PPF’s aliphatic TPU resists hydrolysis, lasting 5-10 years vs. 1-2 years for poor polyester TPU prone to yellowing.,Cohesive protection with glass PPF systems.,Factory – Powered Success: PPF in Rich Hues, Propel Your Brand Forward.

The protective performance of PPF:

- **Resistance to Abrasion from Roadside Vegetation** – When driving on narrow roads with overhanging vegetation, PPF protects the vehicle’s paint from scratches caused by the plants.

- Salt Spray Resistance – Protects against corrosion caused by road salt used in winter or coastal environments.

- Carbon Fiber & Piano Black Protection – Shields high-wear interior surfaces like carbon fiber and glossy trims from scratches.

- **Improved UV – Stability of the Film Itself** – The PPF material itself has good UV – stability, ensuring that it doesn’t degrade or lose its protective properties under long – term sunlight exposure.

- Edge Sealing Technology for Longevity – Prevents edge lifting through precise installation and heat-activated adhesive, ensuring 10 year durability.

- **Resistance to Insect Acid** – The acidic substances in insect remains can damage paint. PPF resists the etching effect of insect acid, keeping the paint in good condition.

- Ceramic Coating Compatibility – Optional ceramic layers enhance hydrophobicity and chemical resistance without compromising self-healing.

- Colored PPF Durability – Features durable topcoats and self-healing tech to maintain vibrant colors and protection.

- Flexible Impact Resistance – Balances elasticity with toughness to absorb impacts while conforming to curves.

The regulations of PPF and after-sales services:

- Regional Regulatory Exemptions – Medical device packaging and hazardous goods transportation are exempt from EU PPWR’s recyclability rules, affecting niche PPF applications .

- Regulatory Updates for EVs – EV-specific PPFs must comply with OEM heat resistance standards (e.g., 120°C for battery zones) to avoid delamination .

- IoT-Enabled Performance Monitoring – Emerging PPFs with embedded sensors monitor UV exposure and damage levels, providing real-time data for predictive maintenance and warranty claims .

- NAR Auto Film’s Compensation Policy – NAR PPF provides 1:1 pre-installation and 1:2 post-installation defect compensation, backed by factory insurance covering up to 100% of replacement costs .

- Solvent-Free Adhesive Requirements – EU REACH and California CARB regulations push PPF producers to adopt solvent-free adhesives, reducing carbon footprints by up to 80% .

- WEEE Directive Compliance – End-of-life PPF must be recycled in accordance with the EU’s WEEE directive, promoting circular economy practices for electronic and automotive waste .

- DIY Installation Void Policies – Most warranties, including PurePPF and 3M, void coverage for self-installed films, emphasizing the need for certified professional application .

- Class Action Liability – Manufacturers face potential litigation for non-compliant PPFs, as seen in cases involving PFAS contamination or false warranty claims .

- Regional Regulatory Exemptions – Medical device packaging and hazardous goods transportation are exempt from EU PPWR’s recyclability rules, affecting niche PPF applications .

- Anti-Yellowing Guarantees – Brands like Aegis Eternal 400 offer 15-year warranties against yellowing, using HALS stabilizers to maintain optical clarity over extended periods .

The market trends and industry changes of PPF:

- Southeast Asia Market Surge**- Indonesia and Vietnam’s PPF markets are growing at 11% CAGR, driven by rising middle-class car ownership and demand for affordable protection packages.

- Regulatory Compliance in Manufacturing – Stringent environmental regulations (e.g., EU REACH) are pushing PPF producers to adopt solvent-free adhesives and energy-efficient production processes, reducing carbon footprints by up to 80%.

- EV Battery Heat Resistance Focus – Next-gen PPF films are engineered to withstand 120°C from EV battery systems, preventing delamination in high-heat zones like undercarriages.

- Rise of Mobile Installation Services – On-demand PPF installation units equipped with portable dust-free booths are gaining traction, targeting busy urban consumers who prefer doorstep service.

- Sustainability-Driven Material Shifts – The EU’s Packaging and Packaging Waste Regulation (PPWR) mandates recyclable materials by 2030, prompting PPF manufacturers to adopt bio-based TPU and recycled polypropylene (PP) to reduce environmental impact.

