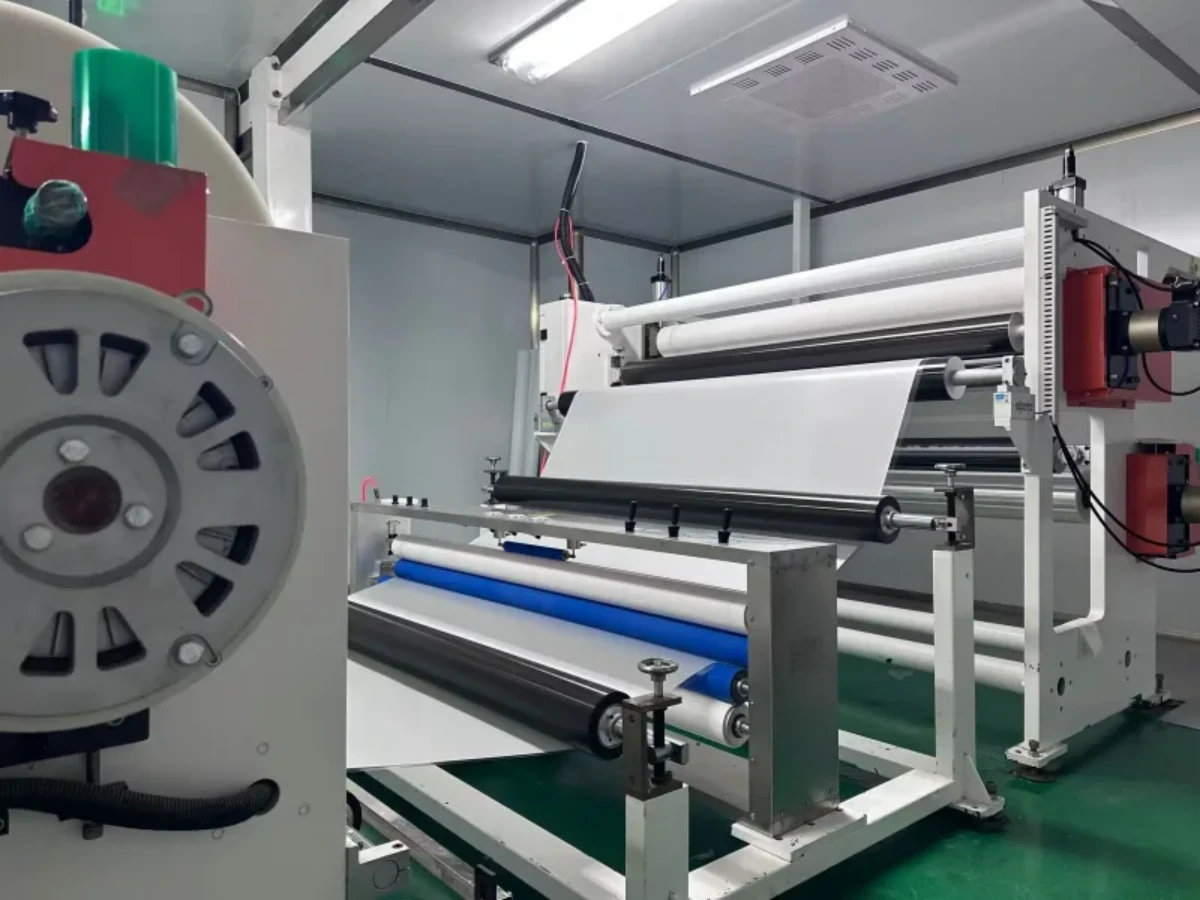

AUTOLI(CN) PPF(Paint Protection Film) manufacturer

autoli TPU PPF Applied to all brand car models as ford、binli、byd、jeep、Bugatti.Our factory cooperates with Auto Repair Center、PPF agent、PPF installer、PPF distributor and all so in many countries and regions around the world,like New Zealand,Macedonia,UK,Iran,Warranty: 10 years.Our advantages:Strict quality control system;Large stock of styles for you to choose from;Our customers are all over the world;Collaborate for Lucrative Returns: Source factory.Our factory also provides car wrapping、Vinyl Car Wrap.