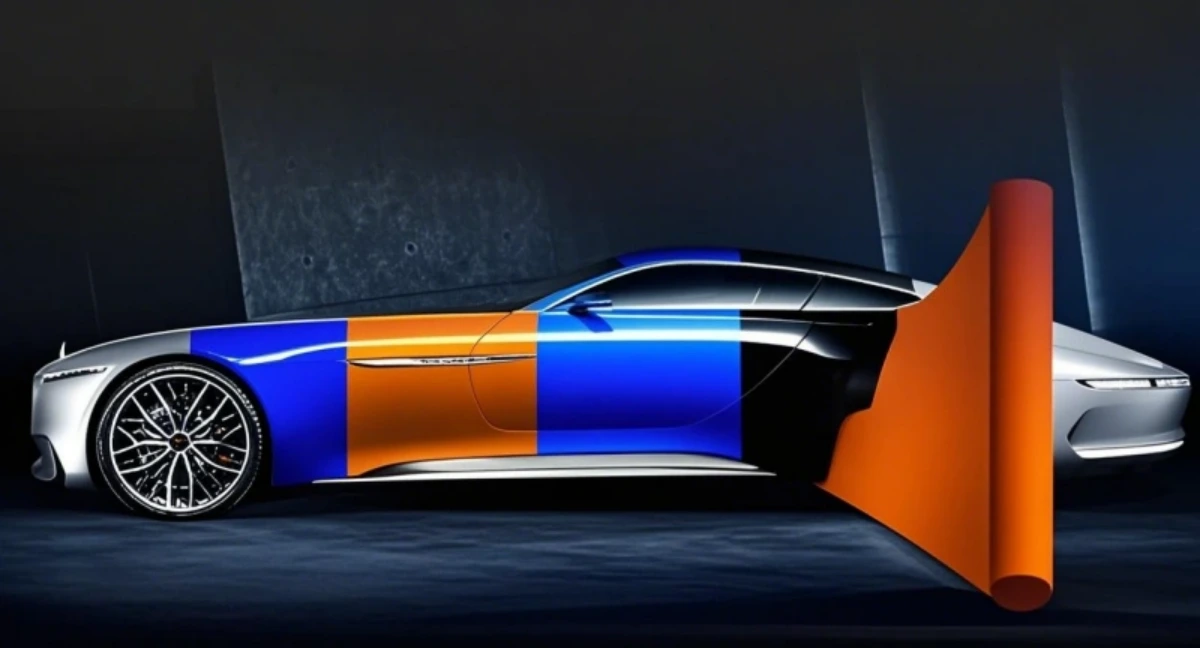

PPF preserves original paint integrity, lifting used car value by 10-20%—a ¥20k investment offsets resale losses for ¥300k cars.,Prevents desert UV-induced paint fading.,Join Forces: Factory – Supplied PPF, Driving Your Profit Engine.

The user scenarios and value validation of PPF:

- Car Rental Companies – Reduces “damage waiver” claims for Hertz and Avis by 40%, as PPF hides minor scratches from renters.

- Tropical Region Owners – Resists acid rain etching in Bangkok and Rio, with PPF maintaining 90% paint clarity vs. 60% for unprotected vehicles after 2 years.

- Luxury Vehicle Owners – Preserves factory paint on high-end cars like Mercedes-Maybach, with 92% of owners reporting retained resale value after 3 years of PPF use.

- Lease Vehicle Users – Avoids lease-end paint repair fees (average $500) by protecting against minor damage, with 95% passing inspections without charges.

- New Car Buyers – Guards fresh factory paint on brand-new vehicles, with 98% of users avoiding “first scratch” frustration in the first 6 months.

- Agricultural Vehicle Users – Shields tractor cabs from crop debris and mud, maintaining visibility and reducing cleaning time by 30% per week.

The production supply chain and quality control system of PPF:

- Technology Partnerships – Collaboration with IoT firms for real-time supply chain visibility tools.

- Material Innovation Collaboration – Joint R&D with suppliers for next-gen TPU formulations (e.g., bio-based, high-heat resistant).

- Defect Classification System – Categorization of flaws (pinholes, bubbles, streaks) by severity to guide corrective actions.

- Sustainability Audits – Annual assessments of suppliers’ carbon footprints and waste reduction efforts for eco-friendly sourcing.

- Water Recycling Systems – Closed-loop water usage in cooling processes, sourced from local utilities with treatment partnerships.