- Regional Market Expansion in Asia-Pacific – The Asia-Pacific PPF market is growing at a 6.6% CAGR, led by China and India, where rising vehicle ownership and premium car sales drive demand for long-lasting protection solutions.

- Detailing Chain Partnerships – PPF brands are collaborating with chains like Detail Garage, offering co-branded training and product bundles to expand reach.

- Increased Adoption in Non-Automotive Sectors – PPF applications are expanding to electronics (screen protection), aerospace (corrosion resistance), and industrial equipment, diversifying revenue streams for manufacturers.

The differentiated user group needs matching of PPF:

- Mobile Farmers Market Trucks – Need weather-resistant PPF that protects custom graphics from rain, sun, and produce transport wear.

- Classic Truck Restorers – Prefer low-gloss PPF that matches vintage paint sheen, preserving patina while preventing further wear.

- Snowmobile Trail Groomers – Need cold-resistant PPF (-40°C) to protect metal and plastic surfaces from ice, salt, and debris buildup.

- Off-Road Racing Trucks – Prioritize impact-dispersing multi-layer PPF, absorbing high-speed rock impacts during desert races like Baja 1000.

- Road Construction Vehicle Operators – Use heavy-duty 15mil PPF to shield cabs from gravel, concrete splatters, and industrial debris.

- Beachside Rental Car Fleets – Choose sand-resistant PPF with enhanced hydrophobicity, reducing cleaning time between rentals in coastal areas.

- Commercial Fleet Operators – Prioritize bulk-roll PPF for cost-effective full-vehicle coverage, reducing repaint cycles by 60% for delivery vans/trucks.

The cost structure and price composition of PPF:

- DIY Kit Pricing – Pre-cut kits retail at $300–$800 per vehicle, with 40–50% margins due to lower labor costs.

- Material Thickness Pricing – Each mil increase (6→10mil) adds $1–$2 per square foot due to higher material usage.

- Low-Volume Vehicle Surcharges – Custom cuts for rare models add 20–30% due to template creation costs.

- Lease Protection Premium – Lease-specific PPF (removable) costs 10–15% more due to residue-free adhesive requirements.

- Digital Marketing Efficiency – Social media campaigns reduce customer acquisition costs by 10–15% vs. traditional ads.

Say Goodbye to Car Scratches: Self-Healing PPF Revealed!:

- Modern self-healing PPF reduces “micro-marring” that dulls paint over time, keeping finishes brighter longer.

- Wet conditions don’t delay healing—self-healing PPF repairs scratches even when exposed to rain or humidity.

- Highway gravel impacts leave temporary marks that heal, reducing long-term paint degradation from road debris.

- Heat from drive-through tunnels or heated garages triggers healing, making repairs effortless during daily routines.

- Unlike temporary scratch removers that wash off, self-healing PPF’s repairs are permanent, with no reapplication needed.

- Sunlight, engine heat, or even a hair dryer triggers the healing process, with most minor scratches vanishing within 24 hours of temperature exposure.

- Self-healing technology keeps PPF “invisible” over time, as scratches don’t accumulate to create a cloudy appearance.

- Self-healing PPF outperforms “scratch-resistant” claims by actively reversing damage rather than just delaying visible wear.

- Desert sand scratches heal, protecting paint in harsh, windy environments with abrasive particles.

- Winter ice scraper scratches heal once temperatures rise, preserving paint through cold-weather maintenance.

The user perception and consumption misconceptions of PPF:

- Correct Perception: Lease Protection Value – Leaseholders use PPF to avoid $500 end-of-term fees, with 95% passing inspections without paint-related charges.

- Correct Perception: UV Testing Validates Anti-Yellowing Claims – Checking for 1,000 hours of UV testing data, ensuring films resist discoloration in real-world use.

- Consumer Misconception: “PPF Installation Requires Paint Removal” – Fearing sanding or stripping, unaware professional installs use gentle cleaning without paint removal.

- Consumer Misconception: “PPF Makes Car Washes Obsolete” – Thinking hydrophobic properties eliminate washing, not realizing heavy grime still requires cleaning.

- Correct Perception: Partial Coverage Value – Many opt for high-impact areas (hood, fenders) over full wraps, balancing protection and cost effectively.

- Correct Perception: Professional Installation Worth Cost – 90% of satisfied users attribute results to certified installers, valuing dust-free environments and precision tools.