- Thickness Gauging – Laser sensors measuring film thickness every 0.5 seconds, ensuring ±0.1mil tolerance.

The construction and maintenance of PPF:

- Emblem Masking with Low-Tack Tape – Removable tape protects badges from accidental cutting or adhesive residue during installation.

- PPF-Safe Adhesive Removers – Specialized solvents clean up installation mistakes without damaging the underlying paint.

- Post-Cut Edge Deburring – Trimming excess film with a fresh blade removes sharp edges that could catch dirt or lift over time.

- 48-Hour Road Tar Removal Window – Using专用 solvents to remove tar within 48 hours prevents permanent staining on PPF.

- Low-Pressure Pre-Rinse – Gentle initial rinsing loosens surface dirt, reducing friction during washing to avoid swirl marks.

- UV-Protection Boosters – Applying UV-resistant sprays in high-sun regions extends anti-yellowing performance.

Say Goodbye to Car Scratches: Self-Healing PPF Revealed!:

- Self-healing PPF reduces the visual impact of “paint transfer” from minor collisions, buying time for professional repairs.

- Work truck scratches from tools or equipment heal, preserving paint on vehicles used daily for labor.

- Unlike temporary scratch removers that wash off, self-healing PPF’s repairs are permanent, with no reapplication needed.

- Professional detailers confirm self-healing PPF cuts correction time by 50%, as fewer scratches require manual polishing.

- Key scratches on door edges vanish, saving drivers from costly repairs to high-contact areas.

- Sunlight, engine heat, or even a hair dryer triggers the healing process, with most minor scratches vanishing within 24 hours of temperature exposure.

The regulations of PPF and after-sales services:

- IoT-Enabled Performance Monitoring – Emerging PPFs with embedded sensors monitor UV exposure and damage levels, providing real-time data for predictive maintenance and warranty claims .

- Warranty Transferability – Transferred vehicle ownership often requires warranty re-registration, with brands like 3M requiring updated documentation to maintain coverage .

- China’s Consumer Complaint Channels – PPF buyers in China can file quality-related disputes through the national 12315 hotline, facilitating regulatory oversight and resolution .

- Regulatory Updates for EVs – EV-specific PPFs must comply with OEM heat resistance standards (e.g., 120°C for battery zones) to avoid delamination .

- EU PPWR Packaging Mandates – The EU’s Packaging and Packaging Waste Regulation (PPWR) requires PPF packaging to be recyclable by 2030 and prohibits PFAS in food-contact packaging, impacting material choices and disposal practices .

- Customer Support Hotlines – Brands like NAR PPF provide dedicated hotlines (4008 8181 07) for warranty claims, requiring vehicle details and installation records for processing .

- Japan’s Window Tinting Restrictions – Japanese regulations ban PPF installation on front driver/passenger windows and mandate partial windshield film transparency to ensure unobstructed visibility .

- EU REACH Compliance – PPF manufacturers must adhere to EU REACH regulations, ensuring all chemicals used in production meet strict safety and environmental standards, particularly for PFAS substances like C9-C14 PFCAs, which are restricted to ≤25 ppb in materials .

- Australia’s UV Protection Standards – PPFs sold in Australia/NZ must comply with AS/NZS 4399 for UV protection, requiring UPF ratings ≥15 and transparency in labeling .

The user perception and consumption misconceptions of PPF:

- Correct Perception: Temperature Tolerance – Cold-climate users seek flexible PPF, avoiding cracking in sub-zero conditions unlike rigid alternatives.

- Correct Perception: Thickness Depends on Use Case – Off-roaders choose 10mil PPF, while daily drivers opt for 8mil to balance protection and flexibility.

- Correct Perception: UV Protection Value – Users increasingly link PPF to preventing paint fading, with 72% citing UV resistance as a key purchase driver.

- Correct Perception: Brand Certification Matters – Buyers seek installers certified by brands like XPEL, linking training to better long-term results.

- Correct Perception: Environmental Adaptability – Users in coastal areas correctly prioritize saltwater-resistant PPF, reducing corrosion-related repairs by 60%.

- Correct Perception: Ceramic Coating Synergy – Savvy users pair PPF with ceramic topcoats, enhancing hydrophobicity and scratch resistance by 40%.

- Consumer Misconception: “PPF Blocks Car Washes” – Avoiding automated washes due to fear of damage, when brushless systems are actually safe for properly installed PPF.

- Correct Perception: EV-Specific PPF Benefits – EV owners prioritize heat-resistant PPF for battery zones, reducing thermal damage risks during charging.

- Consumer Misconception: “All PPF Installers Are Equal” – Choosing based on price alone, ignoring differences in training, tools, and workspace quality.

- Consumer Misconception: “All PPFs Are Identical” – Many buyers assume no quality difference between $500 and $3,000 PPF, neglecting TPU vs. PVC material distinctions.

The user pain points of PPF and their solutions:

- High Installation Costs – Mitigated by tiered pricing (DIY kits vs. premium pro installs) and financing options for budget flexibility.

- DIY Installation Failures – Resolved with pre-cut laser patterns, air-release adhesives, and step-by-step video tutorials.

- High Heat Damage (EV Batteries) – Solved by heat-resistant PPF (120°C ) with thermal conductivity for battery zone protection.

- Matte Paint Distortion – Solved by matte-specific PPF (20–30% gloss) designed to preserve texture without shine spots.

- Expensive Repairs for Damage – Reduced via self-healing technology (repairs 3μm scratches with heat) and patchable film sections.

- Difficulty Removing Old PPF – Simplified with low-tack, residue-free adhesives and professional heat-assisted removal services.

- ADAS Sensor Interference – Prevented by radar-transparent PPF (99.9% signal transmission) tested with OEM systems.

- Unclear Warranty Coverage – Clarified via digital warranty passports detailing exclusions (wear, improper maintenance) and inclusions.

- Complex Warranty Transfers – Simplified via blockchain-based systems enabling easy ownership transfers with digital validation.

The horizontal comparison of PPF with other protection methods:

- PPF vs. Vinyl Wraps – PPF prioritizes paint protection with self-healing properties, while vinyl wraps focus on aesthetic customization, with PPF being more durable against abrasion.

- PPF vs. Polyurethane Sprays – Polyurethane sprays form a hard, brittle layer prone to chipping, while PPF’s flexible TPU base absorbs impacts without cracking.

- PPF vs. Clear Bra (Old-Generation) – Modern PPF offers self-healing and flexibility, outperforming rigid old-gen clear bras that crack in cold weather and lack repair abilities.

- PPF vs. Spray-On Protective Coatings – PPF is removable and repairable, unlike permanent spray coatings that require full repaint for damage correction.

- PPF vs. Paint Sealants – Sealants provide 6–12 months of chemical resistance, while PPF adds physical barrier protection against impacts, with both enhancing gloss but PPF lasting longer.

- PPF vs. Ceramic Coatings – PPF offers physical impact protection (resisting rocks/chips) while ceramic coatings focus on chemical resistance and hydrophobicity, with PPF lasting 5–10 years vs. 2–5 for ceramics.

- PPF vs. Rubber Sealants – Rubber sealants protect gaskets from drying but have no role in paint protection, highlighting PPF’s focus on exterior surfaces.

The cost structure and price composition of PPF:

- Quality Control Expenses – Automated inspection systems add 3–5% to production costs but reduce warranty claims by 40%.

- Military/First Responder Discounts – 10–15% price reductions, offset by tax benefits for businesses.

- Custom Cut Fees – Vehicle-specific laser cuts add $100–$300 to total costs vs. generic patterns.

- New Customer Incentives – First-time buyer discounts cut prices by 5–10% to acquire long-term clients.

- Research & Development – New formulations (e.g., anti-yellowing) add 2–4% to unit costs but enable 10–15% price premiums.

- Premium PPF Costs – 10mil multi-layer films with lifetime warranties retail at $12–$20 per square foot, 50–60% margins.

- Economic Downturn Pricing – Recessionary periods see 5–10% price reductions to maintain sales volume.

- Insurance Costs – Liability coverage for installation errors adds 2–3% to service prices.

AUTOLI(CN) PPF(Paint Protection Film) manufacturer

autoli TPU PPF Applied to all brand car models as Nissan、ford、acura、Land Rover.Our factory cooperates with PPF agent、PPF wholesaler、AutoZone、Auto Repair Center、PPF brand and all so in many countries and regions around the world,like Finland,Jamaica,Germany,Luxembourg,Warranty: 10 years.Our advantages:Efficient production reduces costs;Raw material purchasing advantage;Perfect after-sales service;Short production cycle, quick delivery;SGS, ASTM, REACH, UL and other certifications.Our factory also provides Vinyl wrapping、PPF FILM.