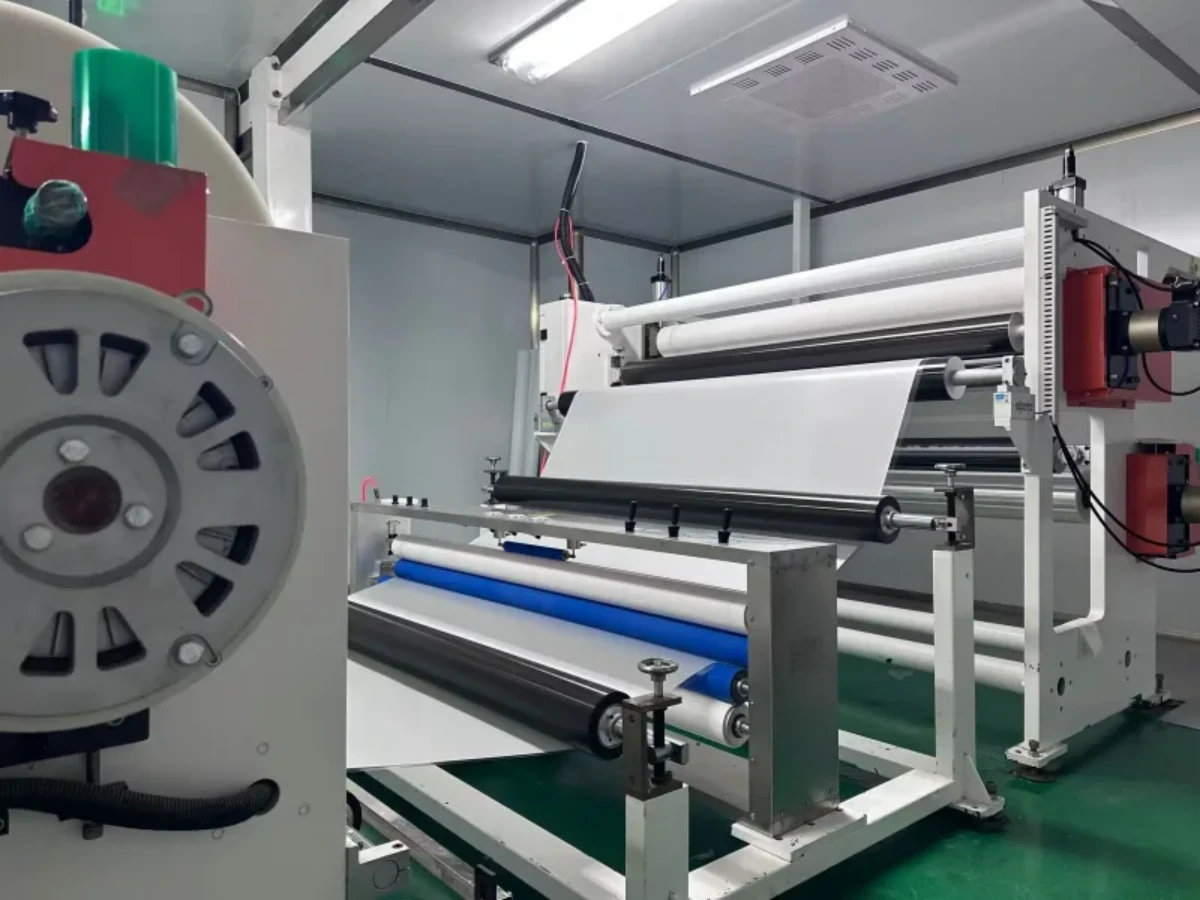

AUTOLI(CN) PPF(Paint Protection Film) manufacturer

autoli TPU PPF Applied to all brand car models as Chrysler、Chevrolet、Volkswagen、Dodge.Our factory cooperates with PPF brand、ppf installation、Auto Spa、PPF agent、car Detail and all so in many countries and regions around the world,like Korea,Russia,Canada,Cameroon,Warranty: 10 years.Our advantages:Strict quality control system;Raw material purchasing advantage;Short production cycle, quick delivery;High quality raw materials and advanced technology;Your Key to Profitable PPF Ventures.Our factory also provides car wrapping、PPF FILM.